Deferred revenue represents payments received by a company for goods or services yet to be delivered, recognized as a liability on the balance sheet. Managing deferred revenue is crucial for accurate financial reporting and tax compliance, as it reflects the company's obligations to provide value in the future. Explore the full article to understand how deferred revenue impacts your business's financial health and accounting practices.

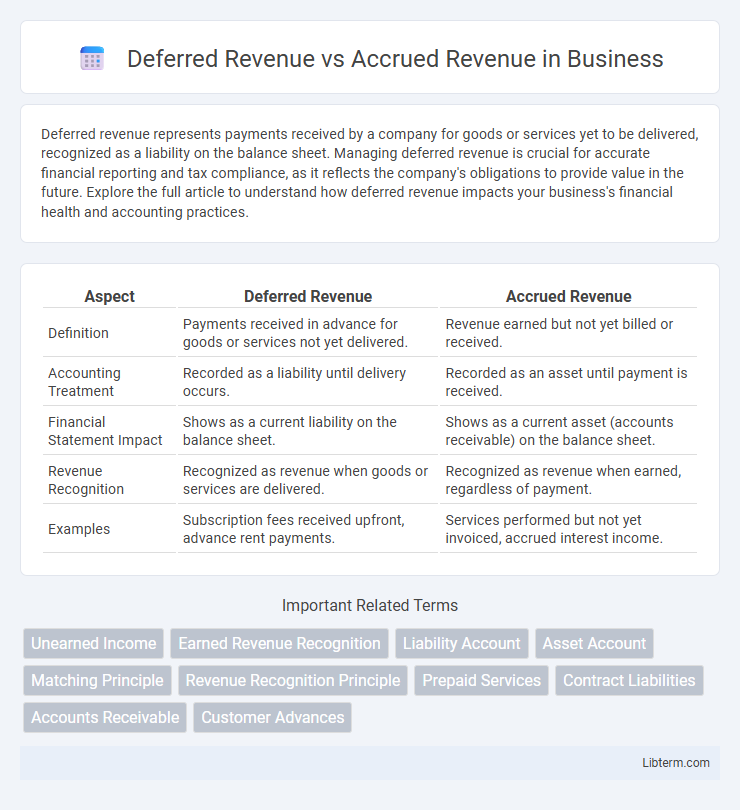

Table of Comparison

| Aspect | Deferred Revenue | Accrued Revenue |

|---|---|---|

| Definition | Payments received in advance for goods or services not yet delivered. | Revenue earned but not yet billed or received. |

| Accounting Treatment | Recorded as a liability until delivery occurs. | Recorded as an asset until payment is received. |

| Financial Statement Impact | Shows as a current liability on the balance sheet. | Shows as a current asset (accounts receivable) on the balance sheet. |

| Revenue Recognition | Recognized as revenue when goods or services are delivered. | Recognized as revenue when earned, regardless of payment. |

| Examples | Subscription fees received upfront, advance rent payments. | Services performed but not yet invoiced, accrued interest income. |

Introduction to Deferred and Accrued Revenue

Deferred revenue represents payments received in advance for goods or services yet to be delivered, reflecting a company's liability on the balance sheet until the revenue is earned. Accrued revenue, on the other hand, refers to income earned for products or services provided but not yet billed or received, showing as an asset on the balance sheet. Understanding these concepts is essential for accurate revenue recognition and financial reporting under accounting standards like GAAP and IFRS.

Key Differences Between Deferred and Accrued Revenue

Deferred revenue represents payments received in advance for goods or services yet to be delivered, classified as a liability on the balance sheet. Accrued revenue, on the other hand, reflects earned revenue for goods or services provided but not yet billed or received, recorded as an asset. The key difference lies in timing: deferred revenue involves cash received before earning the revenue, whereas accrued revenue involves revenue earned before cash receipt.

What is Deferred Revenue?

Deferred revenue represents payments received by a company for goods or services yet to be delivered or performed, classifying it as a liability on the balance sheet. It reflects obligations to customers, such as subscriptions or advance deposits, requiring recognition as revenue over time as the company fulfills its commitments. Accurate deferred revenue accounting ensures compliance with revenue recognition standards like ASC 606 and IFRS 15, enhancing financial transparency and reporting reliability.

What is Accrued Revenue?

Accrued revenue represents income earned by a business for goods or services delivered but not yet billed or received in cash, reflecting a receivable on the balance sheet. This accounting concept aligns with the revenue recognition principle, ensuring revenues are recorded when earned regardless of payment status. Accrued revenue is key for accurate financial reporting, providing a clearer picture of a company's income during an accounting period.

Recognition Criteria Under Accounting Standards

Deferred revenue is recognized as a liability when payment is received before the related goods or services are delivered, aligning with revenue recognition criteria under IFRS 15 and ASC 606 that require performance obligations to be satisfied prior to revenue recording. Accrued revenue is recorded as an asset when goods or services have been provided but payment has not yet been received, meeting the criteria that revenue must be recognized when it is earned and measurable. Both concepts ensure compliance with the matching principle and accurate reflection of financial position in accordance with generally accepted accounting principles (GAAP).

Examples of Deferred Revenue in Practice

Deferred revenue often appears in subscription services where customers pay upfront for annual software access, generating a liability until the service is delivered over time. In retail, gift cards represent deferred revenue as cash is received before the product or service is redeemed. Similarly, airlines record deferred revenue when passengers buy tickets in advance, recognizing income only when the flight occurs.

Examples of Accrued Revenue in Practice

Accrued revenue occurs when a company provides goods or services but has not yet received payment, such as a consulting firm delivering monthly services and invoicing clients afterward. Another example includes an advertising agency running a campaign in December but billing the client in January, reflecting revenue earned in the prior period. Software companies often recognize accrued revenue when subscriptions are used before the customer is billed, aligning income recognition with service delivery.

Financial Statement Impact: Deferred vs Accrued Revenue

Deferred revenue appears as a liability on the balance sheet because it represents cash received for goods or services not yet delivered, impacting the cash flow but not the income statement until earned. Accrued revenue is recorded as an asset, typically accounts receivable, reflecting earned income not yet received in cash and increasing net income on the income statement. The timing differences in recognition between deferred and accrued revenue directly affect reported earnings and financial position in financial statements.

Importance in Financial Analysis and Reporting

Deferred revenue represents cash received for goods or services yet to be delivered, impacting liabilities and cash flow analysis in financial reporting. Accrued revenue reflects earned income not yet received in cash, influencing asset recognition and revenue matching principles. Accurate differentiation ensures reliable profitability assessment and compliance with accounting standards.

Common Challenges and Best Practices

Deferred revenue often causes challenges in accurately matching revenue with expenses due to its recognition before cash is earned, while accrued revenue complicates financial statements by recording income prior to cash receipt. A common best practice involves implementing stringent revenue recognition policies aligned with GAAP or IFRS standards to ensure timely and accurate reporting. Regular reconciliation and use of automated accounting systems help mitigate errors and improve transparency in managing both deferred and accrued revenue.

Deferred Revenue Infographic

libterm.com

libterm.com