Mutual funds pool money from multiple investors to invest in a diversified portfolio managed by professionals, making them ideal for hands-off investors seeking broad market exposure. Exchange-Traded Funds (ETFs) trade on stock exchanges like individual stocks, offering flexibility, lower fees, and intraday liquidity that appeal to active traders and cost-conscious investors. Explore the rest of this article to understand how choosing between these investment vehicles can impact your financial strategy.

Table of Comparison

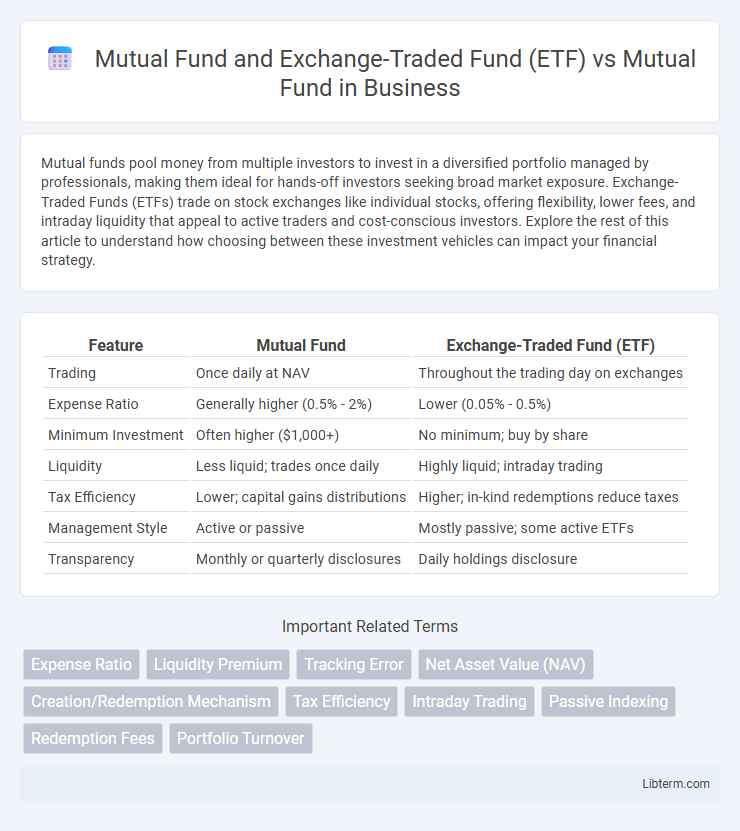

| Feature | Mutual Fund | Exchange-Traded Fund (ETF) |

|---|---|---|

| Trading | Once daily at NAV | Throughout the trading day on exchanges |

| Expense Ratio | Generally higher (0.5% - 2%) | Lower (0.05% - 0.5%) |

| Minimum Investment | Often higher ($1,000+) | No minimum; buy by share |

| Liquidity | Less liquid; trades once daily | Highly liquid; intraday trading |

| Tax Efficiency | Lower; capital gains distributions | Higher; in-kind redemptions reduce taxes |

| Management Style | Active or passive | Mostly passive; some active ETFs |

| Transparency | Monthly or quarterly disclosures | Daily holdings disclosure |

Understanding Mutual Funds: An Overview

Mutual funds pool capital from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities, managed by professional fund managers. Exchange-Traded Funds (ETFs) offer similar diversification but trade on stock exchanges like individual shares, providing greater liquidity and often lower fees compared to traditional mutual funds. Understanding mutual funds involves recognizing their benefits in risk spreading and professional management, contrasted with ETFs' flexibility and cost efficiency in investment strategies.

What are Exchange-Traded Funds (ETFs)?

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, combining features of mutual funds and individual stocks with real-time pricing and liquidity. ETFs typically hold a diversified portfolio of assets such as stocks, bonds, or commodities, providing investors with broad market exposure and lower expense ratios compared to traditional mutual funds. Unlike mutual funds, which are priced once daily at net asset value (NAV), ETFs can be bought and sold throughout the trading day at market prices, offering greater flexibility and tax efficiency.

Structure and Operational Differences between Mutual Funds and ETFs

Mutual funds are actively managed investment vehicles pooled from investors, structured with shares that are priced once daily based on net asset value (NAV), and shares are bought or redeemed directly from the fund company. Exchange-Traded Funds (ETFs) trade on stock exchanges with prices fluctuating throughout the day, combining features of mutual funds and stocks, using an in-kind creation and redemption process to maintain liquidity and tax efficiency. ETFs typically have lower expense ratios due to passive management, while mutual funds can provide active management but with potentially higher fees and less intraday trading flexibility.

Investment Strategies: Mutual Funds vs ETFs

Mutual funds typically employ active management strategies, where portfolio managers frequently adjust holdings to achieve specific investment objectives, often resulting in higher fees. ETFs primarily follow passive investment strategies, tracking market indices with lower expense ratios and offering intraday liquidity similar to stocks. Investors choose mutual funds for potential outperformance through active management, while ETFs appeal for cost-efficiency and flexibility in trading.

Cost and Fees Comparison: Mutual Funds vs ETFs

Mutual funds typically have higher expense ratios, averaging around 0.50% to 1.00%, due to active management and operational costs, whereas ETFs generally feature lower expense ratios, often between 0.05% and 0.30%, reflecting their passive management structure. Mutual funds may also impose sales loads, redemption fees, and back-end fees, increasing the overall cost, while ETFs incur brokerage commissions and bid-ask spreads, which can be minimal with commission-free trades. Investors seeking cost efficiency often prefer ETFs for lower ongoing fees, but mutual funds may offer benefits such as automatic reinvestment and no trading commissions.

Liquidity and Trading Flexibility

Exchange-Traded Funds (ETFs) offer superior liquidity compared to traditional mutual funds, as they trade on stock exchanges throughout the day at market prices, allowing investors to buy and sell shares instantly. Mutual funds, however, are priced only once daily after the market closes, limiting trading flexibility and causing delays in order execution. The intraday trading capability of ETFs enables investors to respond quickly to market fluctuations, whereas mutual fund transactions settle at the end of the day, reducing immediate accessibility to funds.

Tax Efficiency: ETFs vs Mutual Funds

ETFs typically offer greater tax efficiency than mutual funds due to their unique in-kind creation and redemption process, which helps minimize capital gains distributions. Mutual funds often generate capital gains taxes because they must sell securities to meet redemptions, distributing taxable gains to shareholders. Investors seeking to reduce tax liabilities may prefer ETFs, as their structure generally results in lower taxable events compared to traditional mutual funds.

Performance Tracking: Indexing and Active Management

Mutual funds and ETFs both offer options for performance tracking through indexing or active management, with ETFs predominantly utilizing indexing to replicate market indices, which often results in lower fees and diversified exposure. Mutual funds frequently provide actively managed portfolios aiming to outperform benchmarks by selecting securities based on research and analysis, though this approach typically incurs higher management fees. The choice between indexing and active management directly impacts tracking error, cost efficiency, and potential returns, influencing investor decisions based on risk tolerance and investment goals.

Accessibility and Minimum Investment Requirements

Mutual funds often require higher minimum investments, typically ranging from $1,000 to $3,000, which can limit accessibility for small investors. Exchange-Traded Funds (ETFs) trade like stocks on exchanges, allowing investors to buy shares at the market price with no minimum investment beyond the price of one share, enhancing accessibility. This flexibility makes ETFs more appealing to investors seeking lower entry barriers and the ability to invest smaller amounts compared to traditional mutual funds.

Which is Better: Choosing between Mutual Funds and ETFs

Mutual funds and Exchange-Traded Funds (ETFs) both offer diversified investment opportunities but differ in trading flexibility and cost structures. ETFs typically provide lower expense ratios and intraday trading like stocks, making them attractive for active investors seeking liquidity and cost efficiency. Mutual funds, on the other hand, are often better suited for long-term investors who prefer automatic investments and professional management despite higher fees.

Mutual Fund and Exchange-Traded Fund (ETF) Infographic

libterm.com

libterm.com