Asset-light business models minimize ownership of physical assets, focusing instead on leveraging partnerships, technology, and outsourcing to drive growth and efficiency. This approach reduces capital expenditures, increases flexibility, and allows companies to scale operations quickly while mitigating risks associated with asset depreciation. Discover how adopting an asset-light strategy can transform Your business and enhance competitive advantage throughout the rest of the article.

Table of Comparison

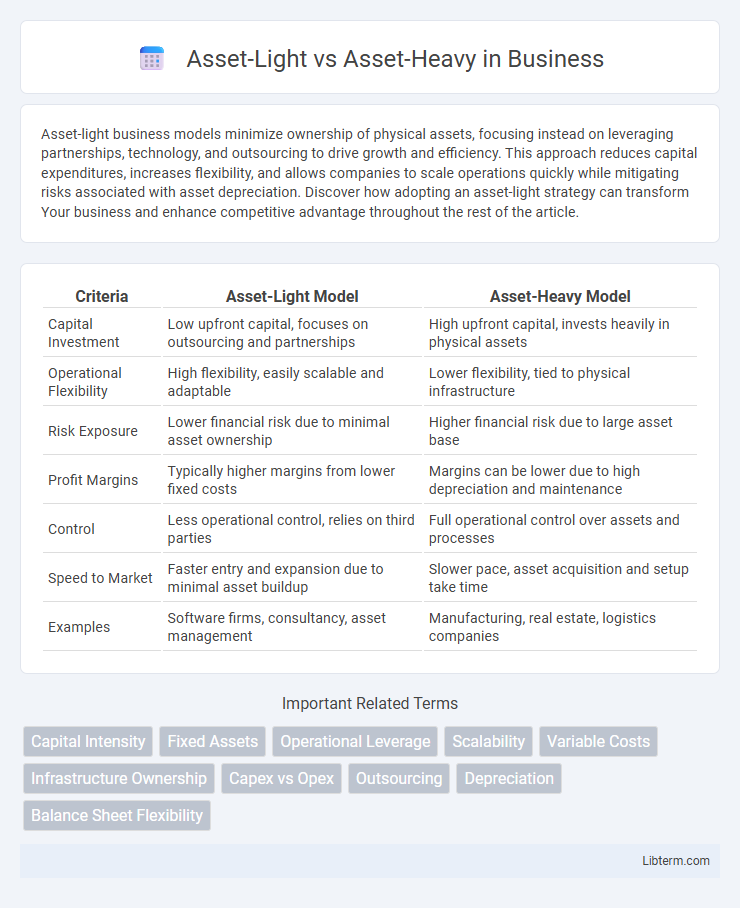

| Criteria | Asset-Light Model | Asset-Heavy Model |

|---|---|---|

| Capital Investment | Low upfront capital, focuses on outsourcing and partnerships | High upfront capital, invests heavily in physical assets |

| Operational Flexibility | High flexibility, easily scalable and adaptable | Lower flexibility, tied to physical infrastructure |

| Risk Exposure | Lower financial risk due to minimal asset ownership | Higher financial risk due to large asset base |

| Profit Margins | Typically higher margins from lower fixed costs | Margins can be lower due to high depreciation and maintenance |

| Control | Less operational control, relies on third parties | Full operational control over assets and processes |

| Speed to Market | Faster entry and expansion due to minimal asset buildup | Slower pace, asset acquisition and setup take time |

| Examples | Software firms, consultancy, asset management | Manufacturing, real estate, logistics companies |

Introduction to Asset-Light and Asset-Heavy Models

Asset-light business models focus on minimizing capital investment in physical assets, relying heavily on outsourcing, partnerships, and technology to deliver products or services efficiently. Asset-heavy models involve significant investment in physical infrastructure, equipment, and inventory, enabling greater control over production and operations but requiring higher fixed costs. Companies in industries like manufacturing and transportation often adopt asset-heavy models, while technology and service-oriented firms tend to prefer asset-light strategies for flexibility and scalability.

Key Characteristics of Asset-Light Businesses

Asset-light businesses prioritize minimal ownership of physical assets, relying heavily on outsourcing, partnerships, and digital platforms to deliver products or services. This model emphasizes scalability, lower capital expenditure, and flexibility, enabling faster adaptation to market changes and reduced operational risk. Key characteristics include high operational efficiency, strong reliance on human capital and technology, and an emphasis on brand development and customer relationships rather than asset accumulation.

Defining Features of Asset-Heavy Companies

Asset-heavy companies own and operate significant physical assets such as manufacturing plants, machinery, and real estate, which require substantial capital investment and ongoing maintenance costs. These companies typically have higher fixed costs but benefit from greater control over production processes and capacity. Industries like manufacturing, utilities, and transportation often exemplify asset-heavy business models due to their reliance on physical infrastructure.

Major Industries Utilizing Asset-Light Approaches

Major industries utilizing asset-light approaches include technology, software development, and consulting sectors, where businesses emphasize intellectual property and service delivery over physical assets. E-commerce platforms like Amazon leverage asset-light models by outsourcing logistics and warehousing, focusing instead on customer experience and technology infrastructure. The financial services industry also adopts asset-light strategies by prioritizing digital platforms and advisory services rather than heavy investment in physical branches.

Sectors Dominated by Asset-Heavy Strategies

Sectors dominated by asset-heavy strategies include manufacturing, oil and gas, utilities, and transportation, where substantial capital investment in physical assets like factories, machinery, pipelines, and fleets is required. These industries rely on long-term asset ownership to maintain operational control, ensure production capacity, and achieve economies of scale. High fixed costs and asset depreciation significantly impact financial performance and strategic decision-making in these sectors.

Comparative Financial Implications

Asset-light models typically require lower capital expenditure and offer higher return on assets (ROA) due to reduced investment in physical infrastructure, enhancing operational flexibility and scalability. In contrast, asset-heavy models involve significant upfront investments, resulting in higher depreciation expenses and fixed costs but can lead to greater control over production and potentially higher long-term profit margins. The choice between asset-light and asset-heavy strategies directly impacts financial metrics such as cash flow stability, leverage ratios, and overall risk exposure.

Risk and Flexibility in Both Models

Asset-light models reduce operational risk by minimizing capital investment and enabling rapid adaptation to market changes, thus enhancing business flexibility. In contrast, asset-heavy models involve significant fixed capital outlays, increasing financial risk but providing greater control over production and quality. Companies favoring asset-light approaches benefit from scalability and agility, while asset-heavy entities leverage asset ownership for stability and long-term value creation.

Scalability and Growth Potential

Asset-light business models enable rapid scalability by leveraging third-party resources and minimizing capital expenditures, allowing firms to quickly adapt to market demands and expand operations with lower financial risk. In contrast, asset-heavy models require substantial investments in physical assets, which can limit growth potential due to higher fixed costs and longer lead times for capacity expansion. Companies adopting asset-light strategies benefit from greater agility and faster market entry, driving accelerated revenue growth and operational flexibility.

Case Studies: Success Stories in Both Models

Amazon exemplifies the asset-light model by leveraging third-party logistics and cloud infrastructure, enabling rapid scalability and reduced capital expenditure. Conversely, Toyota's asset-heavy strategy invests heavily in manufacturing plants and supply chain control, resulting in superior product quality and operational efficiency. Both models demonstrate that aligning asset management with core business strategies drives sustainable competitive advantage.

Choosing the Right Model for Your Business

Asset-light business models prioritize outsourcing and leveraging third-party assets to minimize capital expenditure, enhancing scalability and flexibility in rapidly changing markets. In contrast, asset-heavy models require significant investment in physical assets, offering greater control and potentially higher profit margins but with increased operational risks and slower adaptability. Choosing the right model depends on industry dynamics, capital availability, and long-term strategic goals, with asset-light favored in tech and service sectors, while asset-heavy suits manufacturing and infrastructure-intensive industries.

Asset-Light Infographic

libterm.com

libterm.com