Private placement offers a strategic way to raise capital by selling securities directly to a select group of investors, bypassing public offerings. This method provides benefits such as faster access to funds, reduced regulatory requirements, and the ability to tailor terms to suit both issuer and investor needs. Explore the rest of the article to understand how private placement can be leveraged for your financial growth.

Table of Comparison

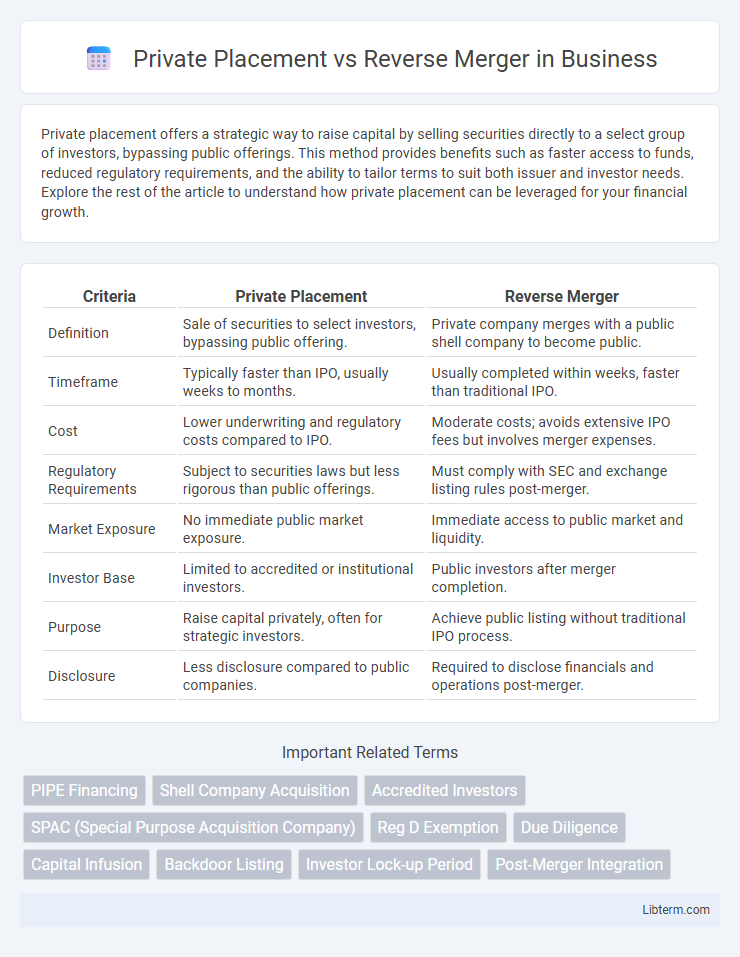

| Criteria | Private Placement | Reverse Merger |

|---|---|---|

| Definition | Sale of securities to select investors, bypassing public offering. | Private company merges with a public shell company to become public. |

| Timeframe | Typically faster than IPO, usually weeks to months. | Usually completed within weeks, faster than traditional IPO. |

| Cost | Lower underwriting and regulatory costs compared to IPO. | Moderate costs; avoids extensive IPO fees but involves merger expenses. |

| Regulatory Requirements | Subject to securities laws but less rigorous than public offerings. | Must comply with SEC and exchange listing rules post-merger. |

| Market Exposure | No immediate public market exposure. | Immediate access to public market and liquidity. |

| Investor Base | Limited to accredited or institutional investors. | Public investors after merger completion. |

| Purpose | Raise capital privately, often for strategic investors. | Achieve public listing without traditional IPO process. |

| Disclosure | Less disclosure compared to public companies. | Required to disclose financials and operations post-merger. |

Introduction to Private Placement and Reverse Merger

Private placement is a capital-raising method where securities are sold directly to a select group of investors, often institutional or accredited, bypassing public markets to expedite funding. A reverse merger involves a private company acquiring a publicly traded shell corporation to instantly gain stock exchange listing without undergoing a traditional initial public offering (IPO). Both strategies offer alternative routes to capital and market presence, with private placement emphasizing targeted investment and reverse merger focusing on streamlined public market access.

Understanding Private Placement: Definition and Process

Private placement involves the sale of securities directly to a select group of investors, such as institutional investors or accredited individuals, bypassing public markets. The process includes preparing a private offering memorandum, conducting due diligence, negotiating terms, and complying with securities regulations like Regulation D under the SEC. This method provides companies with quicker access to capital while maintaining confidentiality and avoiding the extensive disclosures required in public offerings.

What is a Reverse Merger? Key Concepts and Steps

A reverse merger is a process where a private company becomes publicly traded by acquiring a publicly listed shell company, bypassing the lengthy initial public offering (IPO) process. Key concepts include the selection of a suitable shell company, thorough due diligence, and the negotiation of transaction terms to ensure regulatory compliance. The steps involve signing a merger agreement, shareholder approval, filing necessary documentation with the Securities and Exchange Commission (SEC), and completing the reorganization to reflect new ownership and management.

Comparing Funding Mechanisms: Private Placement vs Reverse Merger

Private placement involves raising capital by selling securities directly to a select group of investors, providing immediate funding without undergoing public offering requirements. In contrast, a reverse merger allows a private company to become publicly traded by acquiring an existing public shell company, often facilitating quicker access to public capital markets but requiring additional regulatory disclosures. While private placements prioritize targeted investor engagement and confidentiality, reverse mergers emphasize market visibility and liquidity potential for long-term capital growth.

Eligibility and Requirements for Each Approach

Private placements require companies to be privately held or meet specific securities regulations, often targeting accredited investors and limiting public solicitation. Eligibility for reverse mergers mandates a private company merging with a public shell company, meeting exchange listing standards and regulatory filings to gain public status quickly. Both approaches demand thorough financial disclosures and legal compliance, but reverse mergers typically involve more rigorous SEC reporting and ongoing obligations post-merger.

Advantages of Private Placement for Companies

Private placement offers companies expedited access to capital by selling securities directly to a select group of investors, reducing regulatory burdens and costs compared to public offerings. This method preserves confidentiality, allowing businesses to avoid market scrutiny and maintain strategic flexibility during fundraising. It also enables tailored investment terms, fostering stronger investor relationships and aligning capital structure with long-term growth objectives.

Benefits of Reverse Merger in Going Public

A reverse merger offers a faster and more cost-effective route to going public compared to a traditional IPO or private placement, bypassing the extensive regulatory scrutiny and lengthy approval processes. Companies gain immediate access to liquidity and public capital markets, enhancing credibility and attracting investors without the volatility of public offerings. This streamlined process allows management to retain greater control and flexibility while expanding growth opportunities.

Risks and Challenges: Private Placement vs Reverse Merger

Private placement carries risks such as lack of liquidity and potential undervaluation due to limited market exposure, while reverse mergers face challenges including regulatory scrutiny and potential market skepticism from investors. Private placements may result in less transparency, elevating the risk of fraud, whereas reverse mergers often encounter difficulties integrating the private company into the public shell. Both methods pose significant legal and financial risks, requiring thorough due diligence to mitigate operational and reputational challenges.

Regulatory and Compliance Considerations

Private placements involve the sale of securities directly to selected investors, requiring compliance with Regulation D under the Securities Act of 1933, which mandates specific disclosure and filing requirements to avoid public registration. Reverse mergers enable a private company to become public by acquiring a publicly traded shell company, subjecting it to ongoing Securities and Exchange Commission (SEC) reporting obligations and Sarbanes-Oxley Act compliance. Both methods necessitate stringent adherence to federal securities laws, but reverse mergers typically involve more extensive continuous regulatory scrutiny compared to the relatively streamlined regulatory framework of private placements.

Choosing the Right Path: Factors to Consider

Choosing between private placement and reverse merger depends on a company's capital needs, regulatory tolerance, and timeline for going public. Private placements offer direct funding from select investors with fewer regulatory hurdles but may limit access to broader capital markets. Reverse mergers provide a faster route to public trading and liquidity but often involve complex disclosures and potential market perception challenges.

Private Placement Infographic

libterm.com

libterm.com