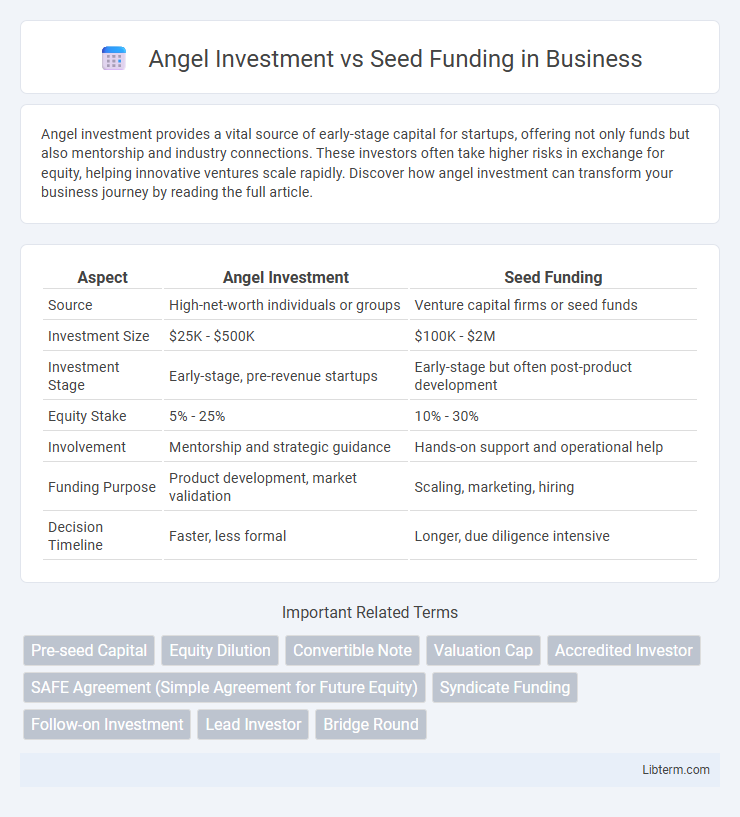

Angel investment provides a vital source of early-stage capital for startups, offering not only funds but also mentorship and industry connections. These investors often take higher risks in exchange for equity, helping innovative ventures scale rapidly. Discover how angel investment can transform your business journey by reading the full article.

Table of Comparison

| Aspect | Angel Investment | Seed Funding |

|---|---|---|

| Source | High-net-worth individuals or groups | Venture capital firms or seed funds |

| Investment Size | $25K - $500K | $100K - $2M |

| Investment Stage | Early-stage, pre-revenue startups | Early-stage but often post-product development |

| Equity Stake | 5% - 25% | 10% - 30% |

| Involvement | Mentorship and strategic guidance | Hands-on support and operational help |

| Funding Purpose | Product development, market validation | Scaling, marketing, hiring |

| Decision Timeline | Faster, less formal | Longer, due diligence intensive |

Understanding Angel Investment

Angel investment involves high-net-worth individuals providing capital to startups in early-stage development, often in exchange for equity ownership. These investors not only supply crucial funding but also offer valuable mentorship and industry connections that can accelerate growth. Unlike seed funding which may come from institutional sources or accelerators, angel investment is typically more flexible and personalized, suited for startups seeking both financial support and strategic guidance.

What Is Seed Funding?

Seed funding is the initial capital raised by startups to develop their product, conduct market research, and build a foundational team. It often comes from angel investors, early-stage venture capitalists, or crowdfunding platforms, aiming to validate the business idea and prepare for larger funding rounds. This stage is crucial for transforming a concept into a viable business model, typically involving amounts ranging from $50,000 to $2 million.

Key Differences Between Angel Investment and Seed Funding

Angel investment involves high-net-worth individuals providing early-stage capital to startups, often in exchange for equity and active mentorship, while seed funding typically comes from institutional investors, accelerators, or crowdfunding platforms aiming to fund initial product development. Angel investors usually invest smaller amounts ranging from $25,000 to $100,000 with a more flexible approach, whereas seed funding rounds are larger, starting from $100,000 up to $2 million, with structured terms and formal valuations. The key differences lie in the source of funds, investment size, involvement level, and risk tolerance associated with each funding type.

Typical Investors: Angels vs Seed Funds

Angel investors are typically high-net-worth individuals who invest their personal capital in early-stage startups, often providing mentorship and industry connections alongside funding. Seed funds, on the other hand, are professional investment firms or venture capital funds that pool capital from multiple investors to invest in a diversified portfolio of startups at the seed stage. Angels tend to invest smaller amounts with more personal involvement, while seed funds allocate larger sums with structured due diligence and emphasis on scalable growth potential.

Investment Amounts: How Much Do Startups Receive?

Angel investors typically provide early-stage startups with investment amounts ranging from $25,000 to $100,000 per individual, collectively reaching up to $1 million in some cases. Seed funding rounds generally involve larger sums, often between $500,000 and $2 million, sourced from institutional investors or venture capital firms targeting initial growth phases. These amounts reflect the varying risk tolerance and strategic goals associated with angel investment versus seed funding in startup financing.

Equity and Ownership Structure

Angel investment typically involves individual investors providing capital in exchange for equity, often taking a significant ownership stake early in the startup's lifecycle. Seed funding can come from angel investors, venture capital firms, or crowdfunding platforms, usually resulting in a more diversified ownership structure with diluted equity for founders. Equity percentages vary widely but angel investors may acquire between 10% to 30%, while seed rounds can dilute founders' stakes further depending on the amount raised and valuation.

Risk Profiles and Investment Stages

Angel investment typically involves early-stage funding from high-net-worth individuals who accept higher risk by investing in startups during the seed or pre-seed stages. Seed funding, often sourced from angel investors or seed funds, targets initial product development and market validation but carries significant uncertainty due to unproven business models. Both investment types carry elevated risk profiles compared to later-stage venture capital, with angels often providing mentorship alongside capital.

Decision-Making Processes

Angel investment involves individual investors who evaluate startups based on personal expertise, market potential, and alignment with their investment philosophy, often making quicker decisions due to fewer bureaucratic constraints. Seed funding typically requires startups to undergo structured vetting by venture capital firms or seed funds, emphasizing detailed business plans, scalable models, and early traction metrics before approval. Decision-making in seed funding relies heavily on data-driven analysis and formal due diligence processes compared to the more flexible and relationship-driven approach of angel investors.

Advantages and Drawbacks for Startups

Angel investment offers startups personalized mentorship and flexible terms, often resulting in faster access to capital and valuable industry connections; however, it may involve relinquishing significant equity and influence. Seed funding provides a larger capital influx and validation from institutional investors, enhancing credibility and scalability prospects, but usually entails rigorous due diligence and more structured repayment or equity dilution. Startups must balance the trade-offs between mentorship and control from angels versus the financial muscle and formal expectations tied to seed funding.

Choosing the Right Funding Option

Angel investment offers early-stage startups personalized support and flexible terms from experienced investors, often providing mentorship alongside capital. Seed funding, typically sourced from venture capital firms or seed funds, delivers larger capital injections to accelerate product development and market entry but may involve more rigorous due diligence and equity dilution. Selecting the appropriate funding option depends on the startup's growth stage, capital needs, control preferences, and willingness to engage with investors for strategic guidance.

Angel Investment Infographic

libterm.com

libterm.com