Maximizing revenue is essential for sustainable business growth and profitability. Effective strategies involve optimizing pricing, expanding market reach, and enhancing customer experience to drive consistent sales increases. Discover how to unlock your business's full revenue potential in the rest of this article.

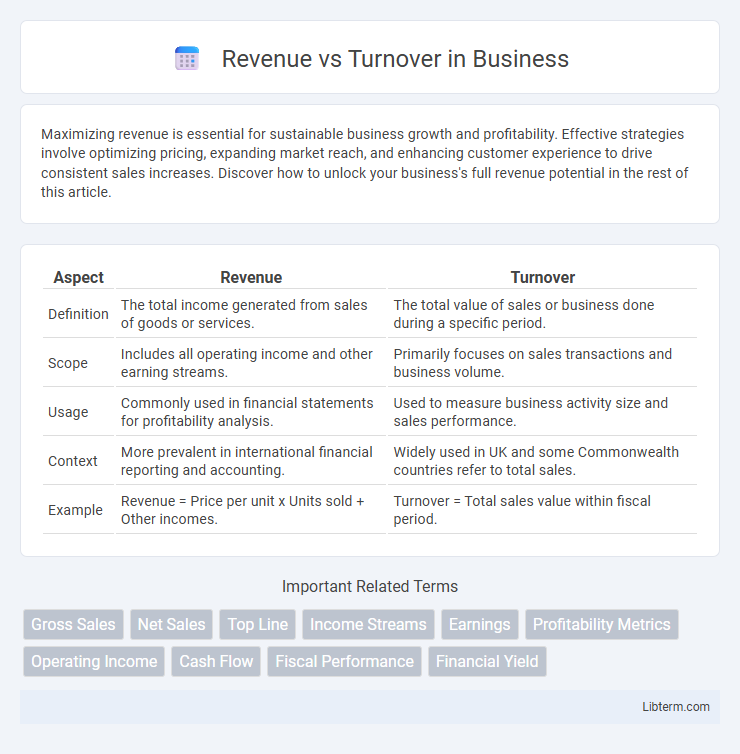

Table of Comparison

| Aspect | Revenue | Turnover |

|---|---|---|

| Definition | The total income generated from sales of goods or services. | The total value of sales or business done during a specific period. |

| Scope | Includes all operating income and other earning streams. | Primarily focuses on sales transactions and business volume. |

| Usage | Commonly used in financial statements for profitability analysis. | Used to measure business activity size and sales performance. |

| Context | More prevalent in international financial reporting and accounting. | Widely used in UK and some Commonwealth countries refer to total sales. |

| Example | Revenue = Price per unit x Units sold + Other incomes. | Turnover = Total sales value within fiscal period. |

Understanding Revenue and Turnover: Key Definitions

Revenue represents the total income generated by a company from its core business activities, typically from sales of goods or services, before any expenses are deducted. Turnover refers to the overall business activity level and can encompass total sales, the rate at which inventory is sold, or the frequency of employee replacement, depending on the industry context. Understanding these distinctions is crucial for analyzing financial performance and operational efficiency accurately within different business sectors.

Core Differences Between Revenue and Turnover

Revenue represents the total income generated by a company from its primary business activities before any expenses are deducted, serving as a key indicator of business performance. Turnover often refers to the rate at which a company's assets, inventory, or employees are replaced or sold within a specific period, and in some regions, it is used interchangeably with total sales or revenue. The core difference lies in revenue focusing strictly on income earned, whereas turnover can imply a broader spectrum of business activity metrics depending on regional business terminology.

Importance of Revenue in Financial Analysis

Revenue represents the total income generated from core business operations, serving as a key indicator of a company's financial health and market demand. Unlike turnover, which may refer to the volume of transactions or asset replacement, revenue provides a clear measure of profitability potential and operational efficiency. Accurate revenue analysis enables investors and analysts to assess growth trends, make informed forecasts, and evaluate a firm's capacity to generate sustainable earnings.

How Turnover Reflects Business Activity

Turnover measures the total value of goods or services sold by a business during a specific period, directly reflecting the scale of its operational activity. High turnover indicates robust sales volume, showcasing market demand and efficient business processes. Revenue, while related, represents the income generated after returns and discounts, emphasizing profitability over sheer activity.

Revenue vs Turnover: Industry-Specific Perspectives

Revenue and turnover often vary in definition depending on the industry, with revenue typically referring to the total income generated from sales or services, while turnover can indicate the total sales or the rate at which inventory or employees are replaced. In retail and manufacturing, turnover usually measures how quickly inventory is sold and replaced within a period, directly impacting cash flow and operational efficiency. Service industries emphasize revenue as the primary metric for financial performance, reflecting the total amount earned from client contracts and service delivery without the inventory turnover component.

Common Misconceptions About Revenue and Turnover

Revenue and turnover are often mistakenly used interchangeably, but revenue refers specifically to the total income generated from sales before any expenses are deducted, while turnover can mean the total volume of sales or the rate at which inventory or staff is replaced. A common misconception is that turnover always reflects income, whereas it may indicate operational efficiency or business activity levels depending on the industry context. Understanding the distinct definitions helps businesses accurately analyze financial performance and make informed operational decisions.

Revenue and Turnover in Financial Statements

Revenue represents the total income generated from core business operations before any expenses are deducted, often reflected as the top line in financial statements. Turnover can refer to the same concept as revenue in some regions, particularly in the UK, or may indicate the rate at which assets or inventory are replaced within a period. Accurate interpretation of revenue and turnover in financial statements is crucial for assessing a company's operational efficiency and overall financial health.

Impact of Revenue and Turnover on Business Valuation

Revenue represents the total income generated from primary business activities, while turnover often refers to the volume of sales or asset replacement rate. High revenue signals robust business operations and market demand, directly boosting business valuation by indicating strong earning potential. Turnover rates provide insights into operational efficiency and asset utilization, which influence investor confidence and overall company worth.

Practical Examples: Revenue vs Turnover in Real Companies

Revenue represents the total income a company earns from its core business activities, such as sales of products or services, while turnover often refers to the volume of business transactions or total sales within a specific period. For example, Apple's revenue in fiscal 2023 was approximately $430 billion, reflecting all sales and services income, whereas turnover can be interpreted as the total number of products sold globally. In the UK, many businesses use turnover to describe gross sales, but in financial reports of firms like Tesco, turnover equates to total revenue reported on the income statement.

Choosing the Right Metric: When to Use Revenue or Turnover

Revenue represents the total income generated from sales of goods or services, making it the preferred metric for assessing a company's profitability and operational efficiency. Turnover, often used to describe how quickly assets or inventory are sold and replaced, is ideal for evaluating business activity and asset management. Selecting the right metric depends on the analysis goal: use revenue to measure financial performance and profitability, while turnover is suited for understanding operational speed and asset utilization.

Revenue Infographic

libterm.com

libterm.com