A conglomerate merger involves the combination of two companies that operate in entirely different industries, aiming to diversify business operations and reduce risk. This type of merger can enhance financial stability and open new market opportunities without direct competition concerns. Explore the rest of the article to understand how a conglomerate merger might impact your business strategy and investment decisions.

Table of Comparison

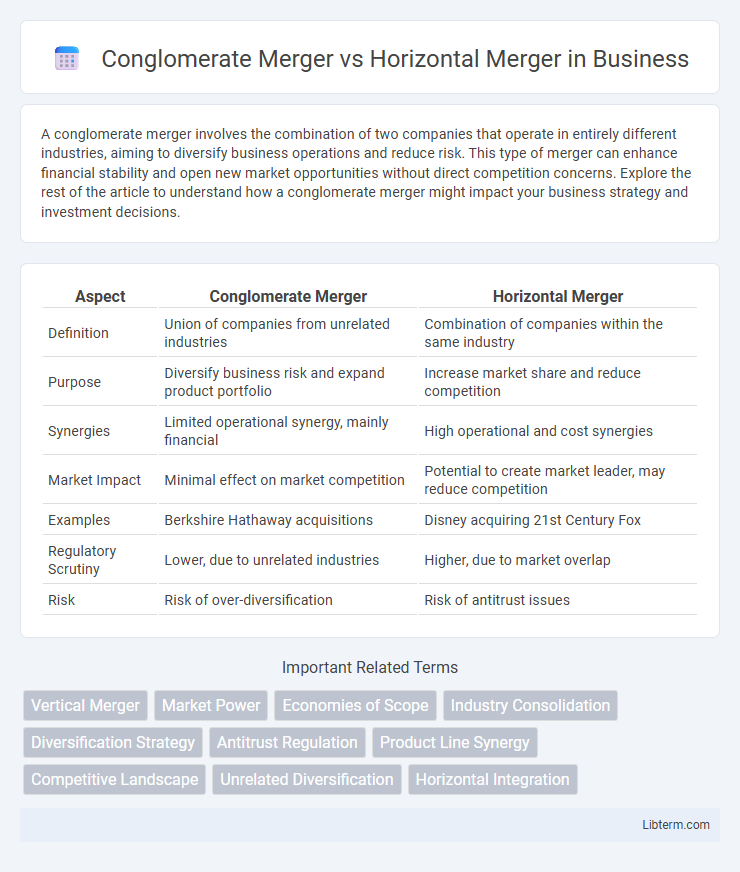

| Aspect | Conglomerate Merger | Horizontal Merger |

|---|---|---|

| Definition | Union of companies from unrelated industries | Combination of companies within the same industry |

| Purpose | Diversify business risk and expand product portfolio | Increase market share and reduce competition |

| Synergies | Limited operational synergy, mainly financial | High operational and cost synergies |

| Market Impact | Minimal effect on market competition | Potential to create market leader, may reduce competition |

| Examples | Berkshire Hathaway acquisitions | Disney acquiring 21st Century Fox |

| Regulatory Scrutiny | Lower, due to unrelated industries | Higher, due to market overlap |

| Risk | Risk of over-diversification | Risk of antitrust issues |

Understanding Conglomerate Mergers

Conglomerate mergers involve the combination of firms operating in unrelated industries, aiming to diversify business risk and expand market reach without overlapping products or services. These mergers differ from horizontal mergers, which occur between companies within the same industry seeking to increase market share and reduce competition. Understanding conglomerate mergers requires recognizing their strategic goal of portfolio diversification and the potential for operational synergies despite the lack of direct market overlap.

What is a Horizontal Merger?

A horizontal merger occurs when two companies operating in the same industry and at the same stage of production combine to form a single entity, aiming to increase market share and reduce competition. This type of merger allows firms to achieve economies of scale, expand their product offerings, and enhance operational efficiency. Unlike conglomerate mergers, which unite firms from unrelated industries, horizontal mergers focus on consolidating similar business operations to strengthen market position.

Key Differences Between Conglomerate and Horizontal Mergers

Conglomerate mergers involve the combination of companies operating in unrelated industries, aiming to diversify business risk and expand market reach, whereas horizontal mergers occur between firms in the same industry, focusing on increasing market share and achieving economies of scale. Key differences include the nature of synergy, with conglomerate mergers emphasizing financial and managerial synergies, while horizontal mergers prioritize operational synergies such as cost reduction and enhanced competitive positioning. Regulatory scrutiny also varies, as horizontal mergers face stricter antitrust regulations due to their potential to reduce competition, unlike conglomerate mergers that typically raise fewer antitrust concerns.

Strategic Objectives of Conglomerate Mergers

Conglomerate mergers primarily aim to diversify a company's portfolio by entering unrelated industries, thereby reducing overall business risk and stabilizing income streams. These mergers also strive to leverage cross-industry synergies, such as sharing technological innovations or managerial expertise, to enhance competitive advantage. Unlike horizontal mergers that focus on market share expansion within the same industry, conglomerate mergers strategically seek growth through diversification and market uncertainty mitigation.

Advantages of Horizontal Mergers

Horizontal mergers offer significant advantages, including enhanced market share and reduced competition by combining companies operating within the same industry. These mergers lead to economies of scale, resulting in lower production costs and increased bargaining power with suppliers. Furthermore, horizontal mergers facilitate access to new customer bases and improve product diversification within the same market.

Risks and Challenges in Conglomerate Mergers

Conglomerate mergers face significant risks including cultural clashes, management complexity, and difficulties in achieving synergies due to diverse business operations. The integration challenges often lead to inefficiencies, increased operational costs, and diluted strategic focus compared to horizontal mergers, which benefit from sectoral similarities and economies of scale. Additionally, conglomerate mergers risk stock market penalties as investors may perceive them as value-destroying or unrelated diversification efforts.

Market Impact of Horizontal Mergers

Horizontal mergers significantly impact the market by reducing competition between firms operating in the same industry, often leading to increased market concentration and potential monopolistic behavior. These mergers can result in higher pricing power for the combined entity, possibly decreasing consumer choice and innovation. In contrast, conglomerate mergers, involving firms from unrelated industries, have less direct effect on market competition within any single sector.

Regulatory Considerations for Both Merger Types

Regulatory considerations for conglomerate mergers focus on potential anticompetitive effects arising from reduced competition in disparate markets and increased market power through diversification. Horizontal mergers face stringent scrutiny under antitrust laws due to the direct overlap in product markets, risking monopolistic dominance and reduced consumer choices. Both merger types require thorough review by agencies like the Federal Trade Commission and Department of Justice to ensure compliance with competition policies and to assess impacts on market competition and consumer welfare.

Real-World Examples: Conglomerate vs Horizontal Mergers

Amazon's acquisition of Whole Foods exemplifies a horizontal merger, expanding its footprint within retail grocery to enhance market share and operational synergy. In contrast, Berkshire Hathaway's diverse portfolio growth through acquisitions like Dairy Queen represents a conglomerate merger, blending unrelated industries to diversify risk and revenue streams. Horizontal mergers typically concentrate on industry consolidation, while conglomerate mergers emphasize diversification across different sectors for strategic stability.

Choosing the Right Merger Strategy

Choosing the right merger strategy depends on the company's goals and market position. Conglomerate mergers combine firms from unrelated industries to diversify risk and expand market reach, while horizontal mergers involve companies within the same industry aiming to increase market share and reduce competition. Evaluating factors such as industry compatibility, potential synergies, and regulatory implications is essential for maximizing value and achieving strategic objectives.

Conglomerate Merger Infographic

libterm.com

libterm.com