A Certificate of Deposit (CD) is a secure savings instrument offered by banks with a fixed interest rate and maturity date, allowing you to earn more than a regular savings account. Typically, funds are locked in for a specific term, ranging from a few months to several years, with penalties for early withdrawal. Discover how CDs can fit into your financial strategy by exploring the details in the rest of this article.

Table of Comparison

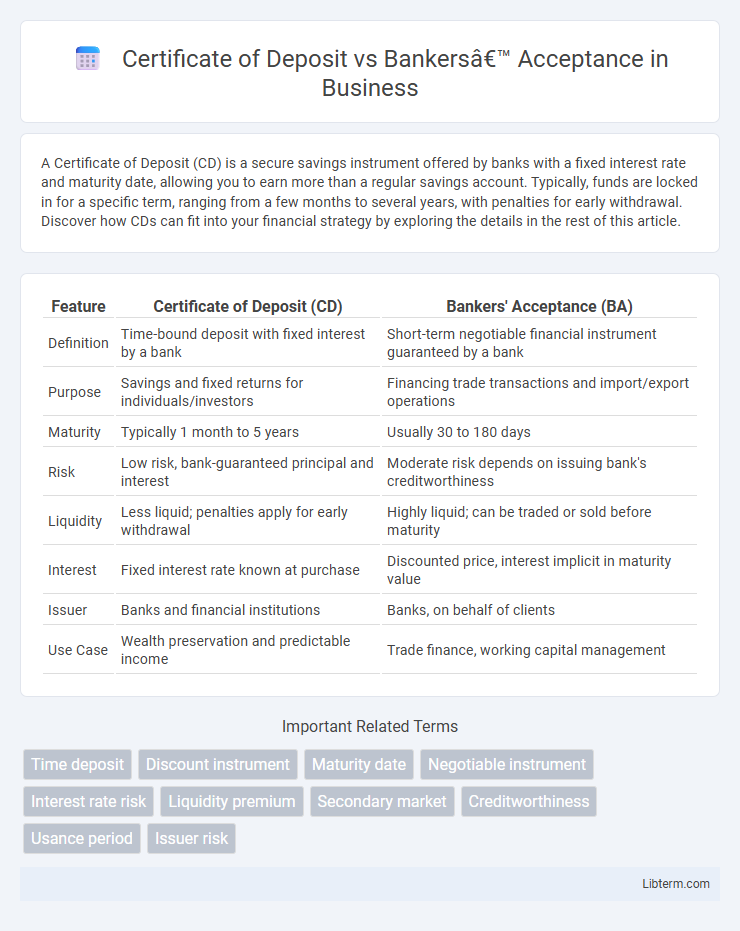

| Feature | Certificate of Deposit (CD) | Bankers' Acceptance (BA) |

|---|---|---|

| Definition | Time-bound deposit with fixed interest by a bank | Short-term negotiable financial instrument guaranteed by a bank |

| Purpose | Savings and fixed returns for individuals/investors | Financing trade transactions and import/export operations |

| Maturity | Typically 1 month to 5 years | Usually 30 to 180 days |

| Risk | Low risk, bank-guaranteed principal and interest | Moderate risk depends on issuing bank's creditworthiness |

| Liquidity | Less liquid; penalties apply for early withdrawal | Highly liquid; can be traded or sold before maturity |

| Interest | Fixed interest rate known at purchase | Discounted price, interest implicit in maturity value |

| Issuer | Banks and financial institutions | Banks, on behalf of clients |

| Use Case | Wealth preservation and predictable income | Trade finance, working capital management |

Introduction to Certificate of Deposit (CD) and Bankers’ Acceptance (BA)

A Certificate of Deposit (CD) is a time-bound savings product issued by banks that offers a fixed interest rate over a specified term, providing a low-risk investment with guaranteed returns. Bankers' Acceptance (BA) is a short-term debt instrument guaranteed by a bank, commonly used in international trade to finance the shipment of goods, offering liquidity and security to investors. Both CDs and BAs serve as reliable financial tools, with CDs focusing on stable interest income and BAs facilitating trade finance with bank-backed credit assurance.

Definition and Key Features of Certificate of Deposit

A Certificate of Deposit (CD) is a time-bound deposit issued by banks with a fixed interest rate and maturity date, serving as a low-risk investment option. Key features of a CD include guaranteed principal, interest earnings over a specified term, and penalties for early withdrawal, making it suitable for conservative investors seeking predictable returns. Unlike Bankers' Acceptances, which are short-term debt instruments used in international trade, CDs primarily focus on individual or institutional savings with less market risk exposure.

Understanding Bankers’ Acceptance: Meaning and Characteristics

Bankers' Acceptance (BA) is a short-term financial instrument issued by a company and guaranteed by a bank, primarily used in international trade to finance the import and export of goods. Unlike Certificates of Deposit (CDs), which are time deposits offered by banks to depositors with a fixed interest rate and maturity, BAs serve as a negotiable promissory note that ensures payment at a future date, backed by the credibility of the issuing bank. Key characteristics of Bankers' Acceptance include liquidity, tradability in secondary markets, and a maturity typically ranging from 30 to 180 days, making it a reliable tool for managing short-term trade financing risks.

How Certificates of Deposit Work

Certificates of Deposit (CDs) are time-bound savings instruments issued by banks that offer fixed interest rates in exchange for locking in funds for a specified term, typically ranging from a few months to several years. The principal amount earns interest over the term, which is paid at maturity or periodically depending on the CD type, providing a low-risk investment option insured by the FDIC up to applicable limits. Unlike Bankers' Acceptances, which are short-term trade finance instruments used for international transactions, CDs serve primarily as secure, interest-bearing deposits for individual or institutional investors seeking predictable returns.

How Bankers’ Acceptances Function

Bankers' Acceptances function as short-term, negotiable financial instruments issued by a bank guaranteeing payment on a future date, typically used in international trade transactions. Unlike Certificates of Deposit, which represent time deposits held by investors with fixed interest, Bankers' Acceptances facilitate trust between buyers and sellers by ensuring payment upon maturity. These instruments can be traded in secondary markets, providing liquidity and reducing credit risk for both parties involved.

Main Differences Between CD and BA

A Certificate of Deposit (CD) is a time-bound deposit offered by banks with a fixed interest rate, primarily used by individual investors seeking low-risk returns, whereas a Bankers' Acceptance (BA) is a short-term credit instrument issued by a firm and guaranteed by a bank, mainly utilized in international trade finance. CDs have fixed maturity periods ranging from a few months to several years, whereas BAs typically mature within 30 to 180 days. The key difference lies in risk and purpose: CDs are low-risk, interest-earning deposits, while BAs serve as negotiable instruments to finance commercial transactions and carry credit risk tied to the issuing firm.

Risk Factors: CD vs Bankers’ Acceptance

Certificate of Deposit (CD) risk primarily involves interest rate sensitivity and bank credit risk, with FDIC insurance mitigating potential losses up to $250,000 per depositor. Bankers' Acceptances (BAs) carry higher credit risk linked to the issuing bank and underlying trade transaction, with no government insurance, thus exposing investors to potential default risk. BAs generally exhibit greater market risk due to limited liquidity compared to CDs, which tend to be more liquid and predictable.

Interest Rates and Returns Comparison

Certificate of Deposit (CD) typically offers fixed interest rates that are generally higher than standard savings accounts, providing predictable returns over a specified term, often ranging from a few months to several years. Bankers' Acceptance (BA) rates tend to fluctuate based on short-term market conditions and credit risk, often reflecting slightly higher yields due to their use in trade finance and limited liquidity. CDs prioritize safety and steady interest income, while BAs potentially deliver greater returns with increased market exposure and credit considerations.

Suitability and Use Cases for Investors

Certificates of Deposit (CDs) offer fixed interest rates and are ideal for conservative investors seeking low-risk, short- to medium-term savings with predictable returns. Bankers' Acceptances (BAs) serve corporate investors and institutional traders looking for short-term liquidity solutions and are often used in international trade financing due to their negotiability and lower default risk. CDs suit individual investors prioritizing capital preservation, while BAs align with entities requiring flexible, marketable instruments to manage cash flow and credit exposure.

Choosing Between Certificate of Deposit and Bankers’ Acceptance

Choosing between a Certificate of Deposit (CD) and a Bankers' Acceptance (BA) depends on investment duration, risk tolerance, and liquidity needs. CDs offer fixed interest rates with lower risk and typically shorter maturities, making them ideal for conservative investors seeking guaranteed returns. Bankers' Acceptances provide negotiable short-term credit instruments backed by banks, suitable for investors requiring flexibility and slightly higher yields in trade finance contexts.

Certificate of Deposit Infographic

libterm.com

libterm.com