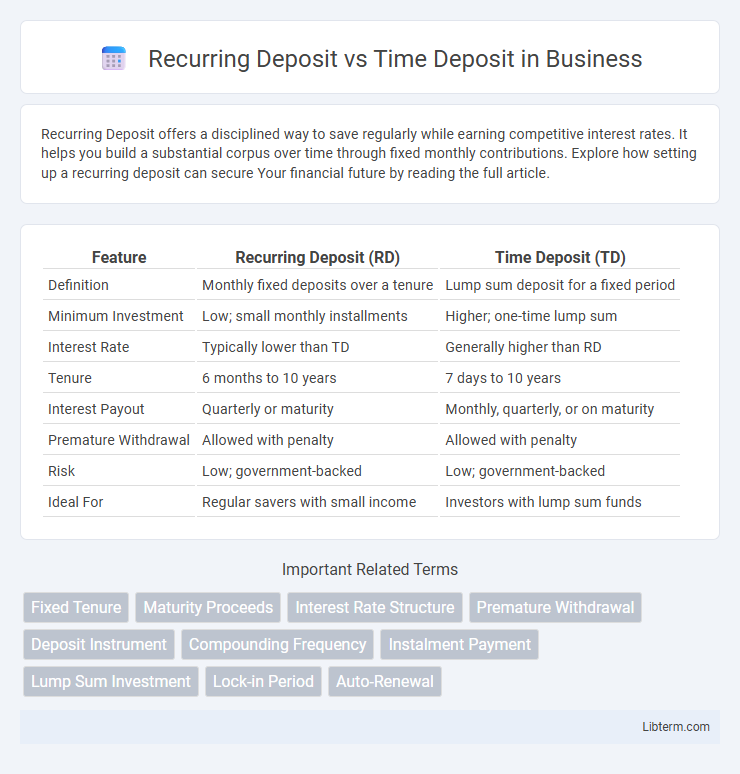

Recurring Deposit offers a disciplined way to save regularly while earning competitive interest rates. It helps you build a substantial corpus over time through fixed monthly contributions. Explore how setting up a recurring deposit can secure Your financial future by reading the full article.

Table of Comparison

| Feature | Recurring Deposit (RD) | Time Deposit (TD) |

|---|---|---|

| Definition | Monthly fixed deposits over a tenure | Lump sum deposit for a fixed period |

| Minimum Investment | Low; small monthly installments | Higher; one-time lump sum |

| Interest Rate | Typically lower than TD | Generally higher than RD |

| Tenure | 6 months to 10 years | 7 days to 10 years |

| Interest Payout | Quarterly or maturity | Monthly, quarterly, or on maturity |

| Premature Withdrawal | Allowed with penalty | Allowed with penalty |

| Risk | Low; government-backed | Low; government-backed |

| Ideal For | Regular savers with small income | Investors with lump sum funds |

Introduction to Recurring Deposit and Time Deposit

Recurring Deposit (RD) is a financial instrument offered by banks that allows individuals to invest a fixed amount monthly for a predetermined tenure, earning interest compounded quarterly. Time Deposit, also known as Fixed Deposit (FD), requires a lump-sum investment for a specific term at a fixed interest rate, providing guaranteed returns upon maturity. Both deposit types offer secure savings options with varying liquidity and interest benefits tailored to diverse financial goals.

Key Features of Recurring Deposits

Recurring deposits require fixed monthly contributions over a predetermined tenure, enabling systematic savings with assured returns at maturity. Interest rates on recurring deposits are generally compounded quarterly, offering better growth compared to regular savings accounts. Unlike time deposits, recurring deposits allow smaller periodic investments, making them ideal for individuals with steady monthly income seeking disciplined savings.

Key Features of Time Deposits

Time deposits offer a fixed interest rate for a predetermined tenure, typically ranging from a few months to several years, ensuring predictable returns on the invested principal. They do not allow additional deposits during the term, differentiating them from recurring deposits, which require regular contributions. Upon maturity, the principal and accrued interest are paid out in a lump sum, emphasizing capital preservation with minimal risk.

Eligibility Criteria and Documentation

Eligibility criteria for Recurring Deposits typically require individuals to have a valid savings account with the bank, allowing regular monthly contributions, whereas Time Deposits are open to individuals, companies, and trusts without mandatory monthly payments. Documentation for both accounts generally includes valid identity proof such as a passport, Aadhaar card, or PAN card, along with address proof like a utility bill or bank statement. Banks may require additional documents for Non-Resident Indians (NRIs) or corporate accounts, ensuring compliance with regulatory norms.

Interest Rate Comparison: RD vs TD

Recurring Deposits (RD) typically offer interest rates ranging from 5.5% to 7.5% annually, making them an attractive option for incremental savings with monthly contributions. Time Deposits (TD), also known as Fixed Deposits, generally provide slightly higher interest rates of about 6% to 8% per annum, depending on the tenure and financial institution. The choice between RD and TD often depends on the investor's cash flow flexibility and the desire for a lump sum investment versus periodic deposits.

Flexibility and Tenure Options

Recurring deposits offer greater flexibility in contribution amounts and enable monthly investments over a predefined tenure, typically ranging from 6 months to 10 years. Time deposits, also known as fixed deposits, provide fixed tenure options varying from 7 days up to 10 years, with lump sum investments made at the start. While recurring deposits require systematic monthly savings, time deposits allow investors to lock in a fixed amount for a set period without ongoing contributions.

Withdrawal Rules and Penalties

Recurring Deposits (RD) typically allow partial or full withdrawals before maturity only under strict conditions, often incurring penalties such as reduced interest rates or forfeiture of bonuses. Time Deposits (Fixed Deposits) generally impose a lock-in period during which premature withdrawal triggers penalty charges, including lower interest payouts or flat fees. Banks specify penalty amounts based on the tenure and the amount withdrawn, making adherence to withdrawal rules crucial to maximizing deposit benefits.

Tax Implications of RD and TD

Recurring Deposits (RD) and Time Deposits (TD) have distinct tax implications impacting investor returns. Interest earned on both RD and TD is fully taxable as per the individual's income tax slab, with no tax benefits on the principal amount invested in either scheme. TDS (Tax Deducted at Source) is applicable if interest exceeds Rs40,000 per year for general taxpayers and Rs50,000 for senior citizens, requiring investors to factor this into post-tax returns.

Suitability: Who Should Choose RD or TD?

Recurring Deposits (RD) suit salaried individuals or those with regular monthly savings who seek disciplined investment with fixed contributions over a specific tenure. Time Deposits (TD), also known as Fixed Deposits, are ideal for investors with lump-sum amounts aiming for assured returns without periodic contributions. Risk-averse investors prioritizing liquidity and steady income often prefer TDs, while those focused on building a habit of saving gradually favor RDs for enhanced financial planning.

Conclusion: Making the Right Choice

Choosing between a Recurring Deposit (RD) and a Time Deposit (Fixed Deposit) depends on your saving ability and financial goals. RD suits individuals with a steady income who prefer disciplined monthly savings and moderate returns, while Time Deposits offer lump-sum investment with higher interest rates for a fixed tenure. Assess your cash flow, investment horizon, and risk tolerance to make an informed decision that maximizes your returns.

Recurring Deposit Infographic

libterm.com

libterm.com