A stop out is a trading term referring to the automatic closure of your positions when your account balance falls below the broker's required margin level. This risk management measure protects both the trader and broker from excessive losses by liquidating positions to prevent a negative balance. Discover how understanding stop out levels can safeguard your investments by reading the full article.

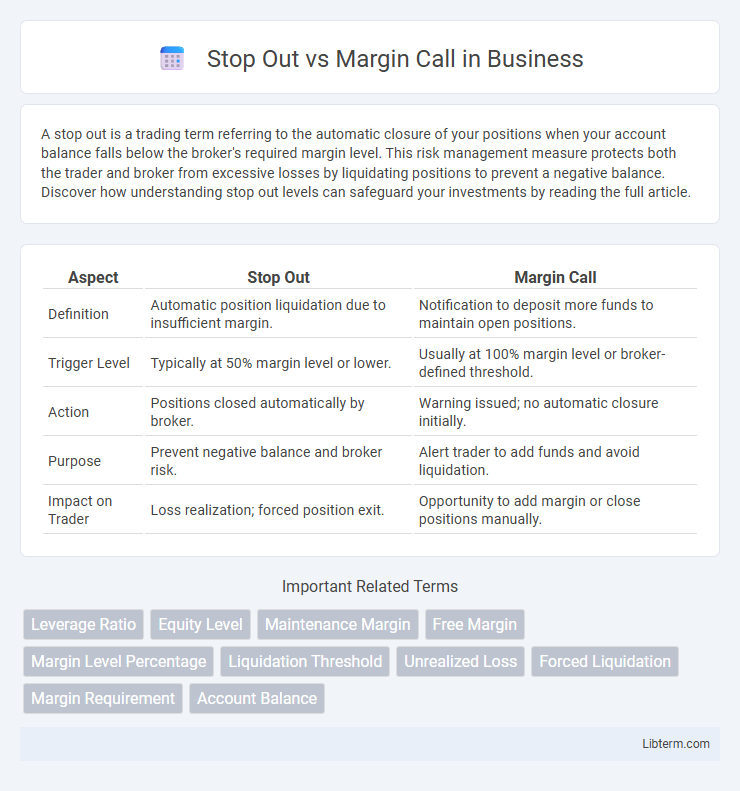

Table of Comparison

| Aspect | Stop Out | Margin Call |

|---|---|---|

| Definition | Automatic position liquidation due to insufficient margin. | Notification to deposit more funds to maintain open positions. |

| Trigger Level | Typically at 50% margin level or lower. | Usually at 100% margin level or broker-defined threshold. |

| Action | Positions closed automatically by broker. | Warning issued; no automatic closure initially. |

| Purpose | Prevent negative balance and broker risk. | Alert trader to add funds and avoid liquidation. |

| Impact on Trader | Loss realization; forced position exit. | Opportunity to add margin or close positions manually. |

Understanding Stop Out and Margin Call

Stop Out occurs when an account's equity falls below the required margin level, triggering automatic closure of open positions to prevent further losses. Margin Call is a warning issued when the equity approaches the maintenance margin, prompting traders to deposit funds or close positions to avoid Stop Out. Understanding the distinction helps traders manage risk and maintain sufficient margin to sustain positions during market fluctuations.

Key Differences Between Stop Out and Margin Call

Stop Out occurs when a trader's account equity falls below the required maintenance margin, triggering automatic closure of losing positions to prevent further losses, while Margin Call is a broker's warning that the trader must deposit more funds or close positions to maintain the minimum margin. The key difference lies in action and timing: Margin Call is an alert demanding immediate attention, whereas Stop Out is the actual forced liquidation of positions. Stop Out levels are typically set by brokers as a percentage of the required margin, often ranging from 20% to 50%, while Margin Calls happen before reaching that critical threshold.

How Stop Out Works in Forex Trading

Stop Out in forex trading occurs when a trader's account equity falls below the broker's required maintenance margin, triggering automatic closure of open positions to prevent further losses. This process ensures that the trader does not incur a negative balance by liquidating positions at the current market price once the stop out level is reached. Understanding the stop out mechanism is crucial for managing risk and maintaining sufficient margin to avoid forced liquidations during volatile market conditions.

What Triggers a Margin Call?

A margin call is triggered when a trader's account equity falls below the broker's required maintenance margin level, indicating insufficient funds to cover potential losses. This occurs due to adverse market movements that reduce the value of held positions, increasing the margin used beyond available equity. Brokers then demand additional funds or position liquidation to restore the account to the required margin balance and prevent a stop out event.

Calculating Stop Out and Margin Call Levels

Stop out and margin call levels are critical thresholds in forex trading, defined by the percentage of used margin relative to the equity in the trading account. The margin call level is calculated by dividing equity by used margin and multiplying by 100, triggering a margin call when this value falls to a broker-set percentage, commonly 100%. The stop out level, often set lower than the margin call level, is calculated similarly and results in automatic liquidation of positions to prevent further losses when the equity drops below this threshold.

Impact of Leverage on Stop Out and Margin Call

Leverage significantly amplifies the risk of reaching a stop out or margin call, as higher leverage reduces the margin available to absorb market losses. When leverage is high, even small adverse price movements can quickly deplete the equity in a trader's account, triggering a margin call requiring additional funds to maintain positions. Failure to meet the margin call often results in a stop out, where the broker automatically closes positions to prevent further losses, emphasizing the critical role of leverage management in risk control.

Preventing Margin Calls and Stop Outs

Preventing margin calls and stop outs requires maintaining sufficient equity above the maintenance margin level by monitoring leverage and avoiding excessive risk exposure. Traders should set conservative stop-loss orders and use proper position sizing to preserve capital and reduce the likelihood of forced liquidation. Regularly reviewing account balance and margin utilization ensures timely adjustments before margin thresholds trigger automatic liquidations.

Role of Brokers in Stop Out and Margin Call

Brokers play a critical role in managing stop out and margin call events by closely monitoring clients' account equity and margin levels. They enforce margin call alerts to warn traders when their funds approach the minimum margin requirement, prompting them to add funds or close positions. During a stop out, brokers automatically liquidate open positions to prevent accounts from falling into negative balances, protecting both the trader and brokerage from excessive losses.

Common Mistakes Leading to Margin Calls

Traders often confuse stop out and margin call levels, leading to critical errors in account management. Common mistakes causing margin calls include over-leveraging, neglecting to monitor open positions regularly, and failing to maintain the required margin ratio set by brokers. Ignoring these factors frequently results in forced liquidation, emphasizing the importance of risk management and accurate margin level awareness.

Effective Risk Management Strategies

Understanding the distinction between stop out and margin call levels is crucial for effective risk management in trading. Stop out occurs when a broker forcibly closes open positions due to insufficient margin, while a margin call is a warning to deposit more funds to maintain open trades. Implementing strict stop loss orders and maintaining adequate account equity can prevent reaching these thresholds, ensuring better control over leverage and minimizing potential losses.

Stop Out Infographic

libterm.com

libterm.com