Precedent transactions analysis evaluates previous mergers and acquisitions to determine the value of a target company, providing critical benchmarks for your deal. This method relies on historical data and market conditions to estimate a fair purchase price, offering insight into industry valuation trends. Explore the article further to understand how precedent transactions can refine your negotiation strategy and optimize transaction outcomes.

Table of Comparison

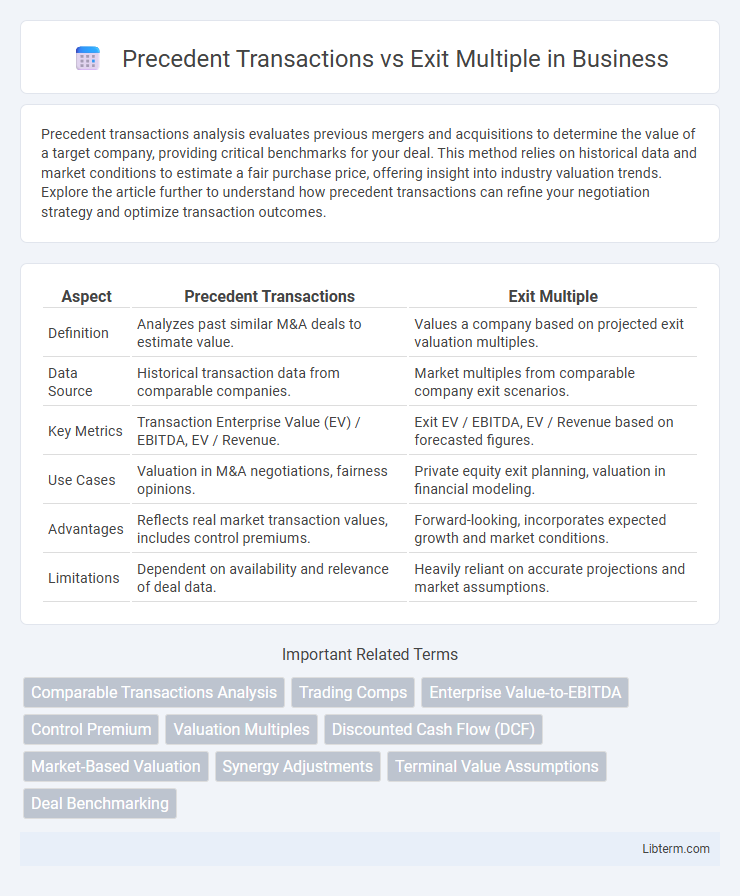

| Aspect | Precedent Transactions | Exit Multiple |

|---|---|---|

| Definition | Analyzes past similar M&A deals to estimate value. | Values a company based on projected exit valuation multiples. |

| Data Source | Historical transaction data from comparable companies. | Market multiples from comparable company exit scenarios. |

| Key Metrics | Transaction Enterprise Value (EV) / EBITDA, EV / Revenue. | Exit EV / EBITDA, EV / Revenue based on forecasted figures. |

| Use Cases | Valuation in M&A negotiations, fairness opinions. | Private equity exit planning, valuation in financial modeling. |

| Advantages | Reflects real market transaction values, includes control premiums. | Forward-looking, incorporates expected growth and market conditions. |

| Limitations | Dependent on availability and relevance of deal data. | Heavily reliant on accurate projections and market assumptions. |

Introduction to Precedent Transactions and Exit Multiples

Precedent transactions involve analyzing historical sales of comparable companies to estimate a firm's valuation based on actual market data from similar deals. Exit multiples refer to valuation ratios, such as EV/EBITDA or EV/Revenue, derived from these comparable transactions to project the potential sale price of a business at exit. Combining precedent transaction analysis with exit multiples provides a market-driven framework to assess target company value in mergers and acquisitions.

Defining Precedent Transactions Analysis

Precedent transactions analysis involves evaluating past M&A deals that are similar in industry, size, and timing to estimate a company's valuation. This method uses transaction multiples derived from comparable deals to benchmark and assess value, reflecting real market premiums paid historically. It contrasts with exit multiple analysis, which relies on projected financial metrics and public market comparables rather than actual transaction data.

Understanding the Exit Multiple Approach

The exit multiple approach estimates a company's future sale price by applying a multiple to a financial metric, such as EBITDA, based on comparable transactions in the market. This method reflects market sentiment and industry trends, providing a forward-looking valuation that aligns with investor expectations. Exit multiples are crucial in private equity and M&A for projecting exit values and assessing potential returns on investment.

Key Differences Between Precedent Transactions and Exit Multiples

Precedent transactions analysis relies on actual market prices from historical M&A deals to value a company, reflecting real buyer behavior and control premiums. Exit multiples project future valuation based on comparable public company multiples, assuming companies can be sold at market prices without significant premiums. The key difference is that precedent transactions capture transaction-specific premiums and deal contexts, while exit multiples provide a forward-looking valuation based on ongoing public market sentiment.

Methodology: How Precedent Transactions Are Calculated

Precedent transactions valuation involves analyzing historical M&A deals within the same industry, considering transaction multiples such as EV/EBITDA and EV/Revenue paid in comparable sales. The methodology includes selecting transactions with similar characteristics, normalizing financial metrics to account for non-recurring items, and applying these multiples to the target company's financials to estimate its enterprise value. Key data points include deal size, timing, control premiums, and synergies, which influence the accuracy and relevance of the precedent multiples.

Methodology: How Exit Multiples Are Estimated

Exit multiples are estimated by analyzing comparable companies' valuations during recent transactions, focusing on financial metrics such as EBITDA, revenue, or earnings to derive a market-based multiple. This method involves selecting relevant precedent transactions within the same industry and adjusting for factors like growth rates, market conditions, and operational scale to ensure comparability. The derived exit multiples provide a standardized approach to estimating the company's future sale value, reflecting current market sentiment and transaction realities.

Pros and Cons of Precedent Transactions

Precedent transactions analysis offers valuable insights by using real market data, reflecting actual prices paid in relevant M&A deals, which enhances valuation accuracy in dynamic industries. However, its reliance on historical transactions may lead to outdated or non-comparable benchmarks, especially in fast-evolving markets or unique deal structures. The approach also risks overestimating value due to synergies and control premiums often embedded in acquisition prices, requiring careful adjustments for reliable exit valuation.

Pros and Cons of Exit Multiples

Exit multiples offer a straightforward and widely used valuation method based on projected financial metrics like EBITDA or revenue at the time of exit, allowing investors to quickly estimate a company's future value. The approach is highly sensitive to market conditions and comparable company data, which can introduce volatility and less accuracy if the multiples are derived from outdated or non-representative transactions. However, exit multiples provide a market-driven perspective, capturing investor sentiment and industry trends, making them useful for benchmarking and scenario analysis in private equity and merger and acquisition contexts.

When to Use Precedent Transactions vs Exit Multiples

Precedent transactions are ideal for valuing companies by analyzing past M&A deals in the same industry, providing market-driven insights when comparable sales data is available. Exit multiples are best utilized in projecting future valuation scenarios during private equity exits or IPOs, leveraging EBITDA or revenue multiples based on industry benchmarks. Use precedent transactions for historical value validation and exit multiples for forward-looking valuation modeling.

Best Practices for Valuation Using Both Methods

Precedent Transactions analysis requires selecting comparable deals with similar industry, size, and transaction timing to ensure accurate valuation multiples reflecting market sentiment. Exit Multiple valuation involves projecting financial metrics and applying appropriate industry-specific multiples derived from public comps or precedent transactions for realistic exit scenarios. Combining both methods, best practices include cross-validating results to capture market trends and adjusting for deal-specific premiums or discounts to enhance valuation precision.

Precedent Transactions Infographic

libterm.com

libterm.com