Liquidation is the process of winding up a company's operations by selling off assets to pay creditors and distribute any remaining funds to shareholders. It often occurs when a business is insolvent or has decided to close voluntarily. Discover how liquidation affects your financial interests and what steps you should take by reading the rest of this article.

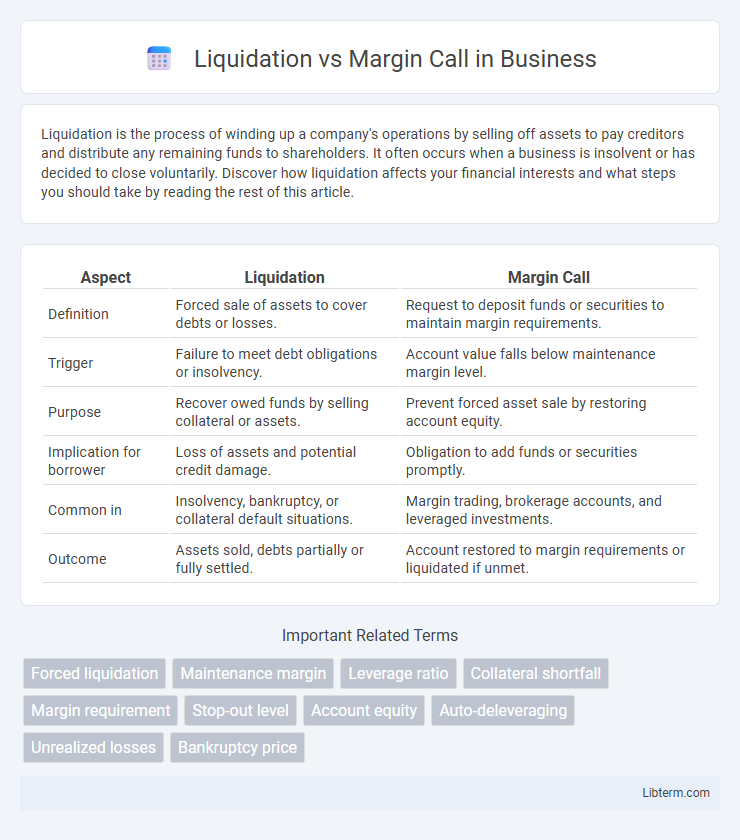

Table of Comparison

| Aspect | Liquidation | Margin Call |

|---|---|---|

| Definition | Forced sale of assets to cover debts or losses. | Request to deposit funds or securities to maintain margin requirements. |

| Trigger | Failure to meet debt obligations or insolvency. | Account value falls below maintenance margin level. |

| Purpose | Recover owed funds by selling collateral or assets. | Prevent forced asset sale by restoring account equity. |

| Implication for borrower | Loss of assets and potential credit damage. | Obligation to add funds or securities promptly. |

| Common in | Insolvency, bankruptcy, or collateral default situations. | Margin trading, brokerage accounts, and leveraged investments. |

| Outcome | Assets sold, debts partially or fully settled. | Account restored to margin requirements or liquidated if unmet. |

Introduction to Liquidation and Margin Call

Liquidation occurs when a trader's account value falls below the required maintenance margin, resulting in the automatic closing of positions to prevent further losses. A margin call is a broker's demand for an investor to deposit additional funds or securities to meet minimum margin requirements. Understanding the distinction between liquidation and margin call is essential for managing risks in leveraged trading environments.

Key Definitions: Liquidation vs Margin Call

Liquidation occurs when a trader's position is forcibly closed by the exchange to prevent further losses after the account's equity falls below the required maintenance margin. A margin call is a demand from the broker for the investor to deposit additional funds or securities to restore the account to the required minimum margin level. Understanding the distinction between liquidation and margin call is crucial for risk management in leveraged trading environments.

How Liquidation Works in Trading

Liquidation in trading occurs when a trader's account balance falls below the required maintenance margin, triggering the automatic closure of positions to prevent further losses. This process forces the sale of assets at market prices, often resulting in significant losses for leveraged traders. Unlike margin calls, which are warnings to deposit more funds, liquidation is the actual enforcement mechanism that protects brokers from default risk.

Understanding Margin Calls

A margin call occurs when the value of an investor's margin account falls below the broker's required minimum maintenance margin, prompting the investor to deposit more funds or sell assets to cover the shortfall. Unlike liquidation, which is the forced sale of securities to meet margin requirements when the margin call is unmet, a margin call provides an opportunity to restore the account's equity before automatic liquidation. Understanding margin calls is crucial for managing leveraged investments and avoiding unexpected forced sales that can amplify losses.

Causes of Liquidation

Liquidation occurs when a trader's collateral falls below the maintenance margin requirement due to significant losses in a leveraged position, forcing the platform to forcibly close the position to prevent further loss. Market volatility, rapid price declines, and insufficient margin deposits are primary causes triggering liquidation events. Failure to meet margin calls exacerbates liquidation risks by depleting the trader's equity and reducing the buffer needed to sustain open positions.

Triggers for Margin Calls

Margin calls are triggered when an investor's account equity falls below the broker's required maintenance margin, typically due to unfavorable price movements in leveraged positions. This drop in equity signals insufficient collateral to cover potential losses, prompting the broker to demand additional funds or asset liquidation to restore the minimum margin level. Liquidation occurs if the investor fails to meet the margin call, leading the broker to forcibly close positions to prevent further losses.

Key Differences Between Liquidation and Margin Call

Liquidation occurs when a trader's margin account falls below the maintenance margin, forcing the broker to close positions automatically to prevent further losses. A margin call is a demand for the trader to deposit additional funds to restore the minimum margin requirement and maintain their positions. The key difference is that liquidation is an automatic process initiated by the broker, while a margin call gives the trader an opportunity to add funds before forced liquidation happens.

Real-World Examples

In the 2020 Tesla stock surge, investors faced margin calls when their leveraged positions dropped below maintenance requirements, forcing them to add funds or sell shares to avoid liquidation. During the 2021 cryptocurrency crash, many leveraged traders experienced automatic liquidations on platforms like Binance as asset values plummeted, wiping out their collateral. Real-world examples highlight how margin calls act as warnings requiring immediate action, while liquidations are forced sales that close positions to prevent further losses.

Risk Management Strategies

Effective risk management strategies distinguish between liquidation and margin call processes by emphasizing proactive monitoring of leverage and collateral levels. Traders implement stop-loss orders and maintain sufficient margin to prevent forced liquidation, which occurs when the account equity falls below the maintenance margin requirement. Utilizing real-time analytics and stress testing helps identify potential margin calls early, allowing timely adjustments to positions and reducing the risk of severe losses.

Conclusion: Protecting Your Portfolio

Liquidation occurs when an investor's position is forcibly closed due to insufficient margin, leading to realized losses, while a margin call demands additional funds to maintain the position. Protecting your portfolio requires maintaining adequate margin levels, setting stop-loss orders, and closely monitoring market volatility to avoid forced liquidation. Prioritizing risk management strategies ensures long-term capital preservation and minimizes unexpected financial exposure.

Liquidation Infographic

libterm.com

libterm.com