Transaction fees are charges applied whenever you complete a financial exchange, often varying by payment method or platform. These fees can impact the overall cost of your purchase or transfer, making it essential to understand their structure. Explore the rest of the article to learn how transaction fees affect your money and how to minimize them effectively.

Table of Comparison

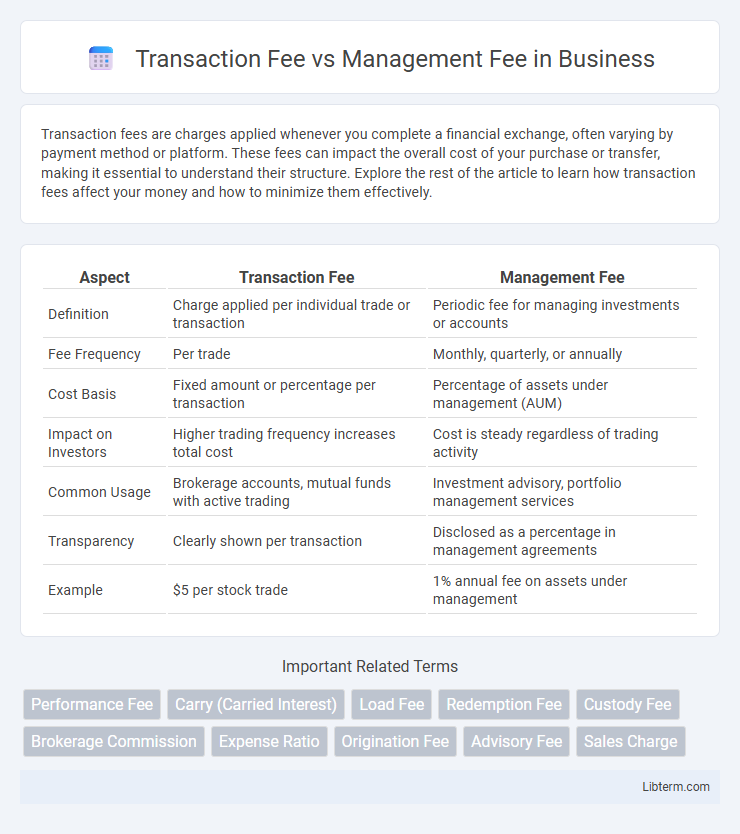

| Aspect | Transaction Fee | Management Fee |

|---|---|---|

| Definition | Charge applied per individual trade or transaction | Periodic fee for managing investments or accounts |

| Fee Frequency | Per trade | Monthly, quarterly, or annually |

| Cost Basis | Fixed amount or percentage per transaction | Percentage of assets under management (AUM) |

| Impact on Investors | Higher trading frequency increases total cost | Cost is steady regardless of trading activity |

| Common Usage | Brokerage accounts, mutual funds with active trading | Investment advisory, portfolio management services |

| Transparency | Clearly shown per transaction | Disclosed as a percentage in management agreements |

| Example | $5 per stock trade | 1% annual fee on assets under management |

Understanding Transaction Fees

Transaction fees are charges incurred each time a financial transaction, such as a stock purchase or sale, is executed, typically calculated as a percentage of the transaction amount or a fixed flat rate per trade. These fees directly impact short-term investment costs and can accumulate significantly for frequent traders, reducing overall returns. Understanding transaction fees is crucial for investors to evaluate the cost-effectiveness of their trading strategies compared to ongoing management fees charged as a percentage of assets under management.

What Are Management Fees?

Management fees are recurring charges paid by investors to fund managers for handling investment portfolios, typically expressed as an annual percentage of assets under management (AUM). These fees cover services such as portfolio selection, research, and administrative expenses, directly impacting the net returns of mutual funds, ETFs, or investment accounts. Unlike transaction fees, which are one-time costs incurred per trade, management fees are ongoing and crucial to evaluating the cost structure of investment products.

Key Differences Between Transaction and Management Fees

Transaction fees are one-time charges applied each time a specific financial transaction occurs, such as buying or selling assets, while management fees are recurring charges based on a percentage of assets under management (AUM) for ongoing portfolio oversight. Transaction fees tend to vary depending on the number and type of trades executed, whereas management fees provide a predictable cost structure regardless of trading frequency. Understanding these key differences helps investors evaluate the total cost impact on investment returns and choose the fee model that aligns with their trading style and financial goals.

How Transaction Fees Impact Investors

Transaction fees directly affect investors by increasing the cost of each trade, reducing overall returns especially in portfolios with frequent transactions. These fees can erode capital gains and dividend income, making active trading less profitable compared to passive strategies with lower transaction costs. Understanding the impact of transaction fees helps investors balance trading frequency and portfolio growth, optimizing long-term investment performance.

The Role of Management Fees in Investment Funds

Management fees in investment funds are typically charged as a fixed percentage of assets under management, covering operational costs such as portfolio management, research, and administrative expenses. These fees ensure continuous professional oversight and strategic decision-making, directly impacting the fund's net returns and investor experience. Unlike transaction fees, which are incurred per trade and vary with activity level, management fees provide a stable revenue stream that funds rely on for efficient and consistent management.

Pros and Cons of Transaction Fees

Transaction fees offer cost efficiency for investors with infrequent trading, as fees are applied only per trade rather than a continuous charge, making them ideal for long-term holders seeking lower overall expenses. However, transaction fees may discourage active trading due to cumulative costs, potentially limiting portfolio flexibility and timely asset reallocation. These fees can lead to higher expenses for frequent traders compared to a flat management fee, impacting overall investment returns.

Pros and Cons of Management Fees

Management fees provide consistent revenue for fund managers, ensuring stable operational funding and ongoing portfolio oversight, which benefits long-term investors. However, these fees can erode investment returns over time, especially if the fund underperforms or fails to justify the cost through active management. Unlike transaction fees that charge per trade, management fees apply regardless of trading frequency, potentially reducing net gains when market activity is low.

Cost Implications: Transaction Fee vs. Management Fee

Transaction fees are incurred each time a trade or transaction occurs, directly impacting short-term trading costs and potentially reducing overall portfolio returns with frequent activity. Management fees are fixed annual percentages based on assets under management, affecting long-term investment costs regardless of transaction volume. Understanding the cost structure of both fees is crucial for investors to optimize net returns and minimize unnecessary expenses.

Factors Influencing Fee Structures

Transaction fees and management fees vary based on several key factors, including the type of investment product, frequency of trades, and the fund manager's experience. Market volatility and fund size also play significant roles, with larger funds often able to negotiate lower fees due to economies of scale. Regulatory environment and competitive landscape further influence fee structures, as firms adjust costs to attract or retain investors.

Choosing the Right Fee Model for Your Investment

Choosing the right fee model for your investment depends on understanding the impact of transaction fees and management fees on your returns. Transaction fees are charged per trade, making them suitable for active traders who execute frequent buys and sells. Management fees are a fixed percentage of assets under management, preferred by long-term investors seeking consistent portfolio oversight without per-trade charges.

Transaction Fee Infographic

libterm.com

libterm.com