Asset purchase involves acquiring specific items or assets of a company rather than buying the entire business entity. This strategy allows buyers to select valuable resources, intellectual property, and equipment tailored to their needs while minimizing liabilities. Discover how an asset purchase can benefit your business and learn the key considerations in the rest of this article.

Table of Comparison

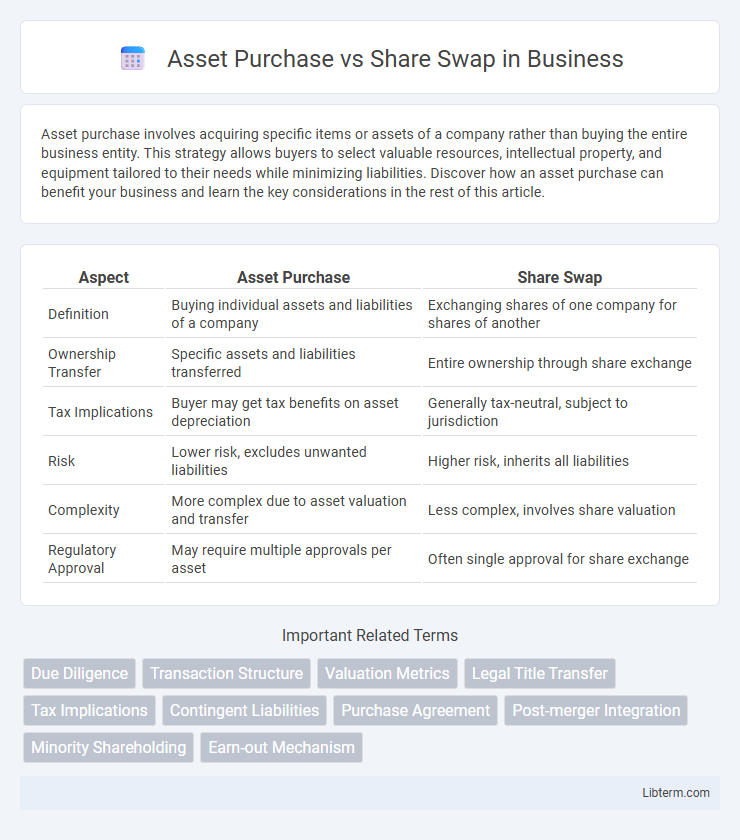

| Aspect | Asset Purchase | Share Swap |

|---|---|---|

| Definition | Buying individual assets and liabilities of a company | Exchanging shares of one company for shares of another |

| Ownership Transfer | Specific assets and liabilities transferred | Entire ownership through share exchange |

| Tax Implications | Buyer may get tax benefits on asset depreciation | Generally tax-neutral, subject to jurisdiction |

| Risk | Lower risk, excludes unwanted liabilities | Higher risk, inherits all liabilities |

| Complexity | More complex due to asset valuation and transfer | Less complex, involves share valuation |

| Regulatory Approval | May require multiple approvals per asset | Often single approval for share exchange |

Understanding Asset Purchase vs Share Swap

Asset Purchase involves acquiring specific assets and liabilities of a company, allowing buyers to select which items to purchase and potentially avoid unwanted obligations. Share Swap entails exchanging shares between companies or shareholders, resulting in the transfer of ownership of the entire entity, including all assets and liabilities. Understanding the distinctions between Asset Purchase and Share Swap is crucial for strategic decision-making, tax implications, and regulatory compliance in mergers and acquisitions.

Key Differences Between Asset Purchase and Share Swap

Asset Purchase involves acquiring specific assets and liabilities of a company, offering targeted control over selected business components, whereas Share Swap entails exchanging shares to gain ownership of the entire company, including all assets and liabilities. Tax implications vary significantly; asset purchases often allow depreciation step-ups, benefiting buyers, while share swaps may offer capital gains advantages for sellers. Legal complexities differ because asset purchases require individual asset transfers and consents, while share swaps involve changing equity ownership without altering underlying contracts.

Legal Implications of Asset Purchase and Share Swap

In an asset purchase, the buyer acquires specific assets and liabilities, allowing precise control over legal responsibilities and potential liabilities, often requiring asset transfer agreements and third-party consents. Conversely, a share swap involves exchanging shares of the acquiring company for shares of the target company, resulting in the transfer of ownership of all company assets and liabilities, including hidden or contingent obligations, without changing the legal identity of the target. Understanding these distinctions is crucial for structuring deals to manage legal risks, regulatory compliance, tax implications, and shareholder approval requirements effectively.

Tax Considerations in Asset Purchase vs Share Swap

Asset purchases often trigger immediate tax deductions through asset depreciation and can result in a step-up in the tax basis, potentially reducing future taxable gains. Share swaps typically defer capital gains tax, as shareholders exchange shares without recognizing immediate income, but also retain underlying tax attributes and liabilities. Careful tax planning is essential to balance immediate tax benefits of asset purchases against the potential deferral advantages and risk retention of share swaps.

Due Diligence Requirements for Each Transaction

Due diligence for asset purchases requires detailed examination of individual assets, contracts, liabilities, and regulatory compliance to ensure clear transfer and valuation accuracy. Share swap due diligence focuses on the target company's overall financial health, corporate structure, shareholder agreements, ongoing liabilities, and potential contingent risks affecting the entire entity. Both transactions demand thorough legal, financial, and tax assessments, but asset purchases emphasize specific asset ownership validation while share swaps require comprehensive evaluation of equity interests and corporate governance.

Advantages of Asset Purchase

Asset purchase allows buyers to selectively acquire specific assets and liabilities, minimizing exposure to unknown or contingent liabilities. It provides greater flexibility in structuring the transaction, enabling tax benefits by stepping up the basis of acquired assets. This method also simplifies post-transaction integration by clearly distinguishing purchased assets from the seller's remaining business operations.

Benefits of Share Swap Transactions

Share swap transactions offer benefits such as tax efficiency by allowing the deferral of capital gains taxes, preserving cash flow for the acquiring company. They facilitate smoother ownership transitions by directly exchanging shares, which may simplify regulatory approvals and maintain continuity in management. Share swaps also enhance alignment of interests among stakeholders, fostering cooperative growth post-merger or acquisition.

Risks and Challenges in Both Acquisition Methods

Asset purchase involves acquiring specific assets and liabilities, exposing buyers to risks such as hidden liabilities, complex valuation, and potential disruption to ongoing contracts. Share swap entails exchanging shares to acquire ownership, posing challenges including shareholder approvals, possible minority interest disputes, and integration risks linked to inherited liabilities. Both methods require thorough due diligence to mitigate financial, legal, and operational uncertainties.

Strategic Considerations for Buyers and Sellers

Strategic considerations in asset purchase versus share swap revolve around control, liability, and tax implications for buyers and sellers. Buyers opting for asset purchases gain flexibility by selectively acquiring assets and avoiding unknown liabilities, while sellers may face higher tax burdens and remain responsible for certain obligations. In share swaps, buyers acquire entire companies with existing contracts and liabilities intact, benefiting from streamlined ownership transfer, whereas sellers can defer tax liabilities and retain shareholder status until completion.

Choosing Between Asset Purchase and Share Swap

Choosing between an asset purchase and a share swap hinges on factors such as tax implications, risk exposure, and control over specific liabilities and assets. Asset purchases allow buyers to selectively acquire liabilities and assets, offering protection from unknown shareholder liabilities, while share swaps transfer ownership of all assets and liabilities, often simplifying the transaction but increasing exposure. Evaluating financial goals, due diligence outcomes, and negotiation flexibility is crucial to determine the best structure for maximizing value and minimizing risk.

Asset Purchase Infographic

libterm.com

libterm.com