Restricted Stock Units (RSUs) are company shares granted to employees as part of their compensation, typically subject to a vesting schedule based on time or performance goals. RSUs provide a valuable incentive aligning employee interests with company success, as they have no immediate tax implications until vested and delivered. Explore this article to understand how RSUs can impact your financial planning and career benefits.

Table of Comparison

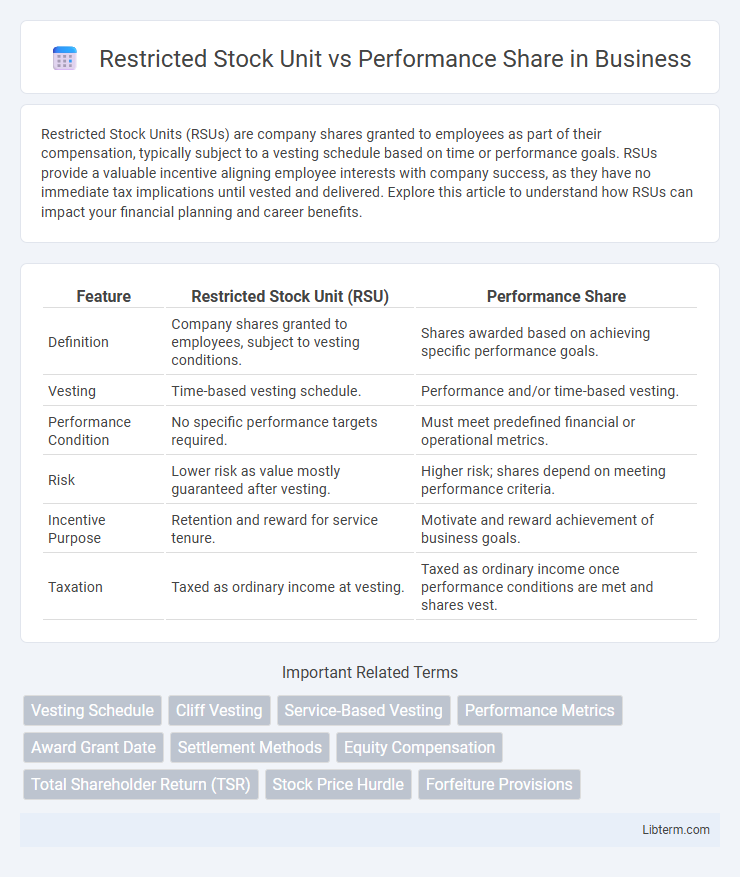

| Feature | Restricted Stock Unit (RSU) | Performance Share |

|---|---|---|

| Definition | Company shares granted to employees, subject to vesting conditions. | Shares awarded based on achieving specific performance goals. |

| Vesting | Time-based vesting schedule. | Performance and/or time-based vesting. |

| Performance Condition | No specific performance targets required. | Must meet predefined financial or operational metrics. |

| Risk | Lower risk as value mostly guaranteed after vesting. | Higher risk; shares depend on meeting performance criteria. |

| Incentive Purpose | Retention and reward for service tenure. | Motivate and reward achievement of business goals. |

| Taxation | Taxed as ordinary income at vesting. | Taxed as ordinary income once performance conditions are met and shares vest. |

Introduction to Restricted Stock Units (RSUs) and Performance Shares

Restricted Stock Units (RSUs) represent company shares granted to employees as part of compensation, typically vesting over time without requiring purchase. Performance Shares are equity awards granted only if specific financial or operational targets are met, aligning employee rewards with company performance. Both RSUs and Performance Shares serve as retention tools, but RSUs offer guaranteed stock based on tenure, while Performance Shares depend on achieving predefined metrics.

Key Definitions: What are RSUs and Performance Shares?

Restricted Stock Units (RSUs) are company shares granted to employees as compensation, subject to vesting conditions typically based on time or employment duration, converting to actual stock upon vesting. Performance Shares are equity awards granted based on the achievement of specific company performance metrics over a set period, aligning employee rewards with corporate goals. Both instruments serve as incentives but differ in vesting triggers: RSUs depend primarily on tenure, while Performance Shares depend on meeting financial or operational targets.

Granting Process: How Employees Receive RSUs vs Performance Shares

Employees receive Restricted Stock Units (RSUs) through a direct grant from their employer, usually as part of compensation or retention plans, where the shares vest over a predetermined schedule. Performance Shares are awarded based on the achievement of specific company performance goals, with the actual number of shares granted determined after the performance period ends. The granting process for RSUs is straightforward, involving a fixed number of shares granted upfront, while Performance Shares involve a conditional grant contingent upon meeting measurable criteria.

Vesting Schedules: Time-based vs Performance-based

Restricted Stock Units (RSUs) typically feature a time-based vesting schedule, where shares vest after a predetermined period, encouraging employee retention over time. Performance Shares use performance-based vesting criteria, linking share awards directly to specific company or individual performance targets, thereby aligning incentives with measurable outcomes. Choosing between RSUs and Performance Shares depends on strategic goals related to employee motivation and long-term value creation.

Payout Mechanisms: When and How Shares Are Delivered

Restricted Stock Units (RSUs) are typically delivered to employees upon vesting, usually after a predetermined time period, and the shares are transferred outright without conditions based on company performance. Performance Shares, on the other hand, are contingent on meeting specific financial or operational targets, with payouts occurring only if these performance criteria are achieved, often resulting in variable share amounts. The timing of Performance Share delivery depends on the evaluation of performance metrics at the end of the performance period, which can extend beyond standard vesting schedules used for RSUs.

Tax Implications for RSUs and Performance Shares

Restricted Stock Units (RSUs) are taxed as ordinary income when they vest, based on the fair market value of the shares at that time, triggering payroll and income tax withholding. Performance Shares are typically taxed only after performance conditions are met and shares are awarded, with the value at vesting subject to ordinary income tax and potential capital gains upon sale. Tax planning for RSUs often involves timing the sale to manage tax liability, while Performance Shares require careful consideration of performance timelines and tax event triggers to optimize after-tax returns.

Impact on Employee Motivation and Retention

Restricted Stock Units (RSUs) provide employees with ownership stakes that vest over time, fostering long-term commitment by aligning their interests with company growth and stability. Performance Shares, contingent on achieving specific company goals, drive motivation by directly linking rewards to individual and corporate performance metrics. The choice between RSUs and Performance Shares significantly influences employee retention strategies, with RSUs promoting loyalty through guaranteed vesting schedules, while Performance Shares incentivize high performance but carry more risk of forfeiture.

Accounting and Reporting Considerations

Restricted Stock Units (RSUs) are recorded as compensation expense based on the fair market value of the shares at the grant date, with expenses recognized over the vesting period according to ASC Topic 718. Performance Shares depend on meeting specific performance targets, requiring companies to estimate probable outcomes and adjust compensation expense accordingly, reflecting changes in the likelihood of achieving performance metrics. Both equity incentives involve complex reporting and disclosure requirements, but Performance Shares introduce additional volatility in expense recognition due to their contingent nature.

Pros and Cons of RSUs vs Performance Shares

Restricted Stock Units (RSUs) offer straightforward equity ownership with a guaranteed value upon vesting, providing employees with predictable compensation and less performance-related risk. Performance Shares depend on meeting specific company goals, potentially offering higher rewards but with increased uncertainty and complexity in valuation. RSUs typically enhance retention with clear timelines, while Performance Shares can better align employee incentives with long-term corporate performance, though they may result in no payout if targets are unmet.

Choosing the Right Equity Compensation: RSUs vs Performance Shares

Choosing the right equity compensation between Restricted Stock Units (RSUs) and Performance Shares depends on aligning with company goals and employee incentives; RSUs provide guaranteed equity value upon vesting, while Performance Shares tie rewards to specific performance targets, driving accountability and company growth. RSUs offer straightforward value and less risk for employees, making them suitable for talent retention, whereas Performance Shares motivate outperformance by linking equity to measurable milestones such as revenue growth or earnings per share. Consider the company's stage, growth strategy, and desired employee behavior to determine whether predictable ownership via RSUs or performance-driven equity incentives through Performance Shares best support long-term success.

Restricted Stock Unit Infographic

libterm.com

libterm.com