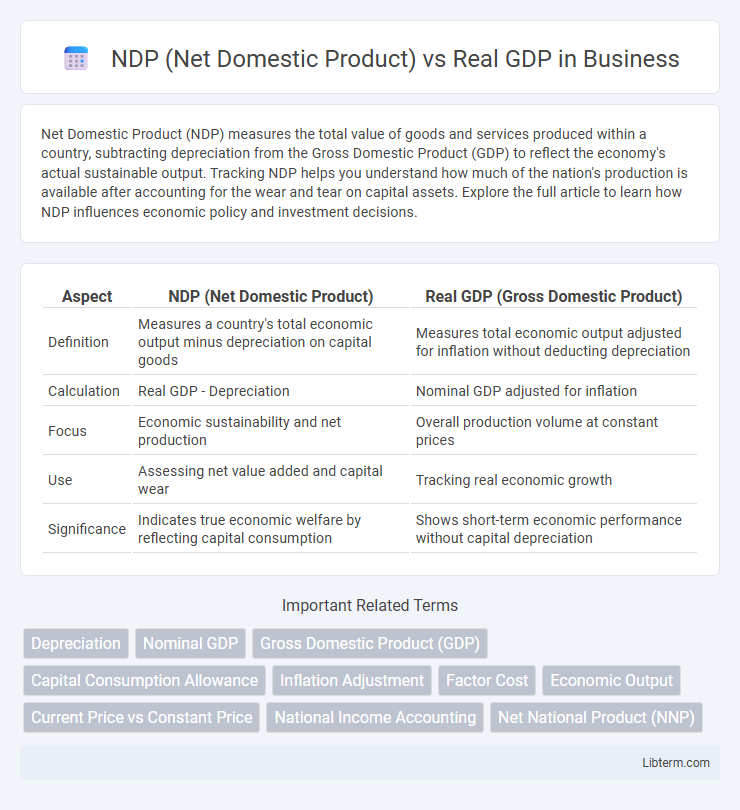

Net Domestic Product (NDP) measures the total value of goods and services produced within a country, subtracting depreciation from the Gross Domestic Product (GDP) to reflect the economy's actual sustainable output. Tracking NDP helps you understand how much of the nation's production is available after accounting for the wear and tear on capital assets. Explore the full article to learn how NDP influences economic policy and investment decisions.

Table of Comparison

| Aspect | NDP (Net Domestic Product) | Real GDP (Gross Domestic Product) |

|---|---|---|

| Definition | Measures a country's total economic output minus depreciation on capital goods | Measures total economic output adjusted for inflation without deducting depreciation |

| Calculation | Real GDP - Depreciation | Nominal GDP adjusted for inflation |

| Focus | Economic sustainability and net production | Overall production volume at constant prices |

| Use | Assessing net value added and capital wear | Tracking real economic growth |

| Significance | Indicates true economic welfare by reflecting capital consumption | Shows short-term economic performance without capital depreciation |

Understanding NDP (Net Domestic Product): Definition and Components

Net Domestic Product (NDP) measures the total market value of all final goods and services produced within a country during a specific period, minus depreciation of capital assets. It consists of Gross Domestic Product (GDP) adjusted by subtracting consumption of fixed capital, reflecting the economy's net production after accounting for asset wear and tear. Understanding NDP provides a clearer picture of sustainable economic output by focusing on the actual addition to the nation's wealth, unlike Real GDP which includes gross total production without asset value reduction.

What is Real GDP? Key Attributes and Calculation

Real GDP measures the value of all final goods and services produced within a country's borders, adjusted for inflation to reflect true economic growth. It excludes the effects of price changes, providing a more accurate comparison of economic output over different time periods. Real GDP is calculated by dividing nominal GDP by a price index, such as the GDP deflator, then multiplying by 100 to remove the inflation component from the nominal GDP figure.

Differences in Measurement: NDP vs Real GDP

Net Domestic Product (NDP) differs from Real GDP primarily in accounting for depreciation, as NDP subtracts the consumption of fixed capital while Real GDP does not. Real GDP measures the total market value of all final goods and services produced within a country, adjusted for inflation, without considering asset wear and tear. Therefore, NDP provides a more accurate reflection of an economy's sustainable production by recognizing capital depreciation, unlike Real GDP's broader output focus.

The Impact of Depreciation in NDP Calculation

Net Domestic Product (NDP) accounts for the depreciation of capital assets by subtracting the consumption of fixed capital from Real GDP, providing a more accurate measure of an economy's sustainable output. Depreciation reflects the wear and tear or obsolescence of physical assets over time, which reduces the actual value of production that can be used for future growth. By incorporating depreciation, NDP highlights the portion of output available for new investments and consumption without depleting the capital stock.

Adjusting for Inflation: The Role of Real GDP

Real GDP adjusts nominal GDP by accounting for inflation, providing a more accurate measure of economic performance over time by reflecting the true value of goods and services produced. Net Domestic Product (NDP) further refines this by subtracting depreciation from Real GDP, highlighting the economy's sustainable output after accounting for capital loss. Understanding Real GDP is essential for comparing economic growth across periods without distortion from price level changes.

Economic Indicators: Comparing Their Uses

Net Domestic Product (NDP) adjusts Real GDP by subtracting depreciation on capital goods, providing a clearer measure of an economy's sustainable output and net production capacity. Real GDP quantifies total economic output adjusted for inflation, serving as a broad indicator of economic performance but potentially overstating long-term growth due to ignoring capital wear and tear. Economists prefer NDP for assessing investment needs and long-term economic health, while Real GDP is widely used for short-term economic analysis and policy decisions.

Policy Implications: When to Use NDP vs Real GDP

Net Domestic Product (NDP) accounts for depreciation by subtracting capital consumption from Real GDP, providing a more accurate measure of economic sustainability and long-term growth potential. Policymakers analyzing investment efficiency and capital stock maintenance rely on NDP to design fiscal strategies that promote sustainable development and infrastructure renewal. Real GDP serves better for short-term economic performance assessments and monetary policy decisions focused on output and inflation without adjusting for capital wear and tear.

Limitations of NDP and Real GDP in Economic Analysis

Net Domestic Product (NDP) excludes depreciation, providing a clearer view of economic sustainability, but it still lacks consideration of quality changes in goods and services, leading to incomplete welfare assessments. Real GDP adjusts for inflation, reflecting true economic growth over time, yet it ignores informal economic activities and environmental degradation, which skews comprehensive economic analysis. Both NDP and Real GDP fail to capture income distribution disparities, limiting their effectiveness in evaluating overall economic well-being.

Practical Examples: NDP vs Real GDP in Real Economies

Net Domestic Product (NDP) accounts for depreciation by subtracting the consumption of fixed capital from Real GDP, offering a clearer picture of an economy's actual productive capacity. For example, if Country A has a Real GDP of $1 trillion but its capital assets depreciate by $100 billion annually, its NDP would be $900 billion, reflecting the net value of goods and services after maintaining capital stock. In contrast, Real GDP of Country B measures total output at $1 trillion without adjusting for wear and tear, potentially overstating sustainable economic performance.

Choosing the Right Metric: NDP or Real GDP for Decision-Making

NDP (Net Domestic Product) accounts for depreciation, providing a clearer picture of an economy's sustainable production by measuring net output after replacing worn-out capital, while Real GDP reflects the total value of goods and services adjusted for inflation without deducting capital consumption. Choosing NDP over Real GDP is crucial for long-term investment and policy decisions focused on economic sustainability and capital maintenance. Real GDP serves better for short-term economic growth analysis, but NDP informs decisions requiring an understanding of net wealth creation and asset preservation.

NDP (Net Domestic Product) Infographic

libterm.com

libterm.com