Book value represents a company's net asset value calculated by subtracting liabilities from total assets, reflecting the accounting value of ownership equity. This metric helps investors assess whether a stock is undervalued or overvalued by comparing the market price to the company's actual worth. Discover how understanding book value can improve your investment decisions by exploring the rest of this article.

Table of Comparison

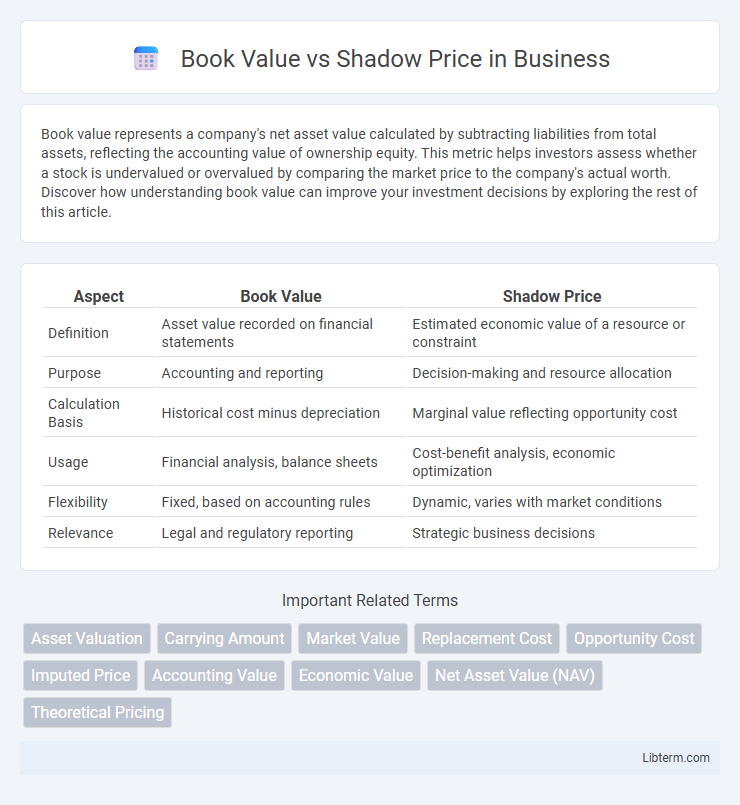

| Aspect | Book Value | Shadow Price |

|---|---|---|

| Definition | Asset value recorded on financial statements | Estimated economic value of a resource or constraint |

| Purpose | Accounting and reporting | Decision-making and resource allocation |

| Calculation Basis | Historical cost minus depreciation | Marginal value reflecting opportunity cost |

| Usage | Financial analysis, balance sheets | Cost-benefit analysis, economic optimization |

| Flexibility | Fixed, based on accounting rules | Dynamic, varies with market conditions |

| Relevance | Legal and regulatory reporting | Strategic business decisions |

Understanding Book Value: Definition and Importance

Book value represents a company's net asset value calculated by subtracting total liabilities from total assets, reflecting the accounting value recorded on the balance sheet. It is crucial for investors and analysts as a baseline for assessing company worth, providing insight into financial stability and long-term solvency. Understanding book value helps distinguish between market valuation and intrinsic asset value, guiding informed investment decisions.

What is Shadow Price? A Comprehensive Overview

Shadow Price represents the implicit or opportunity cost assigned to a resource or constraint in optimization problems, reflecting its true economic value beyond market price. It quantifies the incremental benefit or cost change associated with a one-unit increase in a resource's availability, commonly used in linear programming and cost-benefit analysis. Unlike Book Value, which records historical cost on financial statements, Shadow Price guides decision-making by capturing potential value in resource allocation and efficiency improvements.

Key Differences Between Book Value and Shadow Price

Book value represents the historical cost of an asset recorded on financial statements, reflecting its original purchase price minus depreciation, while shadow price estimates the economic value of that asset in scenarios where market prices are absent or distorted. Book value is used primarily for accounting and reporting purposes, grounded in tangible financial data, whereas shadow price is applied in cost-benefit analysis and resource allocation to reflect true opportunity costs. The key difference lies in book value's basis on recorded transaction costs versus shadow price's role as an inferred economic valuation to guide decision-making.

Methods for Calculating Book Value

Book value is calculated using the historical cost method, where the original purchase price minus accumulated depreciation determines the asset's value on the balance sheet. Another approach involves adjusting for impairment losses to reflect a more accurate book value for assets that have declined in market worth. Shadow price, in contrast, represents the estimated economic value of an asset or resource, often used in cost-benefit analysis when market prices are unavailable or distorted.

Techniques for Estimating Shadow Price

Techniques for estimating shadow price often include the use of linear programming, dual pricing methods, and marginal cost analysis, which help determine the implicit value of resources not reflected in book value. Economists employ sensitivity analysis and opportunity cost evaluation to quantify shadow prices, especially when market prices are absent or distorted. These approaches provide a more accurate representation of economic value compared to traditional accounting-based book value metrics.

Real-World Applications: Book Value vs Shadow Price

Book value represents the recorded cost of an asset on financial statements, reflecting its historical purchase price minus depreciation, essential for accounting and tax reporting. Shadow price quantifies the true economic value of a resource in constrained optimization problems, often used in project evaluation and resource allocation decisions to capture opportunity costs. Real-world applications illustrate book value's role in financial reporting accuracy, whereas shadow price informs strategic investment and policy decisions by revealing hidden values beyond market prices.

Book Value and Shadow Price in Financial Analysis

Book value represents the accounting value of an asset based on its historical cost minus depreciation, reflecting its recorded worth on the balance sheet. Shadow price, used in financial analysis and economic decision-making, indicates the implicit value of an asset or resource not captured by market prices, often derived through optimization or constrained scenarios. Comparing book value and shadow price reveals discrepancies between accounting valuations and opportunity costs, guiding more informed investment and resource allocation decisions.

Advantages and Limitations of Book Value

Book value provides a clear and straightforward measure of an asset's historical cost minus depreciation, offering simplicity and ease of calculation for financial reporting and accounting purposes. Its advantages include objectivity and reliability, as it is based on actual purchase price and not market fluctuations. However, book value is limited by its inability to reflect current market conditions or the intangible value of assets, often resulting in undervaluation or irrelevance in decision-making compared to shadow price, which considers opportunity costs and market dynamics.

Pros and Cons of Using Shadow Price

Shadow price offers a more comprehensive valuation by incorporating opportunity costs and externalities absent in traditional book value assessments, enabling better-informed decision-making. It provides a dynamic measure reflecting real economic value, useful for policy analysis and project evaluation, but its reliance on subjective estimations and assumptions can reduce accuracy and consistency. Implementation complexity and data intensity present challenges, making shadow price less practical for routine accounting compared to the straightforward and objective nature of book value.

Choosing the Right Metric: When to Use Book Value or Shadow Price

Book value measures the historical cost of an asset minus depreciation, reflecting its accounting value, while shadow price estimates the true economic value considering opportunity costs and externalities. Use book value for financial reporting, tax assessments, and analyzing balance sheets where objective, verifiable costs are essential. Opt for shadow price in project evaluation, environmental impact analysis, and cost-benefit studies where market distortions or non-market factors affect decision-making.

Book Value Infographic

libterm.com

libterm.com