A reverse merger is a strategic financial maneuver where a private company acquires a publicly traded shell company to bypass the lengthy and complex process of going public through an initial public offering (IPO). This approach can expedite market entry and provide liquidity more swiftly while potentially reducing costs and regulatory hurdles. Explore the rest of the article to understand how reverse mergers might benefit your business strategy and the key considerations involved.

Table of Comparison

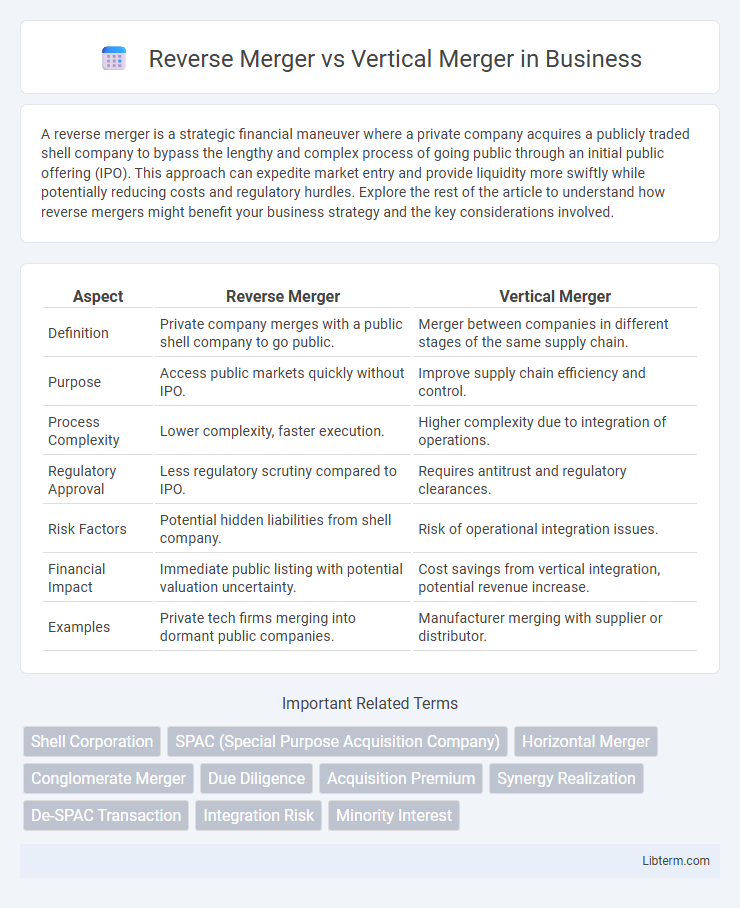

| Aspect | Reverse Merger | Vertical Merger |

|---|---|---|

| Definition | Private company merges with a public shell company to go public. | Merger between companies in different stages of the same supply chain. |

| Purpose | Access public markets quickly without IPO. | Improve supply chain efficiency and control. |

| Process Complexity | Lower complexity, faster execution. | Higher complexity due to integration of operations. |

| Regulatory Approval | Less regulatory scrutiny compared to IPO. | Requires antitrust and regulatory clearances. |

| Risk Factors | Potential hidden liabilities from shell company. | Risk of operational integration issues. |

| Financial Impact | Immediate public listing with potential valuation uncertainty. | Cost savings from vertical integration, potential revenue increase. |

| Examples | Private tech firms merging into dormant public companies. | Manufacturer merging with supplier or distributor. |

Introduction to Reverse and Vertical Mergers

Reverse mergers allow private companies to become publicly traded without a traditional initial public offering by merging with an existing public shell company. Vertical mergers involve the combination of firms operating at different stages within the same industry supply chain, aiming to improve efficiency and control over production or distribution. Both strategies offer distinct growth opportunities, with reverse mergers emphasizing streamlined market entry and vertical mergers highlighting operational integration.

Defining Reverse Merger: Concept and Process

A reverse merger is a corporate strategy where a private company acquires a publicly listed shell company to bypass the traditional initial public offering (IPO) process, enabling quicker access to public capital markets. The process involves the private company shareholders exchanging their shares for a majority stake in the public entity, effectively turning the private business into a publicly traded company. This method contrasts with vertical mergers, which involve combining companies operating at different stages of the same industry supply chain to increase operational efficiency rather than accessing public markets.

Understanding Vertical Merger: Concept and Process

Vertical mergers involve the combination of two companies operating at different stages within the same supply chain, such as a manufacturer merging with a supplier or distributor. This strategic integration streamlines production processes, reduces costs, and enhances supply chain efficiency by gaining control over multiple phases of product development, manufacturing, or distribution. Understanding the vertical merger process entails evaluating synergies, regulatory approvals, and aligning operational workflows to achieve competitive advantages and improved market positioning.

Key Differences Between Reverse and Vertical Mergers

A reverse merger involves a private company acquiring a publicly traded company to bypass the lengthy IPO process, whereas a vertical merger occurs between companies operating at different stages of the supply chain to enhance operational efficiency. Reverse mergers primarily focus on gaining public market access quickly, while vertical mergers aim to streamline production, reduce costs, and control supply chains. Key differences include the purpose of the merger, the nature of the companies involved, and the strategic outcomes sought by the entities.

Strategic Objectives: Why Companies Choose Reverse Mergers

Companies pursue reverse mergers primarily to achieve rapid access to public capital markets without the extensive regulatory scrutiny associated with traditional IPOs. This strategy enables private firms to expedite liquidity events, enhance valuation transparency, and gain immediate market presence. Contrastingly, vertical mergers focus on supply chain integration to improve operational efficiencies rather than expedited market entry.

Strategic Objectives: Why Companies Pursue Vertical Mergers

Vertical mergers enable companies to streamline supply chains, reduce production costs, and improve control over the entire value chain, thereby enhancing operational efficiency. Firms pursue vertical mergers to secure critical inputs, ensure stable supplies, and mitigate risks associated with supplier dependency. This strategic alignment facilitates faster time-to-market, improved product quality, and increased competitive advantage in their industries.

Legal and Regulatory Considerations

Reverse mergers often face stringent regulatory scrutiny from the SEC due to concerns about transparency and potential fraud, requiring comprehensive disclosure and compliance with securities laws. Vertical mergers undergo antitrust review focusing on market competition and potential monopolistic practices, with regulators evaluating the combined entity's control over supply chains and distribution channels. Both require adherence to industry-specific regulations and careful legal due diligence to mitigate risks of litigation and regulatory penalties.

Financial Implications of Reverse vs Vertical Mergers

Reverse mergers often provide a faster and more cost-effective route for private companies to access public capital markets, bypassing traditional IPO expenses and regulatory scrutiny. Vertical mergers, by integrating companies at different stages of production, can realize cost synergies through improved supply chain efficiency and reduced operational expenses. The financial implications of reverse mergers focus on capital raising and liquidity benefits, while vertical mergers emphasize long-term value creation through enhanced competitive positioning and operational control.

Risks and Challenges Associated with Each Merger Type

Reverse mergers pose significant risks such as inadequate due diligence, hidden liabilities, and regulatory scrutiny due to the unconventional nature of acquiring a public shell company. Vertical mergers face challenges including integration difficulties across different stages of the supply chain, potential antitrust violations, and cultural clashes that can disrupt operational efficiency. Both merger types demand careful risk assessment to mitigate financial, legal, and operational consequences that could undermine long-term success.

Choosing the Right Merger Strategy for Business Growth

Choosing the right merger strategy for business growth depends on the company's goals and industry context. A reverse merger offers a faster route to public listing by acquiring a shell company, ideal for raising capital and enhancing market presence without an initial public offering. A vertical merger, integrating companies at different production stages, strengthens supply chain control and operational efficiency, promoting sustainable long-term growth.

Reverse Merger Infographic

libterm.com

libterm.com