A subsidiary is a company controlled by another, known as the parent company, which holds a majority of its shares. Subsidiaries operate independently but contribute to the overall strategy and financial performance of the parent entity. Explore the rest of this article to understand how subsidiaries impact corporate structure and business growth.

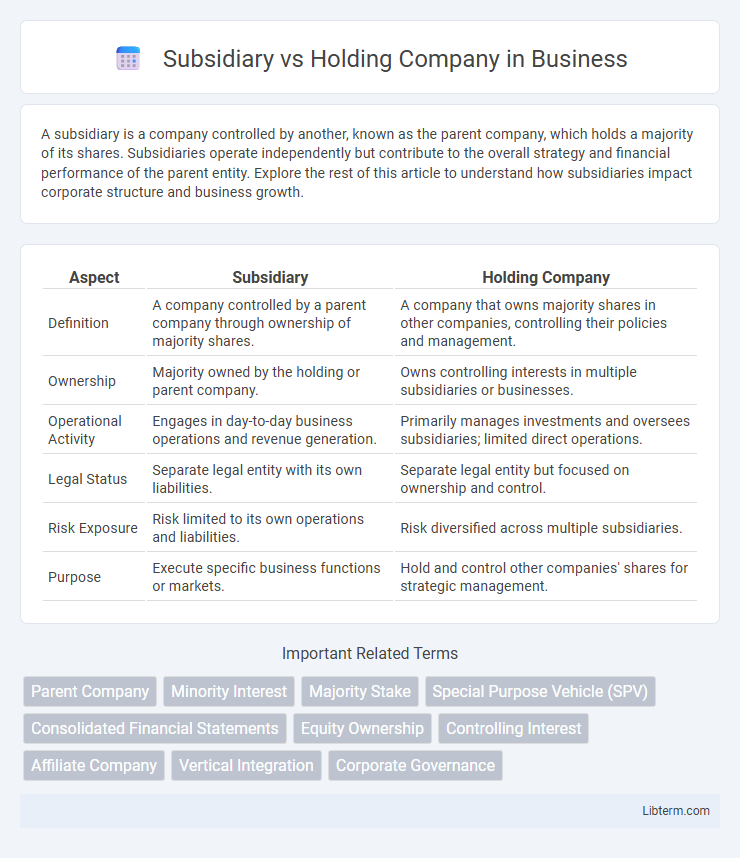

Table of Comparison

| Aspect | Subsidiary | Holding Company |

|---|---|---|

| Definition | A company controlled by a parent company through ownership of majority shares. | A company that owns majority shares in other companies, controlling their policies and management. |

| Ownership | Majority owned by the holding or parent company. | Owns controlling interests in multiple subsidiaries or businesses. |

| Operational Activity | Engages in day-to-day business operations and revenue generation. | Primarily manages investments and oversees subsidiaries; limited direct operations. |

| Legal Status | Separate legal entity with its own liabilities. | Separate legal entity but focused on ownership and control. |

| Risk Exposure | Risk limited to its own operations and liabilities. | Risk diversified across multiple subsidiaries. |

| Purpose | Execute specific business functions or markets. | Hold and control other companies' shares for strategic management. |

Definition of Subsidiary and Holding Company

A subsidiary is a company controlled by another company, known as the holding or parent company, through majority ownership of its voting shares. A holding company primarily exists to own shares of other companies and does not produce goods or services itself, serving to control subsidiaries and manage investments. The holding company exerts control over subsidiaries while allowing them to operate as separate legal entities.

Key Differences Between Subsidiary and Holding Company

A holding company primarily owns controlling interests in other companies, enabling it to influence their policies and management without direct involvement in daily operations. In contrast, a subsidiary operates as a separate legal entity controlled by the holding company and actively engages in business activities. The key differences include control structure, operational autonomy, and legal responsibilities, with subsidiaries bearing liabilities for their actions, while holding companies generally limit risk exposure to their investments.

Structure and Organization

A subsidiary operates as a separate legal entity controlled by a parent company, with its own management and organizational structure tailored to specific business functions. In contrast, a holding company primarily exists to own shares of other companies without engaging in direct business operations, focusing on overall corporate governance and strategic oversight. The organizational distinction lies in subsidiaries having operational autonomy while holding companies maintain centralized control across their investments.

Legal and Financial Responsibilities

A subsidiary operates under the legal ownership and control of a holding company, which holds a majority stake or full ownership, making the holding company responsible for strategic decisions and financial oversight. Legally, the subsidiary is a separate entity, assuming its own liabilities and obligations, while the holding company's liability is generally limited to its investment in the subsidiary. Financially, subsidiaries prepare independent financial statements, but consolidated financial reporting is required at the holding company level to provide an overall view of the corporate group's financial health.

Control and Decision-Making Power

A holding company exercises control by owning a majority of shares in its subsidiaries, enabling it to influence major decisions and governance policies without direct involvement in daily operations. Subsidiaries operate as separate legal entities but remain subject to the strategic direction and oversight imposed by the holding company's board. The holding company's decision-making power primarily manifests through its voting rights and the appointment of key executives in the subsidiary's management structure.

Benefits of Creating Subsidiaries

Creating subsidiaries offers significant advantages, including risk isolation by separating liabilities between the parent and subsidiary, thereby protecting the holding company's assets. Subsidiaries also enable focused management and operational efficiency tailored to specific markets or product lines, enhancing overall business agility. Furthermore, establishing subsidiaries can optimize tax strategies and improve regulatory compliance across different jurisdictions.

Advantages of a Holding Company Structure

A holding company structure offers strategic advantages by enabling centralized control over multiple subsidiaries while limiting liability exposure, which protects the parent company's assets from operational risks. This structure facilitates efficient capital allocation, tax benefits through consolidated filings, and streamlined decision-making processes across diverse business units. Holding companies also enhance flexibility for acquisitions, diversifications, and restructuring without disrupting the individual operations of subsidiary firms.

Risks and Challenges for Subsidiaries and Holding Companies

Subsidiaries face operational risks such as limited control over strategic decisions and potential financial instability if the parent company reallocates resources. Holding companies encounter challenges including regulatory scrutiny, liability exposure through subsidiaries, and the complexity of managing diverse investments. Both structures must address risks related to governance, compliance, and financial transparency to ensure sustainable growth.

Corporate Governance in Both Structures

Subsidiary companies operate under the direct control of the holding company, which exerts authority through majority ownership and appoints the subsidiary's board members, ensuring alignment with corporate governance policies. Holding companies maintain strategic oversight and risk management by establishing governance frameworks that subsidiaries must follow, promoting transparency and accountability across the corporate group. Effective corporate governance in these structures involves clear delineation of roles, compliance with regulatory requirements, and robust communication channels between holding and subsidiary boards to safeguard stakeholder interests.

Real-World Examples of Subsidiary and Holding Companies

Apple Inc. serves as a prime example of a holding company, owning numerous subsidiaries like Beats Electronics and Braeburn Capital, which operate independently but contribute to Apple's overall growth and diversification. In contrast, Alphabet Inc. functions as a holding company with subsidiaries such as Google, Waymo, and Verily, each focusing on different sectors including search engines, autonomous vehicles, and health technology. These real-world examples illustrate how holding companies manage a portfolio of subsidiaries to optimize risk and maximize market reach.

Subsidiary Infographic

libterm.com

libterm.com