A warrant is a financial instrument that grants the holder the right to purchase a company's stock at a specific price before expiration, often used as an incentive in investment deals. This tool can amplify your potential gains by allowing you to buy shares at a predetermined price, which may be lower than the market value. Explore the rest of the article to understand how warrants work and their role in investment strategies.

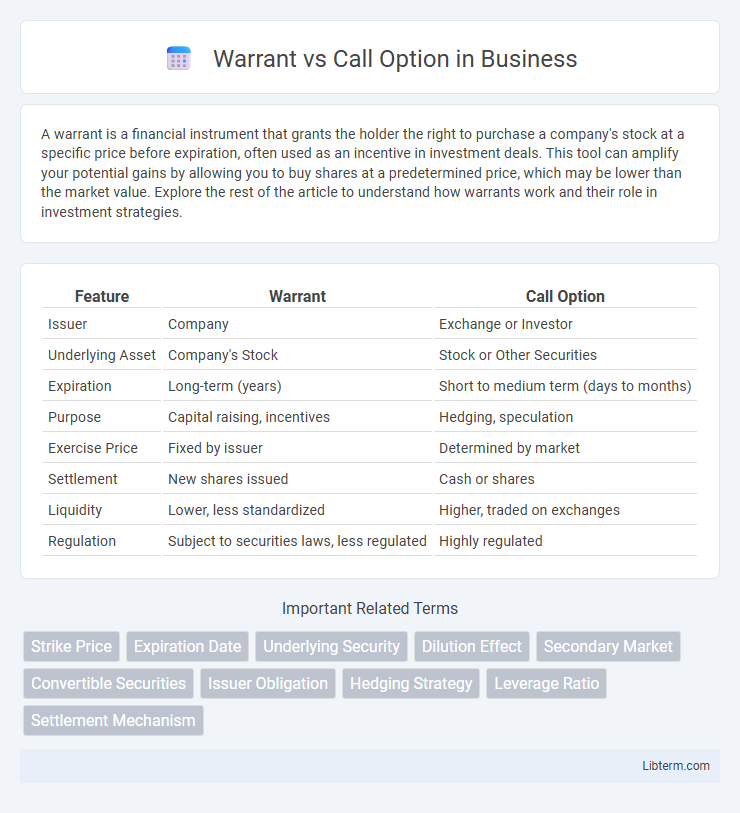

Table of Comparison

| Feature | Warrant | Call Option |

|---|---|---|

| Issuer | Company | Exchange or Investor |

| Underlying Asset | Company's Stock | Stock or Other Securities |

| Expiration | Long-term (years) | Short to medium term (days to months) |

| Purpose | Capital raising, incentives | Hedging, speculation |

| Exercise Price | Fixed by issuer | Determined by market |

| Settlement | New shares issued | Cash or shares |

| Liquidity | Lower, less standardized | Higher, traded on exchanges |

| Regulation | Subject to securities laws, less regulated | Highly regulated |

Introduction to Warrants and Call Options

Warrants and call options both grant investors the right to purchase a specified asset at a predetermined price within a certain timeframe, but warrants are typically issued by the company itself, often as a means to raise capital. Call options are standardized contracts traded on exchanges, offering flexibility and liquidity for investors seeking to leverage potential price increases of underlying securities. Understanding the fundamental differences in issuance, purpose, and trading mechanisms is essential for effective investment strategies involving these financial derivatives.

Definition of a Warrant

A warrant is a financial instrument that grants the holder the right to purchase company stock at a specific price before expiration, often used as an incentive in debt or equity offerings. Unlike call options, warrants are issued directly by the company, leading to potential dilution of shares when exercised. Warrants typically have longer expiration periods, ranging from several years to indefinitely, providing more time for stock appreciation.

Definition of a Call Option

A call option is a financial contract that grants the buyer the right, but not the obligation, to purchase a specific quantity of an underlying asset at a predetermined price, known as the strike price, within a defined time frame. Unlike warrants, call options are standardized and traded on exchanges, providing liquidity and transparency. Call options are used for hedging, speculation, or leveraging potential asset price appreciation with limited risk.

Structure and Mechanics of Warrants

Warrants are long-term financial instruments that grant holders the right to purchase a company's stock at a predetermined price before expiration, often issued directly by the company to raise capital. Structurally, warrants involve the issuance of new shares upon exercise, causing potential dilution of existing shareholders, whereas call options are standardized contracts traded on exchanges with no dilution effects. The mechanics of warrants include a longer lifespan, customizable terms, and intrinsic leverage, making them distinct from the typically shorter-term, standardized call options used primarily for hedging or speculative purposes.

Structure and Mechanics of Call Options

Call options are financial contracts granting the buyer the right, but not the obligation, to purchase an underlying asset at a specified strike price before or on the expiration date. These options are standardized and traded on exchanges, featuring predetermined contract sizes, expiration dates, and strike prices, which enhance liquidity and pricing transparency. The structure of call options includes intrinsic value, time value, and factors such as volatility and interest rates, all influencing the premium paid by the buyer.

Key Differences Between Warrants and Call Options

Warrants are long-term securities issued by a company that grant the holder the right to purchase shares at a specific price, often used as incentives or to raise capital, whereas call options are standardized contracts traded on exchanges giving the right to buy an underlying asset within a short timeframe. Warrants typically have longer expiration periods, sometimes several years, while call options usually expire within months, influencing their pricing and risk profiles. Unlike call options, warrants result in the issuance of new shares upon exercise, causing potential dilution of existing equity.

Advantages and Disadvantages of Warrants

Warrants offer investors the advantage of leverage with a longer expiration period compared to call options, allowing more time for the underlying stock to appreciate. They also provide companies a way to raise capital when issued, unlike call options which are traded on exchanges and do not generate direct capital for the issuer. However, warrants typically dilute existing shareholders upon exercise and often have wider bid-ask spreads, resulting in higher transaction costs and less liquidity than standard call options.

Benefits and Drawbacks of Call Options

Call options offer investors the benefit of leveraged exposure to an asset, enabling control over a large number of shares with limited capital outlay and defined risk equal to the premium paid. The potential for significant profit arises if the underlying asset's price rises above the strike price, but investors face the drawback of total premium loss if the option expires worthless. Unlike warrants, call options typically have shorter expiration periods and are standardized with regulated exchanges, which offer greater liquidity but limit customization.

Use Cases: When to Choose Warrants vs Call Options

Warrants are ideal for long-term investment strategies due to their extended expiration periods, often several years, making them suitable for investors seeking leveraged exposure with a longer time horizon. Call options, with shorter lifespans ranging from weeks to months, are preferred for tactical trading, hedging existing positions, or capitalizing on near-term price movements. Investors should choose warrants for growth opportunities linked to the underlying company's equity while selecting call options for flexibility and precise risk management in volatile markets.

Conclusion: Warrant vs Call Option Summary

Warrants and call options both grant the right to buy assets at a specified price, but warrants are typically issued by the company and often have longer expiration periods, whereas call options are standardized contracts traded on exchanges with shorter lifespans. Investors choose warrants for potential long-term leverage and capital raising benefits to the issuing company, while call options offer greater liquidity and standardized terms for short-term speculative trading. Understanding key differences in origin, duration, and market behavior is essential for effective investment decisions between warrants and call options.

Warrant Infographic

libterm.com

libterm.com