Convertible bonds offer investors a unique blend of fixed income and equity upside by allowing the bondholder to convert debt into a predetermined number of company shares. These hybrid securities provide downside protection through regular interest payments while offering potential capital appreciation if the company's stock price rises. Explore the rest of the article to understand how convertible bonds can enhance your investment strategy and the key factors to consider before investing.

Table of Comparison

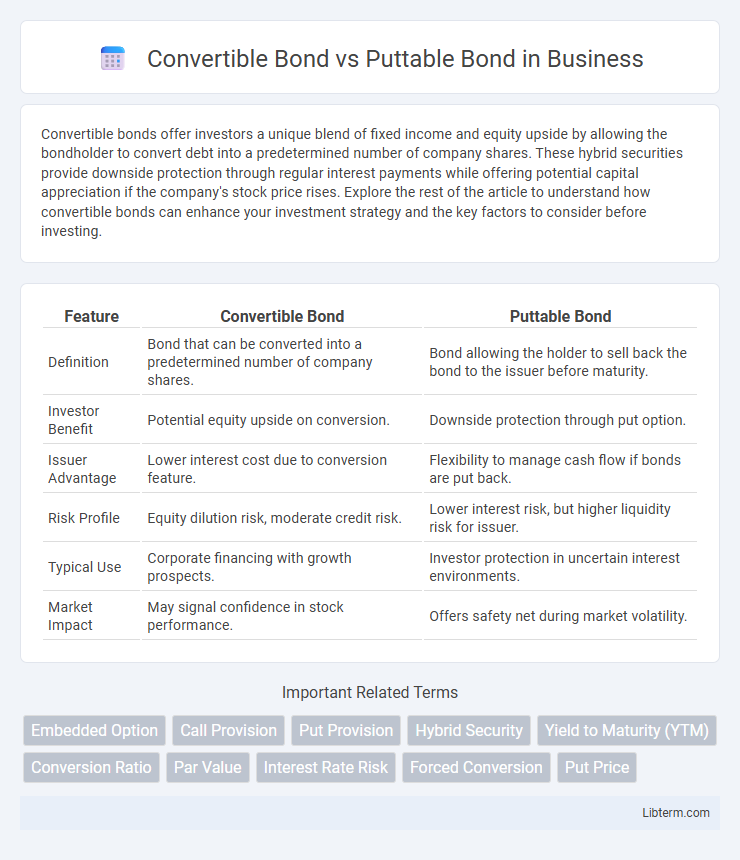

| Feature | Convertible Bond | Puttable Bond |

|---|---|---|

| Definition | Bond that can be converted into a predetermined number of company shares. | Bond allowing the holder to sell back the bond to the issuer before maturity. |

| Investor Benefit | Potential equity upside on conversion. | Downside protection through put option. |

| Issuer Advantage | Lower interest cost due to conversion feature. | Flexibility to manage cash flow if bonds are put back. |

| Risk Profile | Equity dilution risk, moderate credit risk. | Lower interest risk, but higher liquidity risk for issuer. |

| Typical Use | Corporate financing with growth prospects. | Investor protection in uncertain interest environments. |

| Market Impact | May signal confidence in stock performance. | Offers safety net during market volatility. |

Introduction to Convertible and Puttable Bonds

Convertible bonds offer investors the option to exchange the bond for a predetermined number of the issuer's shares, combining debt security with potential equity upside. Puttable bonds provide bondholders the right to sell the bond back to the issuer at a specified price before maturity, offering enhanced protection against interest rate declines or issuer credit deterioration. Both instruments cater to investors seeking customizable risk and return profiles in fixed income markets.

Key Definitions: Convertible Bonds vs Puttable Bonds

Convertible bonds are debt securities that grant holders the option to convert the bond into a predetermined number of shares of the issuing company, combining bond features with potential equity upside. Puttable bonds provide investors with the right to sell the bond back to the issuer at a specified price before maturity, offering enhanced protection against interest rate rises or credit deterioration. Both instruments serve as hybrid securities but differ in investor control mechanisms--conversion into equity versus early redemption rights.

How Convertible Bonds Work

Convertible bonds are hybrid securities that allow investors to convert their bonds into a predetermined number of the issuing company's common shares, typically at the bondholder's discretion. This conversion feature provides upside potential, enabling bondholders to benefit from stock price appreciation while still receiving fixed interest payments before conversion. Unlike puttable bonds that grant holders the right to sell bonds back to the issuer at a specified price, convertible bonds emphasize equity participation, blending fixed income characteristics with potential equity gains.

Mechanics of Puttable Bonds

Puttable bonds grant the bondholder the right to sell the bond back to the issuer at a predetermined price before maturity, enhancing investor protection against interest rate rises or credit deterioration. The mechanics involve specific put dates and put prices embedded in the bond's terms, allowing investors to exercise the put option at optimal times. This feature typically results in lower yields compared to non-puttable bonds, reflecting the added value of downside risk mitigation for bondholders.

Advantages of Convertible Bonds

Convertible bonds offer investors the unique advantage of participating in the equity upside potential while maintaining fixed-income characteristics, allowing for capital appreciation through conversion into common stock. These bonds typically provide lower coupon rates compared to traditional debt due to the embedded option for conversion, reducing the issuer's borrowing cost. The flexibility to convert into shares enhances portfolio diversification and downside protection, making convertible bonds attractive in volatile markets.

Benefits of Puttable Bonds

Puttable bonds offer investors the benefit of reduced interest rate risk by allowing bondholders to sell the bond back to the issuer at a predetermined price before maturity, providing enhanced capital protection in declining markets. This feature increases the bond's appeal to risk-averse investors seeking flexibility and downside protection compared to convertible bonds, which primarily offer upside potential through equity conversion. Puttable bonds often command higher prices and lower yields than non-puttable bonds due to their embedded put option, reflecting the value of liquidity and risk mitigation.

Risks Associated with Convertible Bonds

Convertible bonds carry market risk as their value fluctuates with the underlying stock price, exposing investors to equity volatility. Credit risk is also significant since the issuer's default can lead to loss of principal and interest, despite the bond's potential to convert into equity. Interest rate risk and dilution risk impact convertible bonds, as rising rates reduce bond prices and conversion may dilute existing shareholders.

Drawbacks of Puttable Bonds

Puttable bonds limit the issuer's flexibility by obligating repayment at the bondholder's discretion, potentially leading to unpredictable cash outflows during unfavorable market conditions. These bonds often carry higher interest rates to compensate the issuer for this risk, increasing overall borrowing costs. Investors may face reinvestment risk if they exercise the put option when interest rates are lower, reducing potential returns.

Convertible vs Puttable Bonds: Key Differences

Convertible bonds grant investors the option to convert debt into a predetermined number of shares, offering potential equity upside, while puttable bonds provide the holder the right to sell the bond back to the issuer at a specified price before maturity, reducing credit risk exposure. Convertible bonds typically have lower coupon rates due to the conversion feature, whereas puttable bonds may offer slightly higher coupons as compensation for limited upside potential. The primary distinction lies in the convertible bond's equity participation opportunity versus the puttable bond's enhanced liquidity and downside protection for investors.

Choosing the Right Option for Investors

Convertible bonds offer investors the potential for equity participation by allowing conversion into company shares, making them attractive in bullish markets with growth prospects. Puttable bonds provide enhanced security by granting the right to sell the bond back to the issuer at a predetermined price, appealing to risk-averse investors seeking downside protection. Choosing between these depends on market outlook, risk tolerance, and desired exposure to equity upside or fixed income stability.

Convertible Bond Infographic

libterm.com

libterm.com