A loan provides essential financial support by allowing individuals or businesses to borrow money for various needs such as purchasing a home, funding education, or expanding operations. Understanding the types of loans, interest rates, and repayment terms can help you make informed decisions that optimize your financial health. Explore the rest of this article to unlock key insights about securing the best loan options for your goals.

Table of Comparison

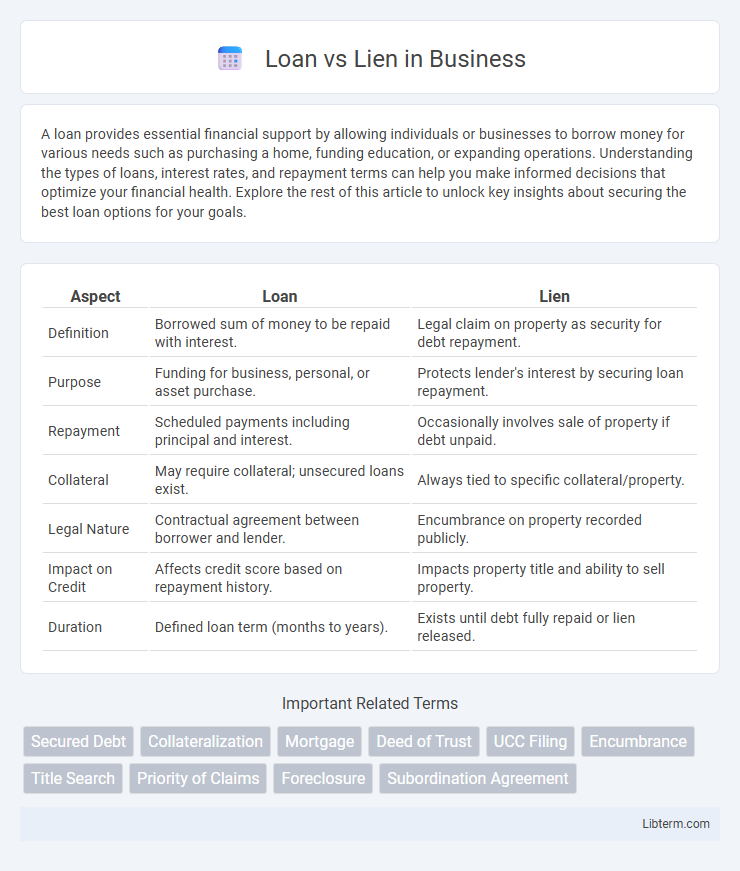

| Aspect | Loan | Lien |

|---|---|---|

| Definition | Borrowed sum of money to be repaid with interest. | Legal claim on property as security for debt repayment. |

| Purpose | Funding for business, personal, or asset purchase. | Protects lender's interest by securing loan repayment. |

| Repayment | Scheduled payments including principal and interest. | Occasionally involves sale of property if debt unpaid. |

| Collateral | May require collateral; unsecured loans exist. | Always tied to specific collateral/property. |

| Legal Nature | Contractual agreement between borrower and lender. | Encumbrance on property recorded publicly. |

| Impact on Credit | Affects credit score based on repayment history. | Impacts property title and ability to sell property. |

| Duration | Defined loan term (months to years). | Exists until debt fully repaid or lien released. |

Introduction to Loan vs Lien

A loan is a financial agreement where a borrower receives funds from a lender with a promise to repay the principal plus interest over a specified period. A lien is a legal claim or right against an asset, typically used by lenders to secure repayment of a debt or loan. Understanding the difference between a loan and a lien is crucial for managing financial obligations and protecting creditor rights.

Defining a Loan

A loan is a financial agreement where a borrower receives a specific amount of money from a lender, agreeing to repay the principal amount along with interest over a set period. Loans can be secured or unsecured, with secured loans involving collateral such as property or assets, while unsecured loans rely solely on the borrower's creditworthiness. The primary purpose of a loan is to provide immediate funds for personal, business, or investment needs, subject to repayment terms defined in the loan contract.

Understanding a Lien

A lien is a legal claim or right a creditor holds on a debtor's property until a debt is satisfied, ensuring repayment security. Unlike a loan, which is the actual borrowed amount, a lien acts as collateral, giving the lender priority in case of default or liquidation. Understanding liens is crucial for both borrowers and lenders to protect financial interests and manage risks effectively.

Key Differences Between Loans and Liens

Loans involve borrowing a specific amount of money that must be repaid over time with interest, while liens are legal claims or rights against property to secure the payment of a debt or obligation. A loan creates a debtor-creditor relationship with scheduled repayments, whereas a lien does not involve direct payment terms but ensures the creditor can seize or sell the property if the debt remains unpaid. Loans are contractual financial agreements, whereas liens function as security interests recorded in public records to protect creditors' rights.

How Loans Work: Process and Requirements

Loans involve borrowing a specific amount of money from a lender, which must be repaid with interest over a predetermined term. The process typically requires an application, credit evaluation, income verification, and collateral assessment, depending on loan type. Borrowers must meet eligibility criteria, sign a loan agreement, and comply with repayment schedules to avoid default and potential liens on assets.

How Liens Operate: Types and Implications

Liens are legal claims or holds on property used to secure the payment of a debt or obligation, typically enforced when the debtor fails to meet their contractual obligations. Common types include mortgage liens, tax liens, and mechanic's liens, each affecting property rights and priorities differently, often impacting the owner's ability to sell or refinance the asset. Liens must be satisfied--either paid off or resolved--before clear title to the property can be transferred, making them critical considerations in real estate and loan transactions.

Loan Benefits and Risks

Loans provide immediate access to capital for personal or business use, enabling growth opportunities and financial flexibility. Key benefits include predictable repayment schedules, potential tax deductions on interest, and improved credit scores with timely payments. Risks involve potential default leading to damaged credit, accumulating interest costs, and possible collateral loss if the loan is secured.

Lien Advantages and Drawbacks

A lien provides lenders with a legal claim against a borrower's property, ensuring priority repayment in case of default, which reduces the lender's risk and potentially offers lower interest rates. While liens secure debt and protect creditor interests, they can restrict the borrower's ability to sell or refinance the asset until the lien is satisfied, limiting financial flexibility. The presence of a lien improves creditor confidence but may complicate the borrower's credit profile and prolong the resolution process if disputes arise.

When to Choose a Loan or a Lien

Choose a loan when you need immediate funds for personal or business purposes, as loans provide upfront capital with structured repayment terms. Opt for a lien when securing a debt against an asset, ensuring you have legal rights to claim the property if the borrower defaults. Loans are ideal for cash flow needs, while liens are strategic for protecting creditor interests in secured transactions.

Conclusion: Making the Right Financial Decision

Choosing between a loan and a lien depends on your financial situation and asset ownership. Loans provide immediate cash without affecting property rights, while liens secure the lender's interest by attaching to an asset, potentially leading to foreclosure if unpaid. Assess your credit, repayment ability, and asset value to make the most informed and responsible financial decision.

Loan Infographic

libterm.com

libterm.com