A merger combines two companies to create a stronger, more competitive business entity by pooling resources, talents, and market share. This strategic move can enhance your company's growth potential, operational efficiency, and market presence. Explore the rest of the article to understand the types, benefits, and challenges of mergers.

Table of Comparison

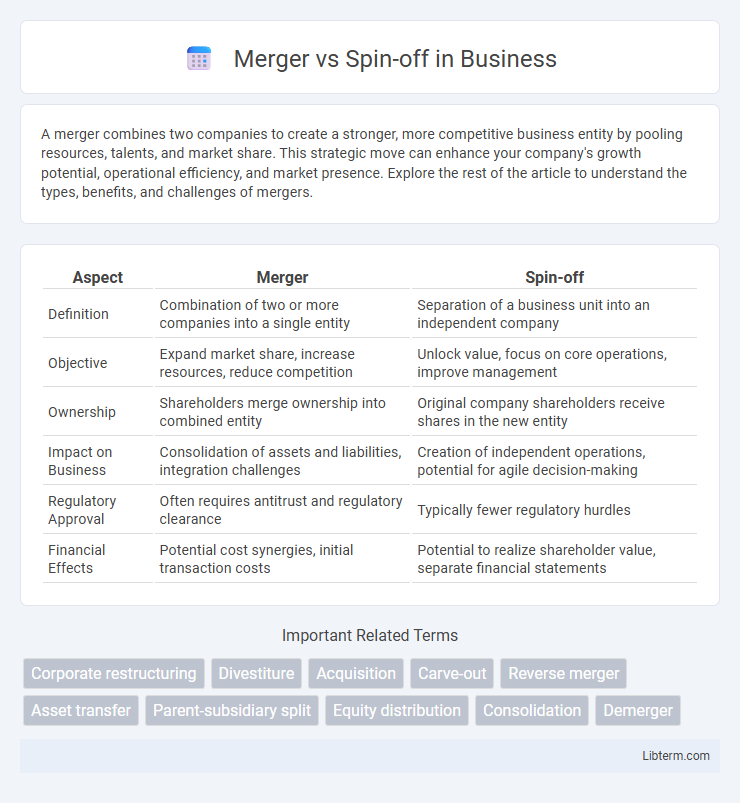

| Aspect | Merger | Spin-off |

|---|---|---|

| Definition | Combination of two or more companies into a single entity | Separation of a business unit into an independent company |

| Objective | Expand market share, increase resources, reduce competition | Unlock value, focus on core operations, improve management |

| Ownership | Shareholders merge ownership into combined entity | Original company shareholders receive shares in the new entity |

| Impact on Business | Consolidation of assets and liabilities, integration challenges | Creation of independent operations, potential for agile decision-making |

| Regulatory Approval | Often requires antitrust and regulatory clearance | Typically fewer regulatory hurdles |

| Financial Effects | Potential cost synergies, initial transaction costs | Potential to realize shareholder value, separate financial statements |

Understanding Mergers and Spin-offs

Mergers involve the combination of two or more companies to form a single new entity, aiming to enhance market share, operational efficiency, and competitive advantage. Spin-offs occur when a parent company creates an independent company by separating part of its business, allowing each entity to focus on its core operations and unlock shareholder value. Understanding these corporate restructuring strategies is crucial for investors and management to assess impacts on financial performance and strategic direction.

Key Differences Between Mergers and Spin-offs

Mergers involve the combination of two or more companies into a single entity to enhance market share, streamline operations, or achieve synergies, while spin-offs create independent companies by separating a division or subsidiary from the parent organization. In mergers, shareholders often receive shares in the new consolidated company, whereas spin-offs typically distribute shares of the new independent entity to existing shareholders without changing their ownership percentage. The primary difference lies in mergers aiming for integration and growth, while spin-offs focus on unlocking value by allowing distinct business units to operate autonomously.

Strategic Reasons for Mergers

Mergers are primarily driven by strategic objectives such as achieving economies of scale, expanding market share, and enhancing competitive positioning. Companies pursue mergers to gain access to new technologies, diversify product portfolios, and enter new geographic markets efficiently. These strategic benefits help firms optimize resources, streamline operations, and maximize shareholder value through improved financial performance and market influence.

Advantages of Corporate Spin-offs

Corporate spin-offs provide strategic advantages by enabling parent companies to unlock shareholder value through the creation of independent entities that can focus on core competencies and optimize operational efficiency. Spin-offs often lead to enhanced managerial focus and agility within the new company, resulting in improved innovation and market responsiveness. Investors benefit from clearer investment opportunities and potentially higher returns as the separated entities perform without being overshadowed by the parent firm's diversified portfolio.

Financial Implications: Merger vs Spin-off

Mergers often result in immediate financial gains through economies of scale, increased market share, and enhanced revenue streams, but may also incur high integration costs and debt financing. Spin-offs generally unlock hidden shareholder value by creating independent entities with focused business models, potentially leading to improved operational efficiency and stock performance. Both strategies impact tax liabilities differently; mergers may trigger taxable events while spin-offs often qualify for tax-free treatment under specific regulatory provisions.

Impact on Shareholders: Mergers vs Spin-offs

Mergers typically result in shareholders receiving new shares of the combined entity, which can lead to diluted ownership but potential for increased value through synergies and expanded market presence. Spin-offs distribute shares of the newly created independent company to existing shareholders, allowing them to retain ownership in both entities and often unlocking hidden value by separating distinct business lines. Shareholders in spin-offs benefit from greater transparency and focused management strategies, while mergers offer potential growth but come with integration risks and altered control structures.

Legal and Regulatory Considerations

Mergers require comprehensive regulatory approval from antitrust authorities to prevent monopolistic practices and ensure fair market competition. Spin-offs involve intricate legal processes related to the transfer of assets, liabilities, and employee contracts, necessitating compliance with securities regulations and corporate governance standards. Both transactions must adhere to jurisdiction-specific disclosure requirements and shareholder approval procedures to validate legal legitimacy.

Challenges in Executing Mergers and Spin-offs

Executing mergers involves challenges such as integrating differing corporate cultures, aligning operational systems, and managing employee uncertainty, which can lead to productivity losses. Spin-offs face difficulties in establishing independent governance structures, securing adequate financing, and maintaining stakeholder confidence during the transition. Both processes require meticulous planning to address regulatory compliance, communication strategies, and value realization risks effectively.

Real-world Examples: Successful Mergers and Spin-offs

The merger between Disney and Pixar in 2006 enhanced creative synergy and market dominance in animation, generating billions in revenue from blockbuster films. Spin-offs like eBay's separation of PayPal in 2015 enabled each entity to focus on core competencies, leading PayPal to become a leading global digital payments provider with a market cap exceeding $100 billion. These real-world cases illustrate how strategic mergers and spin-offs drive growth, innovation, and shareholder value in diverse industries.

Choosing the Right Strategy: Merger or Spin-off?

Choosing between a merger and a spin-off depends on strategic objectives such as growth, market expansion, or operational focus. Mergers consolidate resources and capabilities to enhance competitive advantage, while spin-offs streamline operations by creating independent entities to unlock shareholder value. Analyzing financial performance, market conditions, and long-term goals guides the decision toward the optimal corporate restructuring strategy.

Merger Infographic

libterm.com

libterm.com