Cost of Goods Sold (COGS) represents the direct expenses involved in producing or purchasing the products sold by a business, including materials and labor costs. Accurately calculating COGS is essential for determining gross profit and making informed pricing decisions that impact your overall financial health. Explore the rest of this article to deepen your understanding of COGS and its critical role in your business success.

Table of Comparison

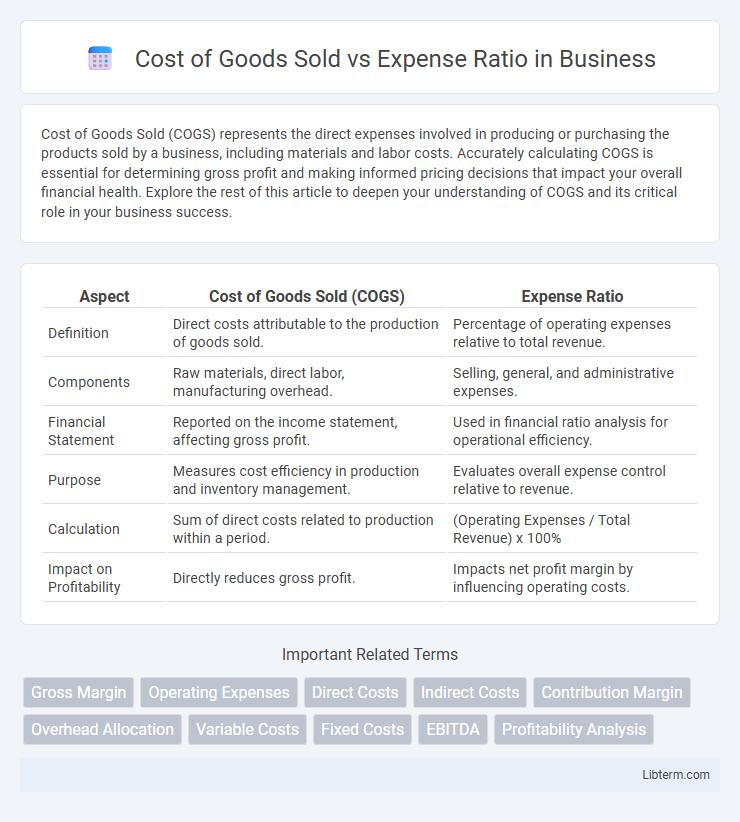

| Aspect | Cost of Goods Sold (COGS) | Expense Ratio |

|---|---|---|

| Definition | Direct costs attributable to the production of goods sold. | Percentage of operating expenses relative to total revenue. |

| Components | Raw materials, direct labor, manufacturing overhead. | Selling, general, and administrative expenses. |

| Financial Statement | Reported on the income statement, affecting gross profit. | Used in financial ratio analysis for operational efficiency. |

| Purpose | Measures cost efficiency in production and inventory management. | Evaluates overall expense control relative to revenue. |

| Calculation | Sum of direct costs related to production within a period. | (Operating Expenses / Total Revenue) x 100% |

| Impact on Profitability | Directly reduces gross profit. | Impacts net profit margin by influencing operating costs. |

Introduction to Cost of Goods Sold and Expense Ratio

Cost of Goods Sold (COGS) represents the direct costs attributable to the production of goods sold by a company, including materials and labor expenses involved in manufacturing. The Expense Ratio measures operating expenses as a percentage of total revenue, providing insight into cost management efficiency relative to sales. Understanding COGS and the Expense Ratio helps businesses analyze profitability by differentiating between production costs and operating expenses.

Defining Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs attributable to the production of goods sold by a company, including raw materials, labor, and manufacturing overhead. COGS is a key metric for calculating gross profit and is essential in assessing a company's production efficiency and pricing strategy. Understanding COGS is critical for accurately analyzing the expense ratio, which compares operational expenses to revenue to evaluate overall financial performance.

Understanding Expense Ratio

The Expense Ratio measures the percentage of a company's total expenses relative to its revenue, providing insight into operational efficiency beyond the direct costs captured by Cost of Goods Sold (COGS). Unlike COGS, which includes expenses directly tied to production, the Expense Ratio encompasses selling, general, and administrative expenses, influencing profitability analysis. Monitoring the Expense Ratio helps businesses control overhead costs and optimize spending to improve net margins.

Key Differences Between COGS and Expense Ratio

Cost of Goods Sold (COGS) represents the direct costs attributable to the production of goods sold by a company, including materials and labor. In contrast, the Expense Ratio measures operating expenses as a percentage of total revenue, reflecting overall efficiency beyond just production costs. The key difference lies in COGS focusing on production expenses, while the Expense Ratio encompasses broader operational costs such as marketing, administration, and overhead.

Importance of COGS in Financial Statements

Cost of Goods Sold (COGS) directly affects gross profit and provides critical insight into the efficiency of production and inventory management in financial statements. Accurate COGS reporting is essential for determining profitability and making informed pricing and budgeting decisions. The expense ratio, while useful for operational efficiency, does not provide the same level of detail on production costs as COGS, emphasizing the importance of COGS in financial analysis.

Role of Expense Ratio in Business Analysis

The Expense Ratio measures the proportion of operating expenses to total revenue, providing insight into a company's cost management efficiency beyond just production costs captured by Cost of Goods Sold (COGS). It plays a crucial role in business analysis by highlighting how well a company controls overhead and administrative expenses while generating revenue. Investors and analysts use the Expense Ratio to assess overall operational efficiency and profitability sustainability in comparison to industry benchmarks.

Impact of COGS on Profit Margins

Cost of Goods Sold (COGS) directly reduces gross profit, significantly impacting profit margins by reflecting the core production costs tied to revenue generation. A higher COGS lowers gross profit margin, indicating less efficiency in managing production expenses and potentially squeezing net profitability. Monitoring COGS alongside expense ratio helps businesses optimize cost structures and improve overall financial performance.

Interpreting Expense Ratios in Financial Performance

Expense ratios provide insight into a company's operational efficiency by comparing operating expenses to total revenue, which is crucial for analyzing profitability alongside the Cost of Goods Sold (COGS). A higher expense ratio indicates greater operational costs relative to revenue, potentially signaling inefficiencies that can erode profit margins despite stable COGS values. Understanding the interplay between COGS and expense ratios allows investors and management to identify cost control opportunities and optimize financial performance.

COGS vs. Expense Ratio: Industry Comparisons

Cost of Goods Sold (COGS) versus Expense Ratio varies significantly across industries, with manufacturing companies typically exhibiting higher COGS due to raw materials and production costs, while service-based industries show elevated expense ratios driven by operational and administrative expenses. Retail sectors often have moderate COGS paired with relatively stable expense ratios, reflecting inventory and sales costs alongside marketing and overhead expenditures. Industry benchmarks indicate that analyzing the balance between COGS and expense ratio helps companies identify efficiency, profitability, and cost management effectiveness within competitive markets.

Optimizing COGS and Expense Ratio for Business Growth

Optimizing Cost of Goods Sold (COGS) and Expense Ratio is crucial for maximizing profit margins and driving sustainable business growth. Lowering COGS through efficient supply chain management and bulk purchasing reduces direct production costs, while controlling the Expense Ratio by streamlining operational expenses improves overall financial health. Strategic monitoring and continuous improvement of these metrics enhance cash flow, enabling reinvestment in marketing, product development, and talent acquisition for accelerated expansion.

Cost of Goods Sold Infographic

libterm.com

libterm.com