Crowdfunding harnesses the power of collective support by allowing individuals to fund projects or ventures online, often through specialized platforms. This innovative financing method enables entrepreneurs, artists, and nonprofits to access capital without traditional banking institutions, expanding opportunities for creative ideas and social initiatives. Explore the rest of this article to discover how crowdfunding can transform Your funding strategy and bring your vision to life.

Table of Comparison

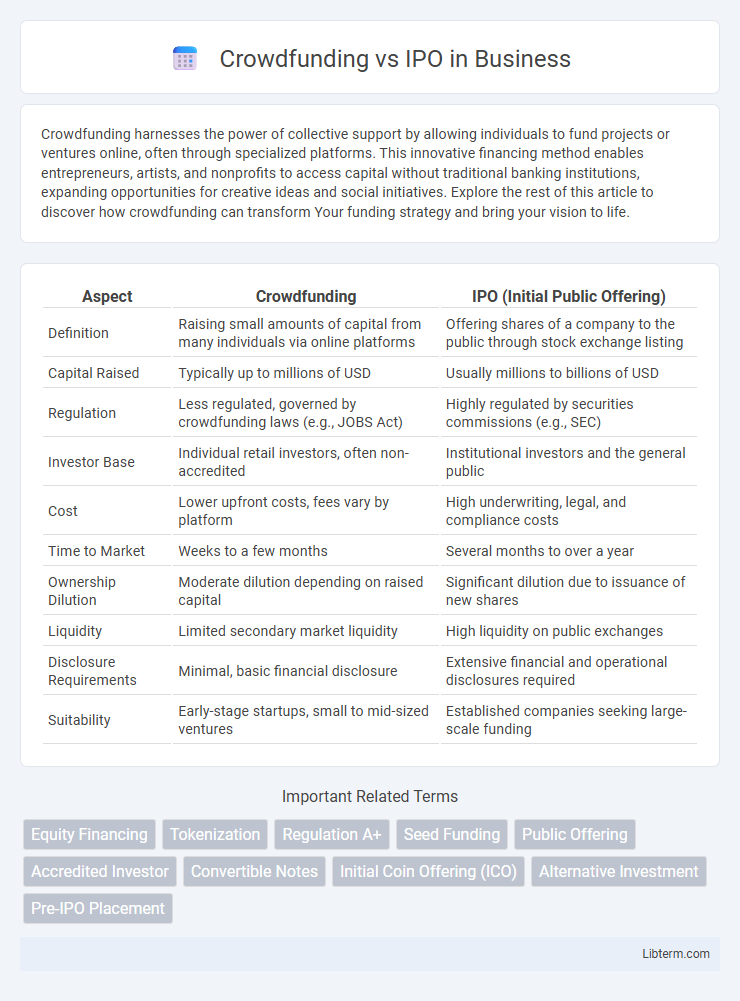

| Aspect | Crowdfunding | IPO (Initial Public Offering) |

|---|---|---|

| Definition | Raising small amounts of capital from many individuals via online platforms | Offering shares of a company to the public through stock exchange listing |

| Capital Raised | Typically up to millions of USD | Usually millions to billions of USD |

| Regulation | Less regulated, governed by crowdfunding laws (e.g., JOBS Act) | Highly regulated by securities commissions (e.g., SEC) |

| Investor Base | Individual retail investors, often non-accredited | Institutional investors and the general public |

| Cost | Lower upfront costs, fees vary by platform | High underwriting, legal, and compliance costs |

| Time to Market | Weeks to a few months | Several months to over a year |

| Ownership Dilution | Moderate dilution depending on raised capital | Significant dilution due to issuance of new shares |

| Liquidity | Limited secondary market liquidity | High liquidity on public exchanges |

| Disclosure Requirements | Minimal, basic financial disclosure | Extensive financial and operational disclosures required |

| Suitability | Early-stage startups, small to mid-sized ventures | Established companies seeking large-scale funding |

Understanding Crowdfunding and IPO

Crowdfunding involves raising capital from a large group of individuals, typically through online platforms, allowing startups and small businesses to secure funds without traditional financial intermediaries. An Initial Public Offering (IPO) is the process whereby a private company offers shares to the public for the first time, enabling significant capital influx and increased liquidity but requiring adherence to stringent regulatory and disclosure requirements. Both crowdfunding and IPOs serve as vital financing mechanisms, with crowdfunding offering accessibility and community engagement, while IPOs provide substantial funding and market visibility.

Key Differences Between Crowdfunding and IPO

Crowdfunding involves raising capital from a large number of small investors through online platforms, while an IPO (Initial Public Offering) is the process of offering shares to the public via stock exchanges. Crowdfunding typically requires less regulatory compliance and lower costs, making it accessible for startups and small businesses, whereas an IPO demands rigorous financial disclosures and adherence to securities regulations. The investor base for crowdfunding is generally more diverse and includes non-accredited investors, contrasting with IPO investors who are often institutional or accredited individuals.

How Crowdfunding Works

Crowdfunding works by allowing startups and entrepreneurs to raise capital from a large number of individual investors, typically through online platforms such as Kickstarter, Indiegogo, or SeedInvest. Investors contribute small amounts of money in exchange for rewards, equity, or debt, enabling businesses to validate their product ideas and secure funding without traditional financial intermediaries. Unlike IPOs, crowdfunding offers a more accessible and flexible fundraising method with fewer regulatory requirements and faster capital acquisition.

The IPO Process Explained

The IPO process involves several key stages including selecting underwriters, conducting due diligence, filing a registration statement with the SEC, and setting the initial offering price before shares become publicly traded on a stock exchange. Companies pursuing an IPO undergo rigorous financial audits and regulatory scrutiny to ensure transparency and protect investors. Compared to crowdfunding, the IPO process is more complex, costly, and time-consuming but provides greater access to capital and broader market exposure.

Advantages of Crowdfunding

Crowdfunding offers startups the advantage of raising capital without giving up significant equity or control, fostering direct engagement with a broad base of early supporters. It provides access to diverse funding sources, reduces reliance on traditional financial institutions, and accelerates market validation through community feedback. Compared to IPOs, crowdfunding involves lower regulatory hurdles and costs, enabling faster and more flexible fundraising for innovative projects.

Benefits of Going Public via IPO

Going public via an IPO offers significant benefits such as access to substantial capital, increased brand visibility, and enhanced credibility with customers and investors. IPOs provide liquidity for early investors and employees through publicly traded shares, enabling easier wealth realization. Companies also gain opportunities for acquisitions and growth by leveraging publicly traded stock as currency.

Risks and Challenges: Crowdfunding vs IPO

Crowdfunding carries risks such as limited regulatory oversight, potential for fraud, and challenges in raising substantial capital compared to IPOs, which undergo rigorous regulatory scrutiny and disclosure requirements. IPOs involve high costs, market volatility risks, and the pressure of meeting shareholder expectations, while crowdfunding investors face higher uncertainty with less liquidity. Both funding methods pose distinct challenges in valuation accuracy and investor protection, impacting the overall success and sustainability of the financed ventures.

Choosing the Right Funding Option

Choosing the right funding option depends on a company's growth stage, capital needs, and investor expectations. Crowdfunding suits startups seeking market validation and smaller capital infusions from a broad base of backers, leveraging platforms like Kickstarter or Indiegogo. IPOs are ideal for mature companies aiming to raise substantial capital through public investors, offering increased liquidity but requiring rigorous regulatory compliance and transparency.

Case Studies: Crowdfunding Success vs IPO Success

Crowdfunding platforms like Kickstarter and Indiegogo have fueled startup growth by enabling companies such as Oculus VR to raise millions from a broad base of individual investors, achieving rapid market validation and customer engagement. In contrast, IPO success stories like Facebook and Alibaba showcase massive capital inflows and public market credibility but often involve lengthy regulatory processes and higher entry barriers. Case studies reveal crowdfunding excels in community building and early adoption, while IPOs provide substantial scale and liquidity for well-established firms.

Future Trends in Fundraising: Crowdfunding and IPO

Crowdfunding is expected to evolve with increasing integration of blockchain technology, enabling more transparent and secure investment processes that attract a wider range of retail investors. Meanwhile, IPOs are likely to see growth in direct listings and special purpose acquisition companies (SPACs), offering companies alternative routes to public markets with reduced regulatory burdens. Both fundraising methods will increasingly leverage digital platforms and data analytics to optimize investor targeting and engagement.

Crowdfunding Infographic

libterm.com

libterm.com