Accurate financial reporting is essential for transparent business operations and informed decision-making. It ensures compliance with regulatory standards while providing valuable insights into your company's financial health. Explore the full article to understand key strategies and best practices for effective financial reporting.

Table of Comparison

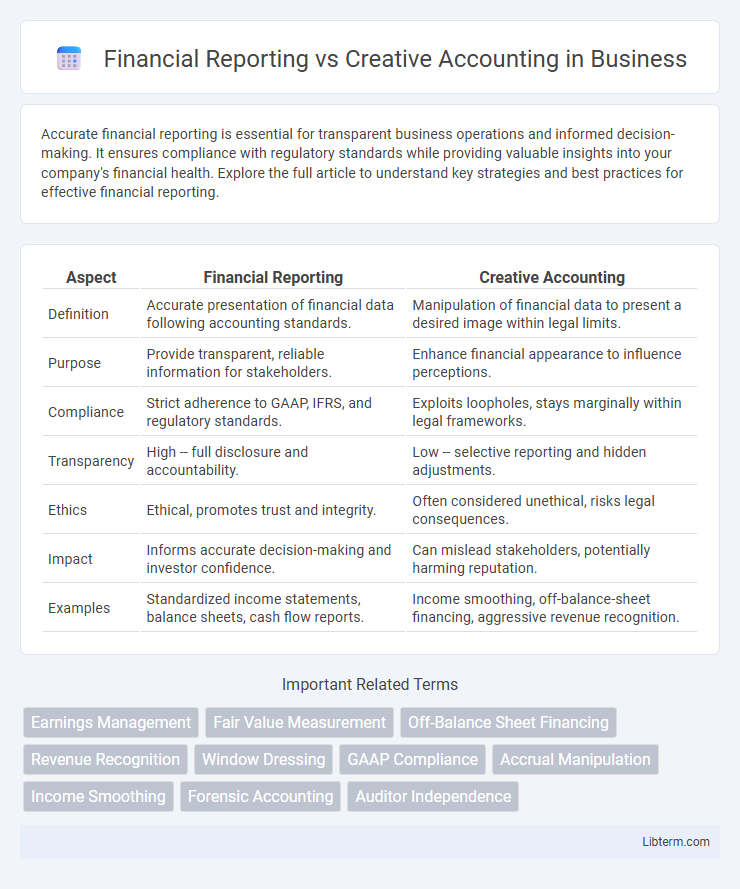

| Aspect | Financial Reporting | Creative Accounting |

|---|---|---|

| Definition | Accurate presentation of financial data following accounting standards. | Manipulation of financial data to present a desired image within legal limits. |

| Purpose | Provide transparent, reliable information for stakeholders. | Enhance financial appearance to influence perceptions. |

| Compliance | Strict adherence to GAAP, IFRS, and regulatory standards. | Exploits loopholes, stays marginally within legal frameworks. |

| Transparency | High -- full disclosure and accountability. | Low -- selective reporting and hidden adjustments. |

| Ethics | Ethical, promotes trust and integrity. | Often considered unethical, risks legal consequences. |

| Impact | Informs accurate decision-making and investor confidence. | Can mislead stakeholders, potentially harming reputation. |

| Examples | Standardized income statements, balance sheets, cash flow reports. | Income smoothing, off-balance-sheet financing, aggressive revenue recognition. |

Introduction to Financial Reporting and Creative Accounting

Financial reporting involves the accurate and transparent presentation of a company's financial performance and position through standardized statements such as the balance sheet, income statement, and cash flow statement, adhering to established accounting principles and regulations like GAAP or IFRS. Creative accounting refers to the manipulation or bending of financial records and reports to present a desired but potentially misleading financial position, often exploiting loopholes or ambiguities in accounting standards. Understanding the distinction between financial reporting's commitment to truthfulness and creative accounting's focus on distortion is critical for stakeholders assessing a company's financial health.

Defining Financial Reporting: Objectives and Standards

Financial reporting involves the systematic preparation and presentation of financial statements to provide stakeholders with accurate and transparent information about a company's financial performance and position. Its primary objectives include enhancing decision-making, ensuring compliance with regulatory requirements, and maintaining investor confidence through standardized frameworks such as IFRS or GAAP. These standards enforce consistency, reliability, and comparability to prevent manipulation and promote truthful financial disclosure.

What Is Creative Accounting? Techniques and Tactics

Creative accounting involves manipulating financial statements to present a more favorable view of a company's financial position without violating accounting standards. Techniques include income smoothing, revenue recognition timing, off-balance-sheet financing, and aggressive asset valuation to enhance profitability or hide liabilities. These tactics obscure true financial performance, misleading stakeholders and potentially increasing risks of regulatory scrutiny and loss of investor trust.

Key Differences Between Financial Reporting and Creative Accounting

Financial reporting involves the accurate and transparent presentation of a company's financial position and performance in accordance with established accounting standards such as GAAP or IFRS. Creative accounting refers to the manipulation or alteration of financial data within legal limits to present a more favorable view of a company's financial status, often through aggressive interpretation of accounting rules. Key differences include transparency, with financial reporting emphasizing clarity and compliance, whereas creative accounting prioritizes the strategic distortion of figures; the intent behind financial reporting is to provide stakeholders with reliable information, contrasting with creative accounting's goal of influencing perceptions or masking true financial health.

The Role of Transparency in Financial Reporting

Transparency in financial reporting ensures accurate, reliable, and accessible financial statements, which build trust among investors, regulators, and stakeholders. Creative accounting often obscures true financial performance through manipulation, undermining transparency and leading to misinformation. Transparent reporting enhances corporate governance, supports regulatory compliance, and facilitates informed decision-making by presenting a clear and honest view of a company's financial health.

Risks and Consequences of Creative Accounting

Creative accounting involves manipulating financial data to present a misleading view of a company's financial health, significantly increasing the risk of regulatory penalties, loss of investor confidence, and legal consequences. Unlike transparent financial reporting, it compromises the accuracy and reliability of financial statements, leading to potential stock market crashes and damaging long-term business sustainability. Stakeholders face severe risks including financial losses, reputational damage, and erosion of trust due to the deceptive nature of creative accounting practices.

Legal and Ethical Implications

Financial reporting involves presenting accurate and transparent financial statements in compliance with established accounting standards and legal requirements, ensuring ethical accountability to stakeholders. Creative accounting manipulates financial data within legal boundaries but often distorts the true financial position, raising significant ethical concerns and risking legal penalties if it crosses into fraudulent territory. The distinction hinges on adherence to both the letter of the law and ethical principles, as financial reporting prioritizes honesty and regulatory compliance, while creative accounting may compromise integrity for financial advantage.

Impact on Stakeholders and Decision-Making

Financial reporting provides transparent and accurate information that enables stakeholders to make informed decisions, fostering trust and accountability in business operations. Creative accounting manipulates financial data to present a misleading picture, potentially deceiving investors, creditors, and regulators, which can result in poor decision-making and loss of stakeholder confidence. The integrity of financial reporting is crucial for maintaining market stability and protecting stakeholder interests against the risks posed by aggressive accounting practices.

Safeguards Against Creative Accounting Practices

Financial reporting relies on transparency, adherence to GAAP or IFRS standards, and thorough external audits as key safeguards against creative accounting practices. Regulatory bodies enforce strict compliance and impose penalties for manipulation, while companies implement internal controls and ethical guidelines to ensure accurate financial disclosures. Advanced data analytics and continuous monitoring further enhance the detection of irregularities that may indicate creative accounting.

Future Trends in Financial Reporting and Ethical Practices

Future trends in financial reporting emphasize increased transparency, real-time data analytics, and the integration of artificial intelligence to enhance accuracy and decision-making. Ethical practices are becoming paramount as regulators and stakeholders demand stricter compliance and standardized frameworks to prevent manipulation associated with creative accounting. Blockchain technology is increasingly adopted to ensure immutable records, fostering trust and reducing the risk of fraud in financial disclosures.

Financial Reporting Infographic

libterm.com

libterm.com