Tangible assets are physical items owned by a business that hold value, such as machinery, buildings, and inventory. These assets play a crucial role in operational efficiency and financial stability by providing collateral for loans and supporting production processes. Explore the rest of the article to understand how managing your tangible assets effectively can boost your company's growth.

Table of Comparison

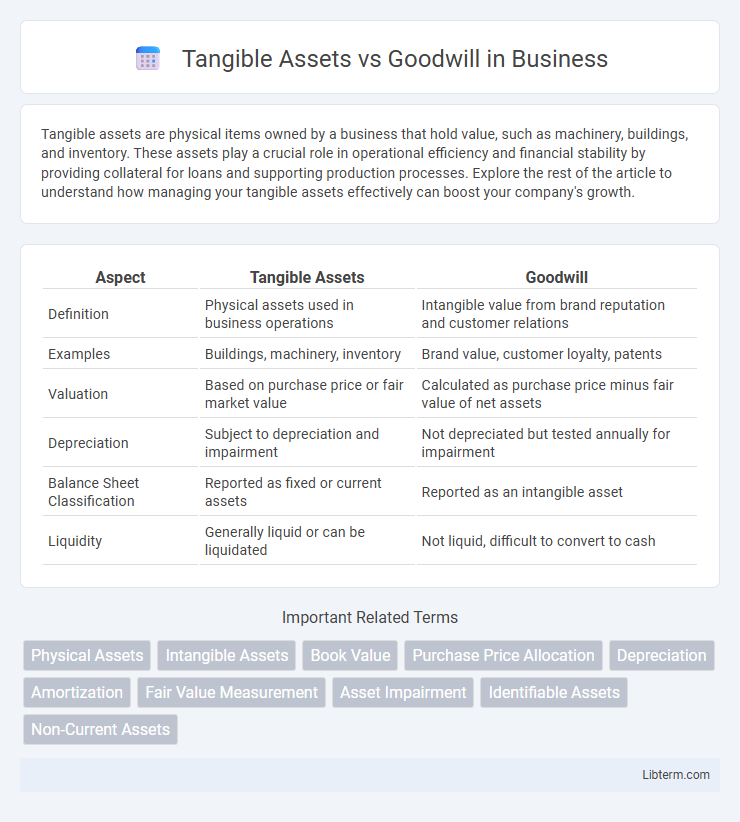

| Aspect | Tangible Assets | Goodwill |

|---|---|---|

| Definition | Physical assets used in business operations | Intangible value from brand reputation and customer relations |

| Examples | Buildings, machinery, inventory | Brand value, customer loyalty, patents |

| Valuation | Based on purchase price or fair market value | Calculated as purchase price minus fair value of net assets |

| Depreciation | Subject to depreciation and impairment | Not depreciated but tested annually for impairment |

| Balance Sheet Classification | Reported as fixed or current assets | Reported as an intangible asset |

| Liquidity | Generally liquid or can be liquidated | Not liquid, difficult to convert to cash |

Understanding Tangible Assets

Tangible assets represent physical items owned by a company, such as machinery, buildings, and inventory, which hold measurable value and are used in operational activities. These assets can be depreciated over time, providing tax benefits and reflecting wear and tear, unlike intangible assets such as goodwill, which lack physical substance and are not subject to depreciation. Understanding tangible assets is crucial for accurate financial reporting and asset management, ensuring a clear valuation of a company's physical resources.

What Is Goodwill?

Goodwill represents the intangible value that arises when a company acquires another business for more than the fair market value of its net identifiable assets, including tangible assets like equipment and inventory. It encompasses brand reputation, customer relationships, intellectual property, and employee expertise, which are not separately identifiable but contribute to future earning potential. Unlike tangible assets, goodwill is recorded as an intangible asset on the balance sheet and is subject to annual impairment testing rather than depreciation.

Key Differences Between Tangible Assets and Goodwill

Tangible assets are physical items such as machinery, buildings, and inventory that hold measurable value on a company's balance sheet, whereas goodwill represents intangible value arising from business reputation, customer loyalty, and brand strength acquired during mergers or acquisitions. Tangible assets depreciate over time due to wear and tear, while goodwill is subject to annual impairment testing but not amortization. Unlike tangible assets with direct market value, goodwill's value fluctuates based on future earnings potential and cannot be sold separately from the business.

Examples of Tangible Assets

Tangible assets include physical items such as machinery, buildings, vehicles, and inventory that a company uses in its operations. These assets are measurable and can be seen or touched, contributing directly to the production process or business activities. In contrast, goodwill represents intangible value arising from factors like brand reputation, customer loyalty, and intellectual property, which cannot be physically measured.

How Goodwill Is Created and Measured

Goodwill is created when a company acquires another business for a price exceeding the fair value of its identifiable tangible and intangible assets. It is measured as the excess purchase price over the net fair value of acquired assets and liabilities, representing factors like brand reputation, customer relationships, and intellectual property. Unlike tangible assets, goodwill is not physically measurable and is subject to periodic impairment testing rather than amortization.

Importance of Tangible Assets in Business Valuation

Tangible assets such as machinery, buildings, and inventory play a critical role in business valuation by providing measurable and liquid value that can be used to secure loans or attract investors. Unlike goodwill, which is an intangible asset reflecting brand reputation and customer relationships, tangible assets offer concrete evidence of a company's operational capacity and financial stability. Accurate appraisal of tangible assets ensures a realistic valuation baseline, aiding in strategic decision-making and financial reporting.

The Role of Goodwill in Mergers and Acquisitions

Goodwill represents the premium paid during mergers and acquisitions (M&A) beyond the fair value of tangible assets and identifiable intangible assets, reflecting factors like brand reputation, customer relationships, and employee expertise. Tangible assets include physical items like machinery, buildings, and inventory, which are straightforward to value and record on the balance sheet. In M&A, goodwill plays a crucial role by capturing the anticipated future economic benefits that are not directly measurable but critical for justifying the acquisition price and supporting long-term strategic growth.

Accounting Treatment: Tangible Assets vs Goodwill

Tangible assets, such as machinery, buildings, and equipment, are recorded on the balance sheet at historical cost less accumulated depreciation, reflecting their physical presence and finite useful life. Goodwill, an intangible asset arising from business acquisitions, is initially recognized as the excess of purchase price over the fair value of identifiable net assets and is subject to annual impairment testing rather than systematic amortization. Accounting standards like IFRS and GAAP require that tangible assets be depreciated over their useful life, while goodwill impairment losses must be recognized promptly if the asset's carrying amount exceeds its recoverable amount.

Impairment and Depreciation: Key Considerations

Tangible assets undergo systematic depreciation, reflecting wear and usage, while impairment occurs only when their carrying value exceeds recoverable amount, indicating permanent loss. Goodwill is not depreciated but tested annually for impairment, with write-downs resulting from declines in the fair value of acquired business units below their carrying amount. Understanding these distinct accounting treatments is crucial for accurate financial reporting and asset valuation.

Impact on Financial Statements and Investor Perception

Tangible assets, such as property, equipment, and inventory, are recorded on the balance sheet at historical cost less depreciation, directly impacting a company's asset base and collateral valuation. Goodwill arises from acquisitions, representing the premium paid over the fair value of net identifiable assets, and appears as an intangible asset subject to annual impairment testing, which can introduce volatility in earnings reports. Investors often view substantial tangible assets as indicators of stable operational capacity, while significant goodwill may raise concerns about acquisition premiums and potential write-downs affecting future profitability.

Tangible Assets Infographic

libterm.com

libterm.com