Acquisition involves the process of obtaining assets, companies, or resources to expand business capabilities and market reach. Successful acquisition strategies require thorough due diligence, financial analysis, and integration planning to maximize value. Explore the rest of the article to learn how your business can leverage acquisitions for growth and competitive advantage.

Table of Comparison

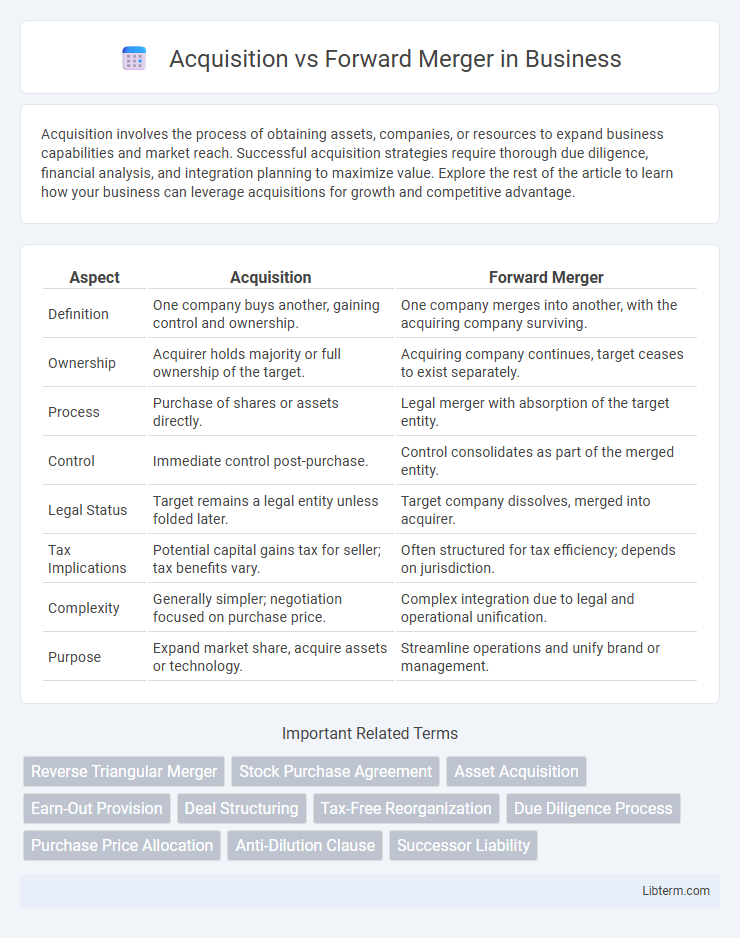

| Aspect | Acquisition | Forward Merger |

|---|---|---|

| Definition | One company buys another, gaining control and ownership. | One company merges into another, with the acquiring company surviving. |

| Ownership | Acquirer holds majority or full ownership of the target. | Acquiring company continues, target ceases to exist separately. |

| Process | Purchase of shares or assets directly. | Legal merger with absorption of the target entity. |

| Control | Immediate control post-purchase. | Control consolidates as part of the merged entity. |

| Legal Status | Target remains a legal entity unless folded later. | Target company dissolves, merged into acquirer. |

| Tax Implications | Potential capital gains tax for seller; tax benefits vary. | Often structured for tax efficiency; depends on jurisdiction. |

| Complexity | Generally simpler; negotiation focused on purchase price. | Complex integration due to legal and operational unification. |

| Purpose | Expand market share, acquire assets or technology. | Streamline operations and unify brand or management. |

Understanding Acquisition and Forward Merger

Acquisition involves one company purchasing another to consolidate assets, operations, and market presence, often resulting in the acquired company ceasing to exist as a separate entity. A forward merger occurs when a target company merges into the acquiring company, which continues its legal existence while absorbing the target's assets and liabilities. Understanding these distinctions helps businesses choose the optimal strategy for growth, regulatory compliance, and shareholder value enhancement.

Key Definitions and Distinctions

An acquisition involves one company purchasing another, resulting in the acquired company often losing its identity, while a forward merger entails a subsidiary merging into its parent company, with the subsidiary dissolving and the parent continuing. Key distinctions include the acquisition's potential for retaining or dissolving the target's entity versus the forward merger's automatic dissolution of the subsidiary. Forward mergers are frequently used to streamline corporate structures, whereas acquisitions focus on control and ownership transfer.

Legal Structures and Processes

Acquisition involves one company legally purchasing another, often resulting in the acquired entity becoming a subsidiary with separate legal identities maintained. In contrast, a Forward Merger legally consolidates two companies into one entity, where the acquired firm ceases to exist and its assets and liabilities transfer to the surviving company. The acquisition process requires detailed due diligence and contract negotiations, while forward mergers typically mandate shareholder approvals and regulatory filings to effect legal integration.

Strategic Motivations Compared

Acquisitions drive strategic growth by enabling companies to rapidly increase market share, diversify product lines, and acquire valuable assets or technologies. Forward mergers focus on consolidating operations under the acquiring company's name, streamlining brand identity and operational control for enhanced efficiency and integration. Both strategies aim to strengthen competitive positioning but differ in execution, with acquisitions emphasizing asset absorption and forward mergers prioritizing seamless corporate alignment.

Impact on Stakeholders

Acquisition often results in significant changes for stakeholders, including shifts in management, potential layoffs, and altered shareholder value due to the absorbing company's control. Forward mergers typically create a streamlined entity where shareholders of the acquired company gain equity, often preserving stakeholder interests and fostering long-term growth. Both strategies influence customer loyalty, employee morale, and market positioning, with acquisitions carrying higher disruption risk compared to the generally smoother integration in forward mergers.

Financial Implications and Valuations

Acquisitions typically involve one company purchasing another with a direct exchange of cash or stock, leading to immediate changes in asset valuation and potential goodwill implications on the balance sheet. Forward mergers consolidate the target into the acquiring company, often resulting in streamlined financial reporting but requiring careful assessment of share exchange ratios to ensure fair valuation. Both methods impact financial statements, tax considerations, and shareholder equity, necessitating thorough due diligence to optimize transaction value.

Tax Considerations in Both Approaches

Acquisition structures often trigger taxable events such as capital gains or asset transfer taxes, impacting the seller and possibly the buyer depending on deal terms and asset vs. stock purchase. In forward mergers, tax benefits may arise through tax-free reorganizations under IRS code Section 368(a), enabling the acquiring company to absorb the target without immediate tax consequences. Careful tax planning is essential to leverage net operating losses, avoid double taxation, and optimize depreciation benefits in both acquisition and forward merger scenarios.

Regulatory and Compliance Factors

Acquisition involves one company purchasing another while maintaining separate legal entities, subjecting the deal to antitrust reviews and securities regulations to prevent market monopolization and ensure investor protection. Forward merger consolidates two companies into one, triggering scrutiny from regulatory bodies like the SEC and FTC to ensure compliance with merger control rules and financial disclosure requirements. Both transactions require thorough due diligence and adherence to jurisdiction-specific compliance frameworks to mitigate legal risks and secure regulatory approval.

Risks and Challenges Analysis

Acquisition involves purchasing a target company's assets or shares, exposing the buyer to integration challenges and potential cultural clashes that can disrupt operations. Forward mergers consolidate two companies by merging the target into the acquiring firm, posing risks related to regulatory approvals and valuation discrepancies. Both strategies carry financial risks, including hidden liabilities and market volatility, requiring thorough due diligence to mitigate post-transaction challenges.

Choosing Between Acquisition and Forward Merger

Choosing between an acquisition and a forward merger depends on strategic goals, integration complexity, and regulatory considerations. Acquisitions offer flexibility with easier management change and asset consolidation, while forward mergers provide a streamlined structure preserving the target company's identity and ongoing contracts. Evaluating factors like tax implications, shareholder impact, and long-term synergy potential is essential for optimal decision-making in corporate growth strategies.

Acquisition Infographic

libterm.com

libterm.com