Maximizing profitability requires a strategic balance between reducing costs and increasing revenue streams. By focusing on efficient resource management and identifying new market opportunities, businesses can enhance their bottom line significantly. Explore the rest of this article to discover actionable tips that can boost your profitability and ensure long-term financial success.

Table of Comparison

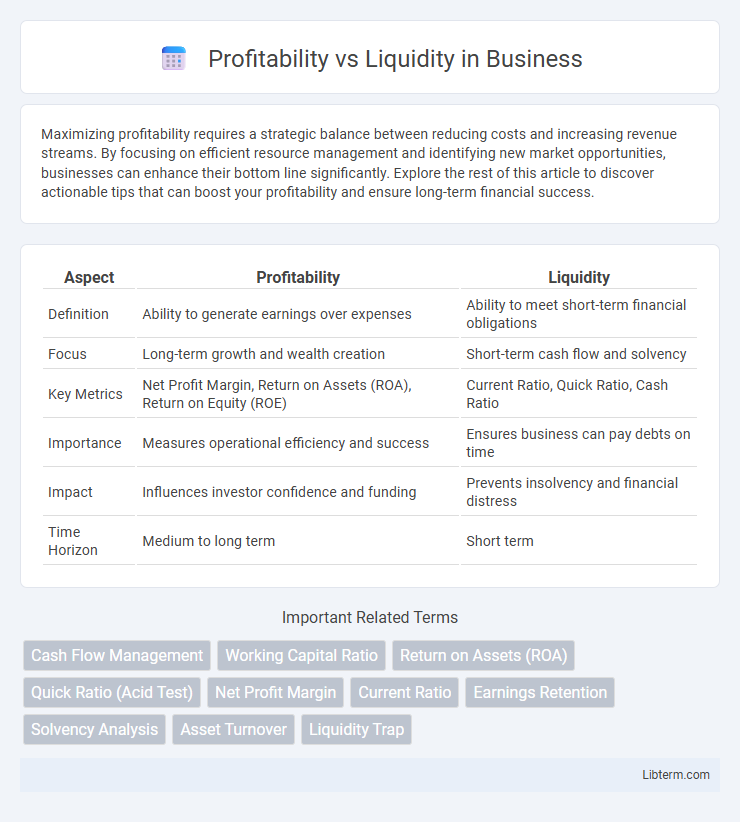

| Aspect | Profitability | Liquidity |

|---|---|---|

| Definition | Ability to generate earnings over expenses | Ability to meet short-term financial obligations |

| Focus | Long-term growth and wealth creation | Short-term cash flow and solvency |

| Key Metrics | Net Profit Margin, Return on Assets (ROA), Return on Equity (ROE) | Current Ratio, Quick Ratio, Cash Ratio |

| Importance | Measures operational efficiency and success | Ensures business can pay debts on time |

| Impact | Influences investor confidence and funding | Prevents insolvency and financial distress |

| Time Horizon | Medium to long term | Short term |

Understanding Profitability and Liquidity

Profitability measures a company's ability to generate earnings compared to its expenses and other relevant costs during a specific period, reflecting overall financial success. Liquidity indicates a firm's capacity to meet short-term obligations by converting assets into cash quickly, ensuring operational stability. Understanding both concepts is crucial for balanced financial management, as profitability drives growth while liquidity maintains day-to-day solvency.

Key Differences Between Profitability and Liquidity

Profitability measures a company's ability to generate earnings relative to its revenue, operating costs, and assets, indicating long-term financial success. Liquidity assesses a firm's capacity to meet short-term obligations using current assets, reflecting immediate financial health. Key differences include profitability focusing on income generation over time, while liquidity emphasizes cash availability for day-to-day operations.

Importance of Profitability in Business Growth

Profitability drives business growth by ensuring sufficient revenue exceeds expenses, fueling reinvestment and expansion opportunities. High profitability attracts investors and improves creditworthiness, enabling access to capital for scaling operations. While liquidity manages short-term obligations, sustained profitability is essential for long-term viability and competitive advantage in dynamic markets.

The Role of Liquidity in Financial Stability

Liquidity plays a critical role in maintaining financial stability by ensuring that an organization can meet its short-term obligations without incurring significant losses. Adequate liquidity safeguards against insolvency risks, enabling businesses to manage cash flow fluctuations and operational expenses efficiently. Prioritizing liquidity alongside profitability helps firms balance immediate financial health with long-term earnings growth.

Profitability Ratios Every Business Should Know

Profitability ratios such as gross profit margin, net profit margin, and return on equity are essential metrics that assess a company's ability to generate earnings relative to sales, assets, and shareholders' equity. These ratios provide critical insights into operational efficiency, cost management, and overall financial performance, enabling businesses to strategize for sustainable growth. Monitoring profitability ratios helps identify trends, benchmark against industry standards, and make informed decisions to enhance profit generation and shareholder value.

Essential Liquidity Ratios for Financial Health

Essential liquidity ratios, such as the current ratio and quick ratio, provide crucial insights into a company's ability to meet short-term obligations without sacrificing profitability. Maintaining a balance between profitability and liquidity ensures sustainable financial health by preventing cash flow crises while supporting operational efficiency. Monitoring these ratios enables businesses to optimize working capital management and maintain investor confidence through consistent financial stability.

Common Challenges in Balancing Profitability and Liquidity

Balancing profitability and liquidity presents common challenges such as cash flow constraints, where businesses generate profits but lack sufficient liquid assets to meet immediate obligations. Companies often struggle to invest in growth opportunities without compromising operational cash reserves, risking insolvency despite positive earnings. Effective management requires optimizing working capital and forecasting cash flows to sustain profitability without jeopardizing liquidity.

Strategies to Improve Both Profitability and Liquidity

Enhancing profitability and liquidity requires strategic actions such as optimizing inventory turnover to reduce holding costs while ensuring sufficient stock to meet demand. Implementing effective credit control policies accelerates cash inflows, improving liquidity without sacrificing sales growth. Cost management initiatives, including expense reduction and process automation, boost profit margins and free up cash, simultaneously strengthening financial stability.

Case Studies: Real-World Examples of Profitability vs Liquidity

Case studies from companies like Tesla and JCPenney illustrate the critical balance between profitability and liquidity, where Tesla maintained high liquidity during rapid expansion to fund innovation while JCPenney faced liquidity crises despite past profitability. Analysis reveals that firms prioritizing liquidity often survive market downturns better, whereas those focusing solely on profitability risk cash flow shortages impairing operations. Real-world examples underscore the necessity for businesses to strategically manage cash reserves and profit margins to ensure sustainable growth and operational stability.

Choosing the Right Balance for Sustainable Business Success

Profitability measures a business's ability to generate income, while liquidity assesses its capacity to meet short-term obligations, making the balance between the two crucial for sustainable success. Prioritizing excessive profitability can strain cash flow, risking insolvency, whereas overemphasizing liquidity limits growth potential by tying up capital. Effective financial management involves optimizing profit margins alongside maintaining adequate liquidity ratios, such as the current and quick ratios, to support operational stability and long-term growth.

Profitability Infographic

libterm.com

libterm.com