The reserve price is the minimum amount a seller is willing to accept during an auction, ensuring that the item is not sold below its true value. Understanding this critical threshold helps you make informed bidding decisions and avoid overpaying for an item. Discover more about how reserve prices impact auctions and strategies to navigate them in the rest of this article.

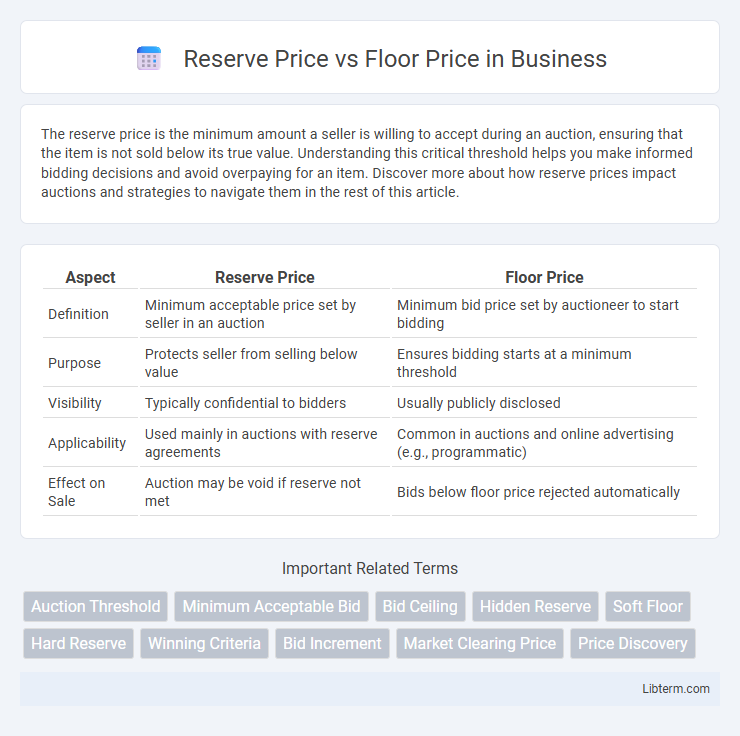

Table of Comparison

| Aspect | Reserve Price | Floor Price |

|---|---|---|

| Definition | Minimum acceptable price set by seller in an auction | Minimum bid price set by auctioneer to start bidding |

| Purpose | Protects seller from selling below value | Ensures bidding starts at a minimum threshold |

| Visibility | Typically confidential to bidders | Usually publicly disclosed |

| Applicability | Used mainly in auctions with reserve agreements | Common in auctions and online advertising (e.g., programmatic) |

| Effect on Sale | Auction may be void if reserve not met | Bids below floor price rejected automatically |

Understanding Reserve Price and Floor Price

Reserve price represents the minimum amount a seller is willing to accept during an auction, ensuring items sell only above this threshold. Floor price is a fixed minimum bid set by sellers or platforms to prevent sales below a specified value, often used in digital advertising for ad impressions. Understanding these prices helps optimize auction strategies by balancing seller protection with market competitiveness.

Key Differences Between Reserve Price and Floor Price

Reserve price is the minimum amount a seller is willing to accept for an item, kept confidential until the auction ends, ensuring the item does not sell below a set threshold. Floor price represents the lowest starting bid publicly announced to attract bidders and initiate competitive bidding. Key differences include reserve price being a hidden minimum acceptable value, while floor price is an open, visible bid floor designed to stimulate auctions.

Purpose and Importance of Reserve Price

The reserve price represents the minimum acceptable bid set by the seller, ensuring that the asset is not sold below its intrinsic value during an auction. It protects sellers from undervaluation and provides a safety net to achieve a satisfactory sale outcome. The floor price, often used in programmatic advertising, establishes the lowest acceptable bid, but unlike the reserve price, it primarily aims to optimize revenue rather than guarantee a minimum sale threshold.

Role of Floor Price in Auctions

The floor price in auctions sets the minimum acceptable bid, ensuring that items are not sold below a predetermined threshold, which protects the seller's interests and maintains market value. Unlike the reserve price, which is a hidden minimum below which an item will not be sold, the floor price is often visible to bidders, influencing their bidding strategy by establishing a baseline. This mechanism helps maintain competitive bidding dynamics and prevents undervaluation of auction items.

How Reserve Price Protects Sellers

Reserve price protects sellers by setting a minimum acceptable bid that must be met for the auction item to be sold, ensuring the seller does not have to accept less than their desired value. Unlike the floor price, which is the minimum starting bid visible to buyers, the reserve price remains confidential until bids reach that threshold, maintaining negotiation leverage. This mechanism safeguards sellers from undervaluation and maximizes potential revenue in competitive bidding environments.

Impact of Floor Price on Buyers

The floor price sets the minimum acceptable bid in an auction, directly influencing buyers by establishing a baseline cost they must meet or exceed, which can limit participation from bidders with lower valuations. Buyers may perceive the floor price as a signal of the item's minimum worth, often impacting their bidding strategy and willingness to compete. A high floor price can reduce the pool of potential buyers, while a strategically set floor price can help sellers achieve optimal sale outcomes without undervaluing the asset.

Examples of Reserve Price in Real-World Auctions

Reserve price in real-world auctions often serves as the minimum acceptable bid set by the seller to ensure items like rare art or vintage cars are not sold below market value. For example, a painting at Sotheby's may have a reserve price of $100,000, preventing the sale if bids do not reach that threshold. This contrasts with the floor price, which is the lowest bid permissible but does not guarantee seller satisfaction or sale completion.

Floor Price Applications in Digital Advertising

Floor price in digital advertising serves as the minimum bid amount that publishers set to protect their ad inventory's value, ensuring that impressions are not sold below a certain threshold. It optimizes revenue by filtering out low bids in real-time bidding (RTB) auctions, maintaining higher yield and quality control across programmatic platforms. Commonly applied in header bidding and supply-side platforms (SSPs), floor price strategies help balance fill rates and price floors to maximize overall ad revenue performance.

Choosing Between Reserve Price and Floor Price

Choosing between a reserve price and a floor price depends on the seller's strategy and auction type; a reserve price sets the minimum acceptable amount hidden from bidders, ensuring the item won't sell below that threshold, while a floor price is a public minimum bid often used in open auctions to encourage competitive bidding. Sellers aiming for control and privacy in sealed-bid or online auctions prefer reserve prices, protecting the item's value without deterring potential bidders. Conversely, floor prices suit sellers seeking to stimulate bidding momentum in live auctions by clearly signaling the lowest starting point.

Best Practices for Setting Reserve and Floor Prices

Setting an optimal reserve price requires analyzing historical auction data and market trends to ensure the minimum acceptable bid maximizes seller revenue without deterring bidders, while setting an appropriate floor price in programmatic advertising helps control the minimum bid in real-time auctions, balancing advertiser demand with inventory value. Employ dynamic pricing strategies using AI tools to adjust reserve and floor prices periodically based on supply, demand fluctuations, and competitor benchmarks. Continuously monitor auction outcomes and adjust prices to reduce unsold inventory and avoid undervaluing assets, thereby improving overall revenue optimization.

Reserve Price Infographic

libterm.com

libterm.com