Hedge funds employ diverse investment strategies to generate high returns while managing risk through active portfolio management and leverage. These funds often target accredited investors seeking sophisticated opportunities beyond traditional stocks and bonds. Explore the rest of the article to understand how hedge funds could play a role in your investment strategy.

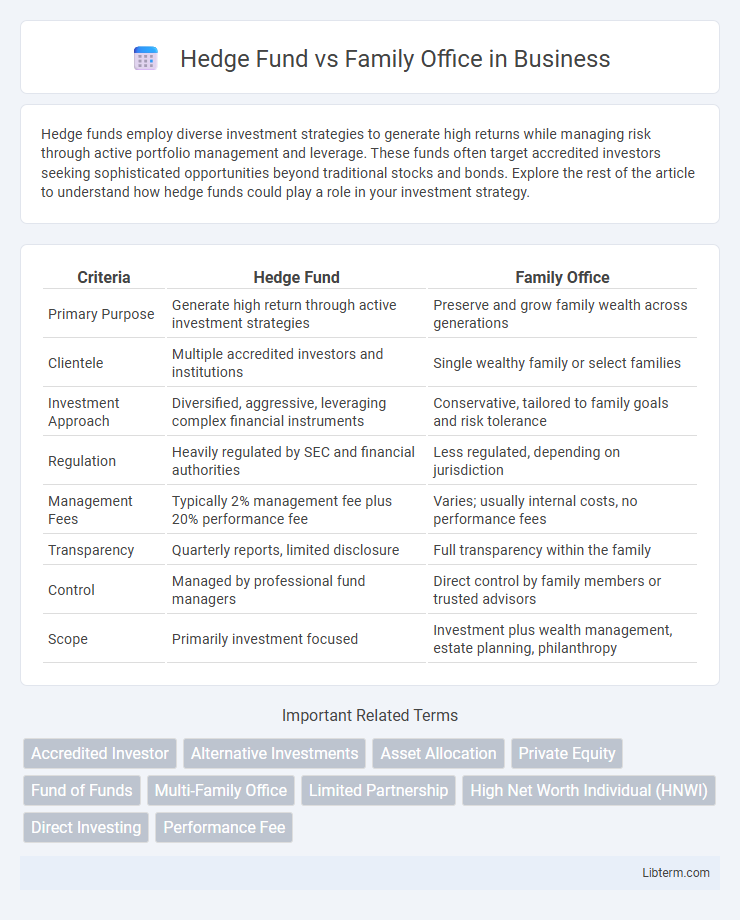

Table of Comparison

| Criteria | Hedge Fund | Family Office |

|---|---|---|

| Primary Purpose | Generate high return through active investment strategies | Preserve and grow family wealth across generations |

| Clientele | Multiple accredited investors and institutions | Single wealthy family or select families |

| Investment Approach | Diversified, aggressive, leveraging complex financial instruments | Conservative, tailored to family goals and risk tolerance |

| Regulation | Heavily regulated by SEC and financial authorities | Less regulated, depending on jurisdiction |

| Management Fees | Typically 2% management fee plus 20% performance fee | Varies; usually internal costs, no performance fees |

| Transparency | Quarterly reports, limited disclosure | Full transparency within the family |

| Control | Managed by professional fund managers | Direct control by family members or trusted advisors |

| Scope | Primarily investment focused | Investment plus wealth management, estate planning, philanthropy |

Introduction to Hedge Funds and Family Offices

Hedge funds are pooled investment vehicles that employ diverse strategies to achieve high returns for accredited investors and institutions, often involving leverage, derivatives, and short-selling. Family offices manage the wealth and financial affairs of ultra-high-net-worth families, offering personalized investment management, estate planning, and philanthropic guidance. Both entities serve distinct purposes in wealth management, with hedge funds emphasizing aggressive growth strategies and family offices focusing on long-term wealth preservation and legacy planning.

Key Differences Between Hedge Funds and Family Offices

Hedge funds primarily manage pooled assets from multiple investors using aggressive investment strategies to maximize returns, often emphasizing high-risk, high-reward opportunities. Family offices cater exclusively to ultra-high-net-worth families, providing personalized wealth management, estate planning, and philanthropic advisory services tailored to preserve and grow family wealth across generations. Unlike hedge funds, family offices prioritize long-term wealth preservation and holistic financial planning over short-term market performance.

Investment Strategies: Hedge Funds vs Family Offices

Hedge funds primarily engage in aggressive investment strategies including short selling, leverage, and derivatives to achieve high returns within shorter time frames. Family offices tend to adopt long-term, diversified investment approaches emphasizing wealth preservation through private equity, real estate, and direct company investments. Both leverage alternative assets, but hedge funds focus on high liquidity and risk-adjusted returns, whereas family offices prioritize intergenerational wealth growth and capital protection.

Regulatory Framework and Compliance

Hedge funds are subject to stringent regulatory frameworks such as the Investment Advisers Act of 1940 in the U.S., requiring registration with the SEC and adherence to disclosure and reporting standards designed to protect investors. In contrast, family offices often qualify for exemptions under regulations like the SEC's Family Office Rule (Rule 202(a)(11)(G)-1), allowing them to operate with significantly fewer compliance burdens since they manage wealth for a single family. The differential regulatory oversight impacts operational risk management, with hedge funds facing more frequent audits, anti-money laundering (AML) requirements, and compliance monitoring compared to family offices.

Ownership Structure and Governance

Hedge funds typically operate under a centralized ownership structure with external investors and professional fund managers who make investment decisions, governed by a board or management team adhering to regulatory frameworks. Family offices are privately owned by one or more families, featuring a governance model centered around family members' control and customized decision-making to manage wealth, investments, and legacy objectives. The governance in family offices emphasizes privacy, long-term strategic planning, and tailored services, contrasting with the performance-driven, compliance-focused governance of hedge funds.

Capital Sources and Fundraising Approaches

Hedge funds primarily raise capital from institutional investors, high-net-worth individuals, and accredited investors through detailed private placements and public offerings regulated by securities laws. Family offices rely on capital sourced predominantly from a single wealthy family's assets, focusing on preserving and growing wealth rather than external fundraising. Hedge funds emphasize performance-based incentives to attract investors, whereas family offices prioritize long-term wealth management and may selectively co-invest with external partners.

Risk Management Practices

Hedge funds employ advanced risk management practices including quantitative models, real-time market monitoring, and diversified asset allocation to mitigate volatility and protect investor capital. Family offices prioritize capital preservation through customized risk assessments, conservative investment strategies, and long-term liquidity planning tailored to the family's wealth and legacy objectives. Both structures utilize comprehensive stress testing and scenario analysis to navigate market uncertainties and optimize portfolio resilience.

Fees and Compensation Models

Hedge funds typically charge a management fee of 1-2% of assets under management (AUM) plus a performance fee of 15-20% on profits generated, aligning compensation with fund performance. Family offices usually operate on a fixed fee or hourly rate basis, often ranging from 0.5% to 1% of AUM, with less emphasis on performance-based compensation to prioritize long-term wealth preservation. The fee structures reflect differing client goals, with hedge funds focused on high returns and performance incentives, while family offices emphasize customized, comprehensive wealth management and cost efficiency.

Client Profiles and Service Offerings

Hedge funds primarily serve high-net-worth individuals and institutional investors seeking aggressive growth through diverse, often high-risk strategies including equities, derivatives, and leverage. Family offices cater exclusively to ultra-high-net-worth families, offering holistic wealth management encompassing estate planning, tax optimization, philanthropy, and multi-generational wealth preservation. The client profile of hedge funds emphasizes performance-driven returns, while family offices prioritize personalized, comprehensive financial and lifestyle services aligned with long-term family goals.

Choosing Between a Hedge Fund and Family Office

Choosing between a hedge fund and a family office depends largely on investment goals, risk tolerance, and control preferences. Hedge funds offer diversified strategies with professional management targeting high returns, often involving higher fees and less direct investor control. Family offices provide tailored wealth management for ultra-high-net-worth families, emphasizing personalized service, legacy planning, and greater autonomy over investment decisions.

Hedge Fund Infographic

libterm.com

libterm.com