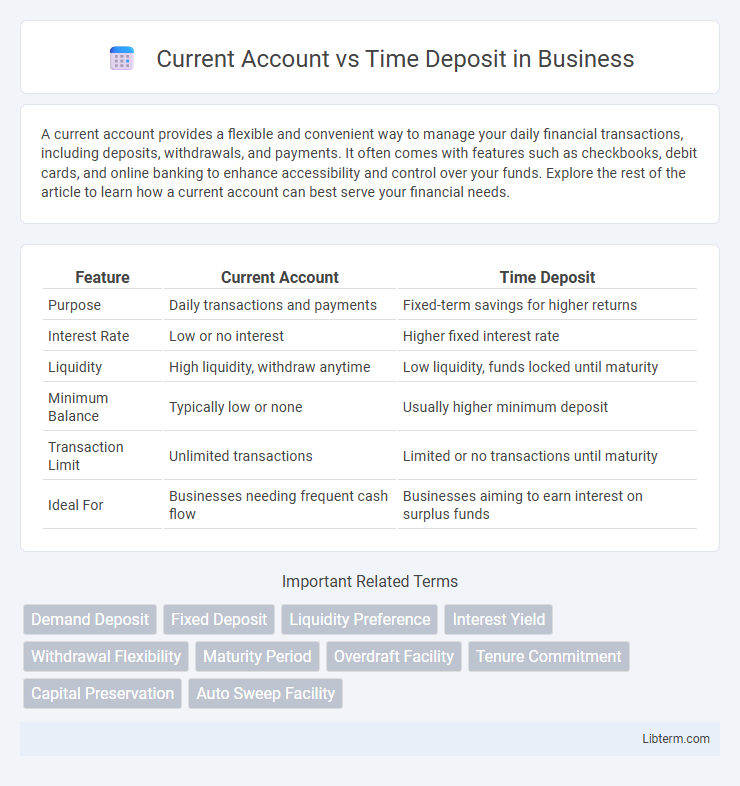

A current account provides a flexible and convenient way to manage your daily financial transactions, including deposits, withdrawals, and payments. It often comes with features such as checkbooks, debit cards, and online banking to enhance accessibility and control over your funds. Explore the rest of the article to learn how a current account can best serve your financial needs.

Table of Comparison

| Feature | Current Account | Time Deposit |

|---|---|---|

| Purpose | Daily transactions and payments | Fixed-term savings for higher returns |

| Interest Rate | Low or no interest | Higher fixed interest rate |

| Liquidity | High liquidity, withdraw anytime | Low liquidity, funds locked until maturity |

| Minimum Balance | Typically low or none | Usually higher minimum deposit |

| Transaction Limit | Unlimited transactions | Limited or no transactions until maturity |

| Ideal For | Businesses needing frequent cash flow | Businesses aiming to earn interest on surplus funds |

Introduction to Current Accounts and Time Deposits

Current accounts offer immediate access to funds with unlimited withdrawals and deposits, designed for daily transactions and business activities. Time deposits lock funds for a fixed period, providing higher interest rates in exchange for restricted access until maturity. Understanding these fundamental differences helps individuals and businesses choose the best option for liquidity needs and investment goals.

Key Differences Between Current Accounts and Time Deposits

Current accounts provide high liquidity with no fixed tenure, allowing unlimited withdrawals and deposits, making them ideal for daily transactions and business operations. Time deposits lock funds for a predetermined period, offering higher interest rates but restricting access until maturity, suitable for long-term savings. The key differences include interest benefits, liquidity, and usage purpose, with current accounts focusing on transactional convenience and time deposits emphasizing earning potential through fixed terms.

Features of Current Accounts

Current accounts offer unlimited transactions, enabling frequent deposits and withdrawals without restrictions, making them ideal for businesses and active account holders. They typically do not provide interest earnings, prioritizing liquidity and easy access to funds over returns. Features include overdraft facilities, cheque book issuance, and minimal or no minimum balance requirements, enhancing transactional convenience.

Features of Time Deposits

Time deposits offer fixed interest rates for a predetermined tenure, ensuring predictable returns compared to the flexible withdrawal options of current accounts. These accounts typically require a minimum deposit amount and impose penalties for premature withdrawal, encouraging longer-term savings. Interest on time deposits is often compounded periodically, providing better earnings than standard current accounts without interest benefits.

Interest Rates: Current Account vs Time Deposit

Time deposits typically offer higher interest rates compared to current accounts, making them more suitable for long-term savings. While current accounts provide easy access to funds with minimal or no interest, time deposits lock funds for a fixed term with guaranteed returns. Interest rates on time deposits vary by tenure and financial institution, often outperforming the near-zero rates on current accounts.

Accessibility and Liquidity Comparison

Current accounts offer high accessibility with unlimited withdrawals and no transaction limits, making funds readily available for daily expenses and business transactions. Time deposits restrict access until the maturity date, limiting liquidity but often providing higher interest rates as compensation for locking in funds. The liquidity trade-off between these accounts reflects a balance between immediate access in current accounts and better returns in time deposits.

Suitability: Who Should Choose Which Account?

Current accounts are ideal for individuals and businesses requiring frequent access to funds for daily transactions, bill payments, and payroll management due to their unlimited withdrawal capabilities and no fixed maturity. Time deposits suit investors seeking higher interest rates through locked-in funds over a predetermined period, offering greater returns but limited liquidity. Choosing between the two depends on liquidity needs and investment goals, with current accounts favored for operational cash flow and time deposits preferred for savings growth.

Risks and Security Considerations

Current accounts offer high liquidity but generally provide lower interest rates and are more susceptible to fraud due to frequent transactions. Time deposits, also known as fixed deposits, lock funds for a predetermined period, reducing liquidity risk while typically offering higher interest rates and stronger protection against market volatility. Security considerations favor time deposits because they have less exposure to unauthorized access and withdrawal risks compared to the more accessible current accounts.

Fees and Charges: A Comparative Overview

Current accounts typically incur monthly maintenance fees and transaction charges, especially for exceeding free transaction limits or using out-of-network ATMs. Time deposits, also known as fixed deposits, generally have fewer fees but may impose penalties for early withdrawal before maturity. Comparing these fee structures helps account holders choose between liquidity and potential cost savings.

Conclusion: Making the Right Choice

Choosing between a Current Account and a Time Deposit depends on your financial goals and liquidity needs. Current Accounts offer easy access to funds and are ideal for daily transactions, while Time Deposits provide higher interest rates but require locking in money for a fixed term. Assessing your cash flow requirements and investment horizon will help determine the most suitable option to maximize returns and financial flexibility.

Current Account Infographic

libterm.com

libterm.com