Reallowance refers to the process of reallocating or redistributing allowances, often found in financial or budget management contexts. It ensures resources are optimally assigned to meet changing priorities or demands. Explore the rest of this article to understand how reallowance can improve your budgeting strategy.

Table of Comparison

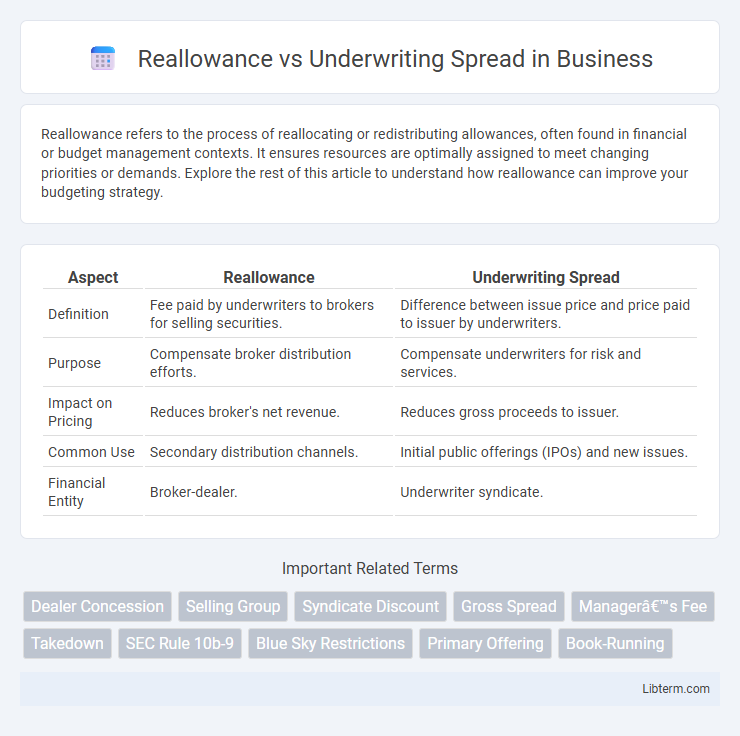

| Aspect | Reallowance | Underwriting Spread |

|---|---|---|

| Definition | Fee paid by underwriters to brokers for selling securities. | Difference between issue price and price paid to issuer by underwriters. |

| Purpose | Compensate broker distribution efforts. | Compensate underwriters for risk and services. |

| Impact on Pricing | Reduces broker's net revenue. | Reduces gross proceeds to issuer. |

| Common Use | Secondary distribution channels. | Initial public offerings (IPOs) and new issues. |

| Financial Entity | Broker-dealer. | Underwriter syndicate. |

Introduction to Reallowance and Underwriting Spread

Reallowance represents the portion of underwriting spread that underwriters return to other brokers as compensation for their participation in selling securities. Underwriting spread is the difference between the price at which underwriters purchase securities from the issuer and the price at which they sell them to the public, covering fees and profits. Understanding reallowance and underwriting spread is essential for analyzing the cost structure and distribution process in securities offerings.

Definitions: Reallowance Explained

Reallowance refers to the portion of the underwriting spread that the lead underwriter returns to selling group members or brokers as a commission or fee for distributing a new security issue. It represents a financial incentive designed to encourage participation in the offering process by compensating intermediaries for marketing efforts. The reallowance is distinct from the underwriting spread itself, which covers the total discount between the public offering price and the price paid to the issuer.

Understanding Underwriting Spread

Understanding underwriting spread involves recognizing it as the difference between the amount underwriters pay to an issuer and the price at which they sell securities to the public, representing the gross compensation for underwriting services. This spread covers components such as management fees, underwriting fees, and selling concessions, reflecting the financial incentive for underwriters to distribute the securities. Analyzing underwriting spread is essential for investors and issuers to evaluate the cost and risk associated with public offerings and the overall pricing efficiency in capital markets.

Key Differences Between Reallowance and Underwriting Spread

Reallowance refers to the portion of the underwriting spread redistributed to selling brokers or agents as an incentive for distributing new issues, while underwriting spread is the total discount or fee underwriters receive for managing the issuance of securities. The key difference lies in their allocation: underwriting spread encompasses the entire compensation, including syndicate expenses and risk premiums, whereas reallowance is specifically the share passed on to intermediaries. Understanding these distinctions is crucial for accurately analyzing issuer costs and intermediary incentives in equity or debt offerings.

How Reallowance Works in Securities Offerings

Reallowance in securities offerings functions by redistributing a portion of the underwriting spread to brokers or dealers who assist in selling the securities, incentivizing wider distribution and increased market reach. This practice enhances liquidity by encouraging intermediaries to actively market the securities to their client base. The underwriting spread typically includes the reallowance as a component, aligning the interests of underwriters and sub-agents in the successful placement of the offering.

Components of Underwriting Spread

The underwriting spread consists of several components including the manager's fee, underwriting fee, and selling concession, which collectively represent the compensation earned by underwriters for managing, distributing, and assuming risk in a securities offering. Reallowance refers specifically to the portion of the underwriting spread that is shared with other brokerage firms or dealers who assist in selling the issued securities. Understanding these components is crucial for analyzing the cost structure and incentives within an underwriting syndicate in capital markets.

Impact on Investment Banking Revenue

Reallowance reduces investment banking revenue by sharing underwriting fees with broker-dealers, decreasing the net underwriting spread retained by the issuer's bank. The underwriting spread, which is the difference between the price paid by investors and the amount received by the issuer, directly impacts the bank's revenue, as a larger spread translates to higher profits from managing the offering. Optimizing the balance between reallowance and underwriting spread is crucial for maximizing profitability in syndicate-managed securities offerings.

Importance of Reallowance and Underwriting Spread in IPOs

Reallowance and underwriting spread are critical components in IPO pricing, directly impacting the distribution of shares and underwriting compensation. The underwriting spread represents the difference between the IPO price and the price paid to the issuer, compensating underwriters for their risk and services, while reallowance incentivizes brokers to sell shares by offering a portion of the spread. Efficient management of the reallowance and underwriting spread ensures optimal market allocation, enhances underwriting syndicate performance, and influences investor demand in the primary offering.

Regulatory Considerations and Market Practices

Reallowance and underwriting spread involve regulatory frameworks ensuring transparency and fairness in securities offerings, with the SEC closely monitoring compensation structures to prevent conflicts of interest. Market practices dictate that reallowance compensates brokers for selling shares, while underwriting spread covers the underwriters' risk and expenses, requiring clear disclosure under FINRA rules. Both mechanisms adhere to specific regulatory limits and reporting standards to maintain investor protection and market integrity.

Summary: Choosing Between Reallowance and Underwriting Spread

Reallowance and underwriting spread are key components in securities distribution, impacting the costs and incentives for brokers and underwriters. Reallowance refers to the portion of the underwriting spread paid to brokers as a commission for selling the securities, while underwriting spread represents the difference between the price underwriters pay to issuers and the price at which they sell the securities to the public. Selecting between reallowance and underwriting spread depends on factors like market conditions, distribution strategy, and the need to balance underwriting fees with broker incentives to maximize the efficiency and success of the securities offering.

Reallowance Infographic

libterm.com

libterm.com