Acquisition rate measures the speed at which new customers or users are gained over a specific period, reflecting business growth and marketing effectiveness. Understanding and optimizing your acquisition rate helps maximize resource allocation and boost revenue. Discover how improving your acquisition rate can transform your business success by reading the full article.

Table of Comparison

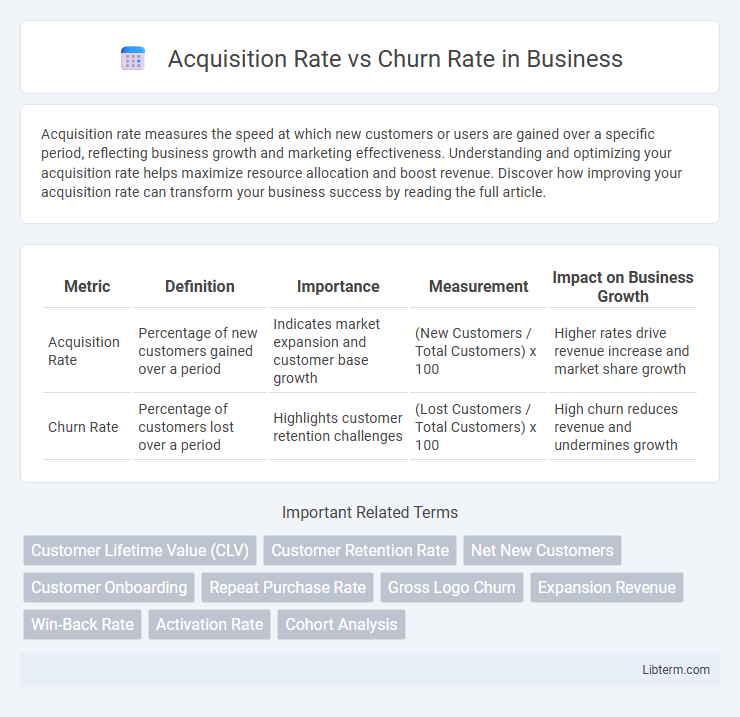

| Metric | Definition | Importance | Measurement | Impact on Business Growth |

|---|---|---|---|---|

| Acquisition Rate | Percentage of new customers gained over a period | Indicates market expansion and customer base growth | (New Customers / Total Customers) x 100 | Higher rates drive revenue increase and market share growth |

| Churn Rate | Percentage of customers lost over a period | Highlights customer retention challenges | (Lost Customers / Total Customers) x 100 | High churn reduces revenue and undermines growth |

Understanding Acquisition Rate

Acquisition Rate measures the percentage of new customers or users gained over a specific period, serving as a key indicator of business growth and marketing effectiveness. Calculating Acquisition Rate involves dividing the number of new customers acquired by the total target audience or market size, then multiplying by 100 to get a percentage. A high Acquisition Rate signifies successful customer attraction strategies, essential for offsetting Churn Rate and achieving sustainable revenue expansion.

Defining Churn Rate

Churn rate measures the percentage of customers who stop using a product or service during a specific time period, serving as a critical indicator of customer retention and satisfaction. This metric highlights the effectiveness of customer engagement strategies and the health of a business's subscription or user base. Lower churn rates correlate with higher customer loyalty, directly impacting revenue growth and long-term profitability.

The Importance of Balancing Acquisition and Churn

Balancing acquisition rate and churn rate is vital for sustainable business growth, as a high acquisition rate paired with an equally high churn rate results in stagnation or decline in net customer base. Optimizing this balance ensures customer lifetime value (CLV) increases, thereby improving overall revenue and profitability. Effective strategies involve not only acquiring new customers but also enhancing retention through improved customer experience and loyalty programs.

Measuring Customer Acquisition Effectively

Measuring customer acquisition effectively requires analyzing the Acquisition Rate in relation to the Churn Rate to ensure sustainable growth. High Acquisition Rates paired with low Churn Rates indicate successful marketing strategies and strong customer retention, optimizing lifetime value and ROI. Tracking these metrics through CRM tools and analytics platforms provides actionable insights for refining customer acquisition campaigns and enhancing long-term profitability.

Calculating and Interpreting Churn Rate

Calculating churn rate involves dividing the number of customers lost during a specific period by the total number of customers at the beginning of that period, then multiplying by 100 to express it as a percentage. Interpreting churn rate provides insights into customer retention, highlighting how effectively a business maintains its customer base relative to the acquisition rate. Low churn rate combined with high acquisition rate typically indicates healthy growth, while high churn rate signals potential issues in customer satisfaction or market competition.

Acquisition Rate vs Churn Rate: Key Differences

Acquisition Rate measures the percentage of new customers gained over a specific period, while Churn Rate represents the percentage of customers lost during the same timeframe. High Acquisition Rates signify successful marketing and sales strategies, whereas high Churn Rates indicate customer dissatisfaction or competitive pressure. Understanding the balance between Acquisition Rate and Churn Rate is crucial for sustainable business growth and long-term profitability.

Impact of Churn Rate on Business Growth

A high churn rate directly hampers business growth by reducing the customer base faster than new acquisitions can replenish it, leading to decreased revenue and increased acquisition costs. Lowering churn enhances customer lifetime value (CLV), stabilizes cash flow, and improves profitability, making sustainable growth achievable. Companies that effectively manage churn can allocate resources more efficiently, fostering long-term competitive advantage and market expansion.

Strategies to Improve Acquisition Rate

Improving acquisition rate relies heavily on targeted marketing campaigns, leveraging data analytics to identify and engage high-potential customer segments. Enhancing user experience through personalized onboarding and clear value propositions increases conversion rates from leads to customers. Investing in referral programs and strategic partnerships further amplifies outreach efforts, driving sustained growth in acquisition metrics.

Reducing Churn Rate: Proven Tactics

Reducing churn rate is essential for maximizing customer lifetime value and ensuring sustainable business growth. Proven tactics include enhancing customer engagement through personalized communication, offering loyalty programs, and proactively addressing customer feedback to solve pain points. Implementing robust onboarding processes and predictive analytics can further identify at-risk customers and reduce churn effectively.

Optimizing for Sustainable Customer Growth

Focusing on optimizing the acquisition rate relative to the churn rate is essential for sustainable customer growth. Businesses should aim to increase customer acquisition through targeted marketing strategies while simultaneously implementing retention initiatives to minimize churn, such as personalized engagement and improved customer support. Monitoring metrics like Customer Lifetime Value (CLV) and Net Promoter Score (NPS) helps balance acquisition and churn efforts, ensuring long-term profitability and growth stability.

Acquisition Rate Infographic

libterm.com

libterm.com