Crowdfunding allows individuals and businesses to raise capital by collecting small contributions from a large number of people, typically via online platforms. This innovative financing method empowers entrepreneurs, artists, and nonprofits to bring their ideas to life without relying on traditional funding sources. Discover how crowdfunding can transform Your projects and what steps to take by reading the rest of this article.

Table of Comparison

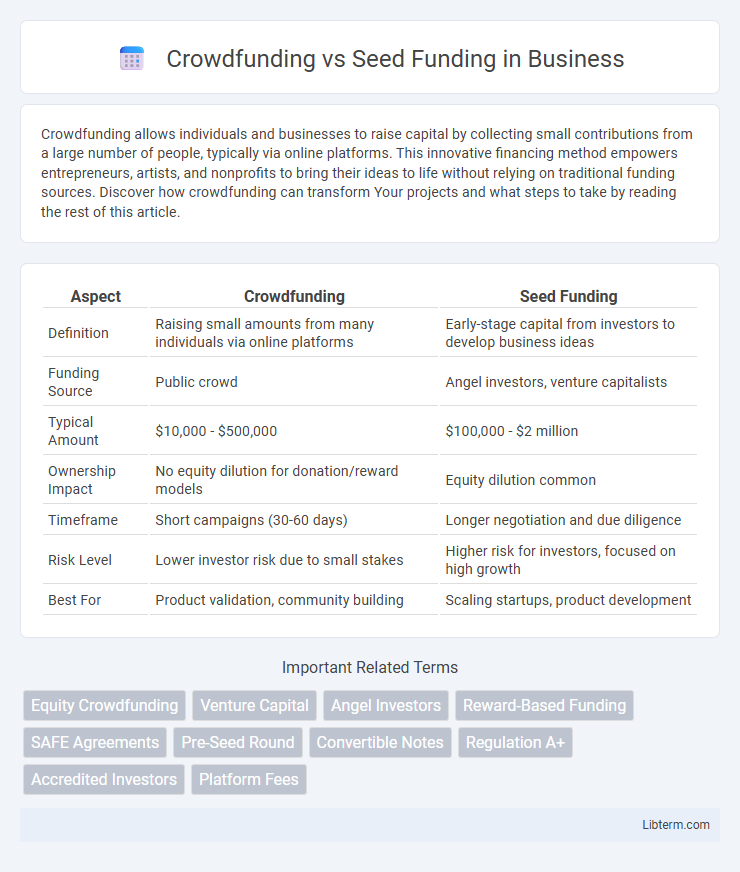

| Aspect | Crowdfunding | Seed Funding |

|---|---|---|

| Definition | Raising small amounts from many individuals via online platforms | Early-stage capital from investors to develop business ideas |

| Funding Source | Public crowd | Angel investors, venture capitalists |

| Typical Amount | $10,000 - $500,000 | $100,000 - $2 million |

| Ownership Impact | No equity dilution for donation/reward models | Equity dilution common |

| Timeframe | Short campaigns (30-60 days) | Longer negotiation and due diligence |

| Risk Level | Lower investor risk due to small stakes | Higher risk for investors, focused on high growth |

| Best For | Product validation, community building | Scaling startups, product development |

Understanding Crowdfunding: An Overview

Crowdfunding involves raising small amounts of capital from a large number of people, typically through online platforms like Kickstarter or Indiegogo, enabling startups or creative projects to gain initial funding without giving away equity. This method diversifies financial risk and validates market demand by engaging a broad audience early on. Seed funding, by contrast, usually comes from angel investors or venture capitalists who provide early-stage capital in exchange for equity and strategic support.

What Is Seed Funding?

Seed funding is an early stage of capital investment provided to startups to develop their product, conduct market research, and build a scalable business model. Typically sourced from angel investors, venture capitalists, or seed funds, seed funding ranges from $10,000 to $2 million depending on the startup's industry and growth potential. Unlike crowdfunding, which raises small amounts from many contributors, seed funding involves larger investments from fewer, more strategic stakeholders aiming for equity ownership.

Key Differences Between Crowdfunding and Seed Funding

Crowdfunding involves raising small amounts of capital from a large number of individuals, often through online platforms, providing businesses with access to a broad base of investors without giving up significant equity. Seed funding typically comes from angel investors or venture capitalists who provide early-stage capital in exchange for equity and strategic support, emphasizing investor expertise and long-term growth potential. The key differences lie in the source of funds, investor involvement, and the scale of capital, with crowdfunding offering democratized access and seed funding delivering more targeted financial and advisory resources.

Pros and Cons of Crowdfunding

Crowdfunding offers entrepreneurs access to a wide pool of potential investors, allowing for market validation and community engagement without relinquishing significant equity. However, it often requires substantial marketing efforts and public disclosure of ideas, increasing the risk of intellectual property theft and campaign failure. Unlike seed funding from venture capitalists or angel investors, crowdfunding may provide less strategic guidance and lower financial commitment per individual backer.

Pros and Cons of Seed Funding

Seed funding provides early-stage startups with essential capital from investors such as angel investors, venture capitalists, or seed funds, accelerating product development and market entry. However, it often requires giving up equity, potentially leading to diluted ownership and increased pressure to meet investor expectations. While it offers substantial financial resources and mentorship, seed funding involves rigorous due diligence and may limit founder control compared to crowdfunding, which relies on smaller contributions from a broader audience without equity loss.

Investor Expectations in Crowdfunding vs Seed Funding

Investor expectations in crowdfunding typically focus on community engagement, product validation, and early access, often with non-financial rewards or equity stakes in exchange for smaller investments. Seed funding investors expect detailed business plans, milestones, and a clear path to ROI, emphasizing growth potential and strategic involvement in company development. Crowdfunding appeals to a broader audience seeking innovation and involvement, whereas seed funding targets experienced investors prioritizing financial returns and scalable business models.

Suitable Business Models for Each Funding Type

Crowdfunding suits product-based startups, creative projects, and early-stage ideas that benefit from public engagement and market validation. Seed funding is ideal for scalable tech ventures, SaaS companies, and businesses requiring significant initial capital and strategic mentorship from investors. Choosing the right funding depends on business goals, target audience, and growth potential, ensuring alignment with each model's risk tolerance and capital access.

Application and Approval Processes Compared

Crowdfunding platforms enable startups to raise capital directly from a large pool of individual investors by presenting a project or product online, with approval typically centered around meeting platform guidelines and compliance with securities regulations. Seed funding involves securing investment from angel investors or venture capitalists who perform rigorous due diligence, assessing business plans, market potential, and founder expertise before approval. The application process for crowdfunding is generally faster and less formal, while seed funding demands comprehensive financial projections and strategic alignment for successful approval.

Equity Dilution: Crowdfunding Versus Seed Funding

Crowdfunding typically involves raising capital from a large number of small investors, often resulting in minimal equity dilution for founders since contributions are usually in exchange for rewards or pre-sales rather than ownership. Seed funding, however, often requires giving up a significant portion of equity to a smaller group of investors or venture capitalists, leading to more noticeable ownership dilution. Founders must balance the potential for rapid capital influx in seed funding against the benefits of crowdfunding's lower equity dilution but possibly slower growth.

Choosing the Right Funding Option for Your Startup

Selecting between crowdfunding and seed funding depends on your startup's goals, target audience, and growth stage. Crowdfunding leverages public interest and marketing potential, ideal for consumer-facing products needing market validation, while seed funding offers larger capital from investors with strategic support and mentorship critical for tech startups requiring rapid scaling. Assess your product's market readiness, funding amount needed, and the value of investor guidance to choose the most effective financing path.

Crowdfunding Infographic

libterm.com

libterm.com