Asset-owning companies hold significant value by maintaining control over key resources that drive long-term profitability and competitive advantage. Leveraging their assets efficiently can enhance operational performance and sustain market leadership. Discover how optimizing your asset ownership can transform your business by reading the full article.

Table of Comparison

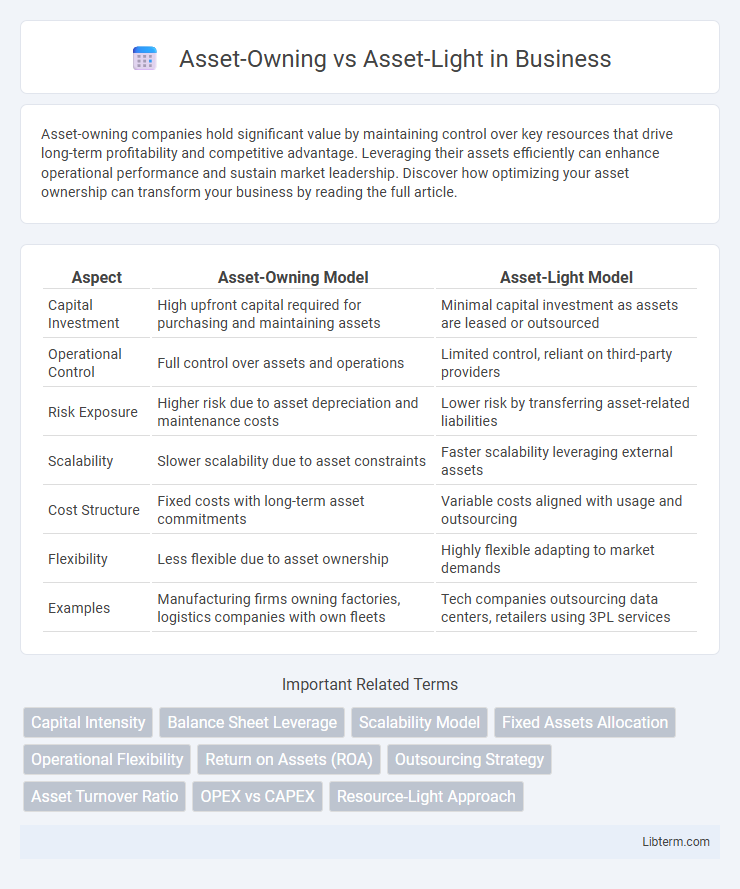

| Aspect | Asset-Owning Model | Asset-Light Model |

|---|---|---|

| Capital Investment | High upfront capital required for purchasing and maintaining assets | Minimal capital investment as assets are leased or outsourced |

| Operational Control | Full control over assets and operations | Limited control, reliant on third-party providers |

| Risk Exposure | Higher risk due to asset depreciation and maintenance costs | Lower risk by transferring asset-related liabilities |

| Scalability | Slower scalability due to asset constraints | Faster scalability leveraging external assets |

| Cost Structure | Fixed costs with long-term asset commitments | Variable costs aligned with usage and outsourcing |

| Flexibility | Less flexible due to asset ownership | Highly flexible adapting to market demands |

| Examples | Manufacturing firms owning factories, logistics companies with own fleets | Tech companies outsourcing data centers, retailers using 3PL services |

Introduction to Asset-Owning and Asset-Light Models

The asset-owning model involves companies maintaining significant physical assets such as manufacturing plants, machinery, and real estate, providing direct control over production and operations. In contrast, the asset-light model focuses on leveraging third-party assets through outsourcing, franchising, or partnerships to minimize capital investment and improve operational flexibility. This approach allows businesses to scale rapidly and reduce fixed costs while maintaining strategic oversight of core functions.

Defining Asset-Owning Businesses

Asset-owning businesses maintain significant physical assets such as real estate, manufacturing plants, or equipment, which provide them long-term operational control and collateral value. These companies benefit from tangible assets that enhance stability, support debt financing, and generate consistent revenue streams. Ownership of assets influences valuation, risk management, and strategic decision-making within industries like manufacturing, logistics, and real estate.

Understanding Asset-Light Business Strategies

Asset-light business strategies emphasize minimizing ownership of physical assets to reduce capital expenditure and increase operational flexibility. Companies adopting asset-light models often outsource manufacturing, rely on partnerships, or leverage technology platforms, enabling rapid scalability and lower risk exposure. Key industries utilizing this approach include technology, hospitality, and transportation, where intangible assets and service delivery become primary competitive advantages.

Key Differences Between Asset-Owning and Asset-Light Approaches

Asset-owning business models maintain significant physical assets such as factories, machinery, or real estate, enabling direct control over production and operations, which often results in higher capital expenditures and fixed costs. Asset-light approaches leverage outsourcing, partnerships, or digital platforms to minimize investment in physical assets, emphasizing flexibility, scalability, and lower operational risks. The key differences lie in capital intensity, control over the value chain, and the ability to quickly adapt to market changes, with asset-light models prioritizing agility and asset-owning models focusing on asset control and long-term stability.

Advantages of Asset-Owning Models

Asset-owning models provide greater control over quality, supply chains, and operational efficiency by allowing companies to directly manage and maintain physical assets such as manufacturing plants, warehouses, or transportation fleets. This approach enhances long-term cost savings through asset depreciation and reduces dependency on third-party providers, leading to improved reliability and strategic flexibility. Furthermore, asset ownership facilitates better innovation opportunities by enabling customized investments aligned with specific business goals.

Benefits of Adopting an Asset-Light Strategy

An asset-light strategy reduces capital expenditure and operational risks by minimizing investments in physical assets and focusing on core competencies such as innovation and customer service. Companies adopting this model benefit from increased agility, enabling faster adaptation to market changes and scalability through outsourcing or partnerships. This approach also enhances financial flexibility and improves return on invested capital (ROIC) by lowering fixed costs and boosting asset turnover ratios.

Risks and Challenges: Asset-Owning vs Asset-Light

Asset-owning business models face significant risks including high capital expenditure, asset depreciation, and limited flexibility to adapt to market changes, which can lead to liquidity constraints during downturns. In contrast, asset-light models mitigate these risks by leveraging outsourcing and partnerships but encounter challenges such as dependency on third-party reliability, less control over quality, and potential vulnerability to supply chain disruptions. Both approaches require strategic risk management tailored to their structural vulnerabilities to maintain operational resilience and competitive advantage.

Industry Examples Illustrating Both Models

The asset-owning model is exemplified by companies like ExxonMobil and Maersk, which invest heavily in physical infrastructure such as refineries and shipping fleets to maintain control over production and distribution. In contrast, asset-light companies like Airbnb and Uber leverage digital platforms to connect users with services, minimizing capital expenditure on physical assets while maximizing scalability. These industry examples highlight how asset ownership impacts business strategies, operational flexibility, and capital intensity in sectors such as energy, transportation, and hospitality.

Choosing the Right Model for Business Growth

Selecting the appropriate business model between asset-owning and asset-light strategies directly impacts scalability and capital efficiency. Asset-owning models provide greater control and potential for long-term value appreciation but require significant upfront investment and higher operational costs. Conversely, asset-light approaches enable faster market entry, reduced fixed costs, and flexibility by leveraging third-party resources, making them ideal for rapid growth and innovation-driven industries.

Future Trends in Asset-Owning and Asset-Light Strategies

Future trends in asset-owning strategies emphasize increased integration of digital technologies, such as IoT and AI, to enhance asset utilization and predictive maintenance, driving operational efficiency and cost savings. Asset-light strategies are evolving towards greater reliance on strategic partnerships and platform-based ecosystems, enabling rapid scalability and flexibility in response to market fluctuations. Both models are increasingly adopting sustainability-focused innovations, reflecting growing regulatory pressures and stakeholder demand for environmental responsibility.

Asset-Owning Infographic

libterm.com

libterm.com