Zero-coupon bonds are debt securities that do not pay interest periodically but are issued at a discount to their face value, providing returns through capital appreciation at maturity. Investors benefit from the assured lump-sum payment without reinvestment risk, making them suitable for long-term financial goals. Explore the rest of this article to understand how zero-coupon bonds can fit into your investment portfolio.

Table of Comparison

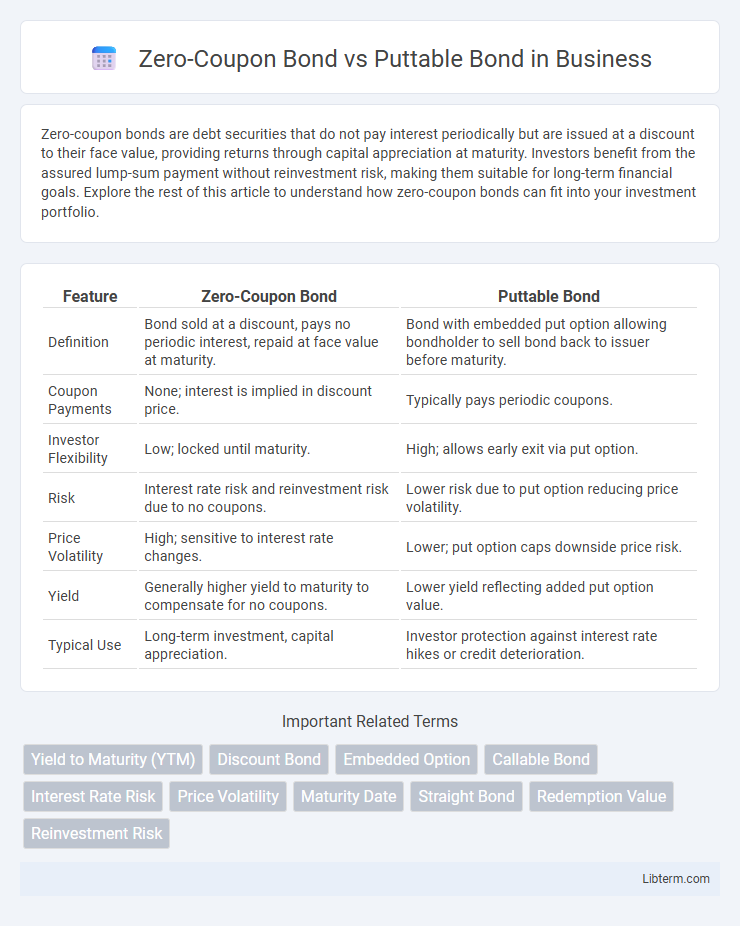

| Feature | Zero-Coupon Bond | Puttable Bond |

|---|---|---|

| Definition | Bond sold at a discount, pays no periodic interest, repaid at face value at maturity. | Bond with embedded put option allowing bondholder to sell bond back to issuer before maturity. |

| Coupon Payments | None; interest is implied in discount price. | Typically pays periodic coupons. |

| Investor Flexibility | Low; locked until maturity. | High; allows early exit via put option. |

| Risk | Interest rate risk and reinvestment risk due to no coupons. | Lower risk due to put option reducing price volatility. |

| Price Volatility | High; sensitive to interest rate changes. | Lower; put option caps downside price risk. |

| Yield | Generally higher yield to maturity to compensate for no coupons. | Lower yield reflecting added put option value. |

| Typical Use | Long-term investment, capital appreciation. | Investor protection against interest rate hikes or credit deterioration. |

Introduction to Zero-Coupon and Puttable Bonds

Zero-coupon bonds are debt securities that do not pay periodic interest but are issued at a significant discount to their face value, maturing at par. Puttable bonds give holders the right to sell the bond back to the issuer at a predetermined price before maturity, providing downside protection. Both bond types cater to different investor needs: zero-coupon bonds appeal to those seeking long-term capital appreciation without periodic income, while puttable bonds attract investors valuing flexibility and reduced interest rate risk.

Key Characteristics of Zero-Coupon Bonds

Zero-coupon bonds are debt securities issued at a significant discount to their face value and do not pay periodic interest, instead providing returns through appreciation at maturity. They have a fixed maturity date and promise a single payment at face value, making them highly sensitive to interest rate changes due to their long duration. Unlike puttable bonds, zero-coupon bonds lack embedded options, meaning investors cannot redeem them early, resulting in higher interest rate risk and predictable cash flow.

Main Features of Puttable Bonds

Puttable bonds grant the bondholder the right to sell the bond back to the issuer at a predetermined price before maturity, providing protection against interest rate increases and credit deterioration. These bonds typically offer lower yields compared to non-puttable bonds due to this embedded option, making them attractive to risk-averse investors. Unlike zero-coupon bonds, which pay no periodic interest and are issued at a discount, puttable bonds provide periodic coupon payments alongside the put option feature.

How Zero-Coupon Bonds Work

Zero-coupon bonds are debt securities that do not pay periodic interest and are issued at a deep discount to their face value, maturing at par value upon maturity. Investors benefit from the bond's accrual of interest through the difference between the purchase price and the redemption amount, providing a predictable lump sum payment at maturity. Unlike puttable bonds, which grant the holder the right to sell the bond back to the issuer before maturity, zero-coupon bonds have no embedded options, making their cash flows fixed and solely dependent on the maturity date.

How Puttable Bonds Operate

Puttable bonds grant investors the right to sell the bond back to the issuer at a predetermined price before maturity, providing a safety net against interest rate declines or issuer credit deterioration. This embedded put option enhances bondholder flexibility and typically results in a lower yield compared to non-puttable bonds. The operational mechanism of puttable bonds involves periodic opportunities for investors to exercise the put option, allowing them to manage interest rate risk more effectively than zero-coupon bonds, which lack such a feature.

Risk and Return Comparison

Zero-coupon bonds offer fixed returns by paying no periodic interest, making them highly sensitive to interest rate risk but free from reinvestment risk, while puttable bonds provide investors the right to sell the bond back to the issuer before maturity, reducing credit and interest rate risk due to the embedded put option. The return on zero-coupon bonds is realized at maturity through the difference between the purchase price and face value, often resulting in higher price volatility compared to puttable bonds, which typically yield lower but more stable returns due to the added investor protection. Risk-averse investors may prefer puttable bonds for downside protection, whereas those seeking higher potential returns and willing to accept greater price fluctuations might choose zero-coupon bonds.

Investor Suitability: Zero-Coupon vs Puttable Bonds

Zero-coupon bonds suit investors seeking fixed returns with no periodic interest payments, often appealing to those targeting long-term goals like retirement due to their predictable maturity value. Puttable bonds attract risk-averse investors who value flexibility, allowing them to sell the bond back to the issuer before maturity if interest rates rise or credit quality declines. The choice depends on investment horizon, risk tolerance, and the desire for income versus capital preservation options.

Market Scenarios Favoring Each Bond Type

Zero-coupon bonds tend to be favored in stable or declining interest rate environments, offering investors a predictable return through discount appreciation without interim coupon payments. Puttable bonds gain appeal in volatile or rising interest rate markets, as the embedded put option allows holders to sell the bond back to the issuer before maturity, minimizing downside risk. Market conditions with uncertainty or credit concerns also enhance the value of puttable bonds by providing investors an exit strategy and increased liquidity.

Tax Implications and Considerations

Zero-coupon bonds often generate imputed interest income annually, which is taxable even though no cash is received until maturity, potentially increasing tax liability for investors in high tax brackets. Puttable bonds allow investors to sell the bond back to the issuer before maturity, potentially mitigating capital gains tax if interest rates rise and the bond's market value declines. Understanding these tax implications is crucial, as zero-coupon bonds may lead to phantom income tax burdens while puttable bonds provide more flexibility in managing tax timing and capital gains exposure.

Choosing Between Zero-Coupon and Puttable Bonds

Zero-coupon bonds offer fixed returns without periodic interest, making them ideal for investors seeking predictable long-term growth and capital appreciation. Puttable bonds provide added flexibility by allowing investors to sell the bond back to the issuer before maturity, reducing interest rate risk and enhancing liquidity. Choosing between zero-coupon and puttable bonds depends on the investor's risk tolerance, cash flow needs, and market outlook.

Zero-Coupon Bond Infographic

libterm.com

libterm.com