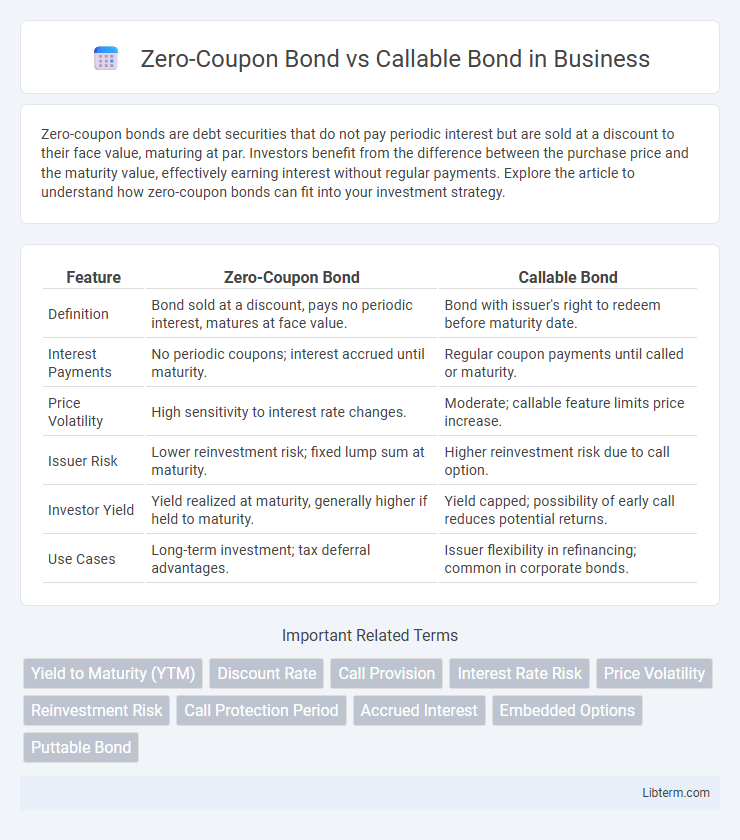

Zero-coupon bonds are debt securities that do not pay periodic interest but are sold at a discount to their face value, maturing at par. Investors benefit from the difference between the purchase price and the maturity value, effectively earning interest without regular payments. Explore the article to understand how zero-coupon bonds can fit into your investment strategy.

Table of Comparison

| Feature | Zero-Coupon Bond | Callable Bond |

|---|---|---|

| Definition | Bond sold at a discount, pays no periodic interest, matures at face value. | Bond with issuer's right to redeem before maturity date. |

| Interest Payments | No periodic coupons; interest accrued until maturity. | Regular coupon payments until called or maturity. |

| Price Volatility | High sensitivity to interest rate changes. | Moderate; callable feature limits price increase. |

| Issuer Risk | Lower reinvestment risk; fixed lump sum at maturity. | Higher reinvestment risk due to call option. |

| Investor Yield | Yield realized at maturity, generally higher if held to maturity. | Yield capped; possibility of early call reduces potential returns. |

| Use Cases | Long-term investment; tax deferral advantages. | Issuer flexibility in refinancing; common in corporate bonds. |

Introduction to Zero-Coupon and Callable Bonds

Zero-coupon bonds are debt securities issued at a discount without periodic interest payments, maturing at face value to deliver the investor's return. Callable bonds grant issuers the option to redeem the bond before maturity, typically at a premium, allowing them to refinance debt if interest rates decline. Understanding the structural differences between zero-coupon and callable bonds is essential for evaluating cash flow timing, risk profiles, and yield implications in fixed income portfolios.

Key Features of Zero-Coupon Bonds

Zero-coupon bonds are debt securities issued at a significant discount to their face value and do not pay periodic interest, with investors receiving the full face value at maturity. These bonds have a fixed maturity date and their return is derived entirely from the appreciation between the purchase price and the par value at redemption. Unlike callable bonds, zero-coupon bonds cannot be redeemed by the issuer before maturity, eliminating reinvestment risk for investors.

Key Features of Callable Bonds

Callable bonds grant the issuer the right to redeem the bond before its maturity date, typically at a predetermined call price, providing flexibility to manage interest rate risks. These bonds usually offer higher yields to compensate investors for the call risk, which can limit potential price appreciation. Key features include call protection periods, call schedules, and embedded call options that impact the bond's risk and return profile.

Interest and Payment Structures

Zero-coupon bonds do not pay periodic interest, as they are issued at a discount and mature at face value, providing returns through capital appreciation. Callable bonds offer fixed periodic interest payments but grant the issuer the right to redeem the bond before maturity, potentially limiting the bondholder's interest income if called early. The interest payment structure of zero-coupon bonds appeals to investors seeking lump-sum future value, while callable bonds attract those desiring steady income with callable risk.

Risk Profiles: Default and Interest Rate Risks

Zero-coupon bonds carry higher interest rate risk due to their long duration and lack of periodic coupon payments, making their prices more sensitive to rate changes compared to callable bonds. Callable bonds present increased default risk if the issuer exercises the call option during declining interest rates, typically when refinancing at lower rates, potentially limiting upside for investors. Both bond types expose investors to credit risk, but callable bonds have added reinvestment risk from the call feature, affecting overall risk profiles.

Price Volatility in Different Market Conditions

Zero-coupon bonds exhibit higher price volatility compared to callable bonds due to their long duration and absence of periodic interest payments, making them highly sensitive to interest rate changes in fluctuating markets. Callable bonds tend to have lower price volatility because the issuer's right to redeem the bond early limits price appreciation when interest rates decline, capping potential gains for investors. In rising interest rate environments, zero-coupon bonds experience sharper price declines, whereas callable bonds' prices decrease more moderately as the call option typically remains unexercised.

Yield Comparison: Zero-Coupon vs Callable Bonds

Zero-coupon bonds typically offer higher yields than callable bonds due to the absence of periodic interest payments, compensating investors for the longer duration risk and reinvestment uncertainty. Callable bonds often feature lower yields because issuers hold the right to redeem the bond before maturity, limiting upside potential for investors and embedding call risk. Yield comparison must consider factors like interest rate volatility, call premium, and the bond's time to maturity to accurately assess expected returns.

Suitability for Different Investor Types

Zero-coupon bonds suit investors seeking predictable, long-term growth without periodic interest income, ideal for those with long investment horizons or targeting future financial goals like education or retirement. Callable bonds appeal to income-focused investors willing to accept reinvestment risk due to the issuer's right to redeem early, often attracting those prioritizing higher yields but comfortable with potential call risk. Understanding investor risk tolerance and cash flow needs is critical when choosing between zero-coupon and callable bonds.

Tax Implications and Considerations

Zero-coupon bonds generate imputed interest income annually, which is taxable despite no cash payments until maturity, potentially increasing tax liability each year. Callable bonds may result in unpredictable tax events due to the issuer's option to redeem before maturity, causing capital gains or losses when bonds are called. Investors should consider the timing of taxable events and consult tax professionals to optimize strategies around interest accrual and call risk impacts.

Making the Right Choice: Factors to Consider

Assessing the right choice between zero-coupon bonds and callable bonds requires analyzing risk tolerance, investment horizon, and income needs. Zero-coupon bonds offer predictable returns with no periodic interest payments, ideal for long-term goals, while callable bonds provide higher yields but carry the risk of early redemption by the issuer, impacting potential income. Investors should evaluate market interest rate trends, credit quality, and liquidity preferences to align bond selection with their financial objectives.

Zero-Coupon Bond Infographic

libterm.com

libterm.com