A reverse merger allows a private company to become publicly traded by acquiring an existing public company, bypassing the traditional initial public offering process. This strategy offers faster access to capital markets and can reduce regulatory scrutiny and costs. Explore the rest of the article to understand how a reverse merger might benefit your business growth.

Table of Comparison

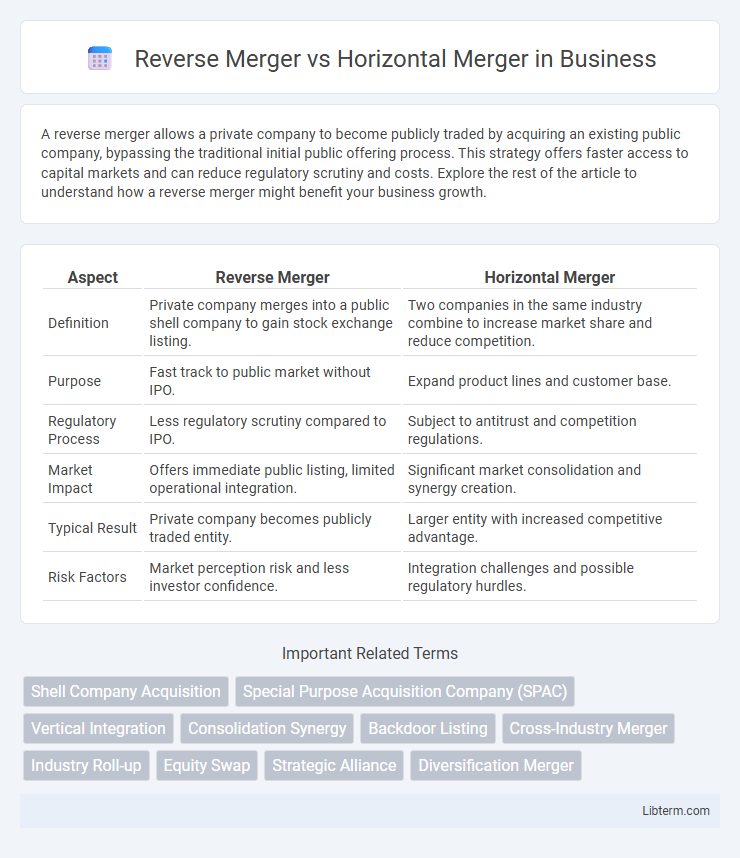

| Aspect | Reverse Merger | Horizontal Merger |

|---|---|---|

| Definition | Private company merges into a public shell company to gain stock exchange listing. | Two companies in the same industry combine to increase market share and reduce competition. |

| Purpose | Fast track to public market without IPO. | Expand product lines and customer base. |

| Regulatory Process | Less regulatory scrutiny compared to IPO. | Subject to antitrust and competition regulations. |

| Market Impact | Offers immediate public listing, limited operational integration. | Significant market consolidation and synergy creation. |

| Typical Result | Private company becomes publicly traded entity. | Larger entity with increased competitive advantage. |

| Risk Factors | Market perception risk and less investor confidence. | Integration challenges and possible regulatory hurdles. |

Introduction to Reverse Merger and Horizontal Merger

Reverse mergers enable private companies to become publicly traded by acquiring existing public shell companies, offering a faster and often less costly alternative to traditional IPOs. Horizontal mergers involve the consolidation of two companies operating within the same industry to enhance market share, reduce competition, and realize economies of scale. Both strategies serve distinct corporate growth objectives, with reverse mergers focusing on market entry and horizontal mergers targeting industry expansion.

Key Definitions: Reverse Merger vs Horizontal Merger

A reverse merger is a corporate strategy where a private company acquires a publicly listed company to bypass the traditional initial public offering (IPO) process, enabling faster public market entry. A horizontal merger occurs between companies operating in the same industry and at the same stage of production, aiming to increase market share, reduce competition, and achieve economies of scale. The primary difference lies in their objectives: reverse mergers focus on going public, while horizontal mergers emphasize market consolidation.

Structural Differences Between Reverse and Horizontal Mergers

Reverse mergers involve a private company acquiring a public shell company to bypass the lengthy IPO process, resulting in a structural shift where the private company gains public status without creating a new entity. Horizontal mergers occur between companies within the same industry or market segment, combining operations to increase market share and achieve economies of scale, structurally integrating similar business functions and assets. The key structural difference lies in the purpose and execution: reverse mergers restructure ownership by changing a private company into a public one, while horizontal mergers consolidate entities with overlapping operations to enhance competitive positioning.

Objectives and Strategic Motivations

Reverse mergers enable private companies to go public quickly by acquiring a publicly traded shell company, primarily aiming to access capital markets without an initial public offering (IPO). Horizontal mergers involve the consolidation of companies within the same industry to enhance market share, achieve economies of scale, and reduce competition. The strategic motivation behind reverse mergers centers on rapid market entry and liquidity, while horizontal mergers focus on operational synergies and competitive advantage.

Legal and Regulatory Framework

Reverse mergers undergo a rigorous legal and regulatory framework involving SEC filings, meticulous disclosure requirements, and adherence to public company compliance standards to ensure transparency and investor protection. Horizontal mergers face extensive antitrust scrutiny under laws such as the Clayton Act and Hart-Scott-Rodino Act to prevent monopolistic practices and maintain market competition. Both merger types require approval from regulatory bodies such as the Federal Trade Commission (FTC) and the Securities and Exchange Commission (SEC), with horizontal mergers often subject to a more intense competitive impact review.

Financial Implications and Valuation Issues

Reverse mergers often provide faster access to public capital markets with lower upfront costs but can carry hidden liabilities and valuation uncertainties due to less rigorous initial scrutiny. Horizontal mergers tend to create synergies that enhance market share and revenue, potentially boosting firm valuation, yet they may face antitrust scrutiny and integration challenges that impact financial performance. Valuation issues in reverse mergers stem from limited market data and potential information asymmetry, while horizontal mergers require detailed due diligence to accurately assess combined asset values and future cash flow projections.

Pros and Cons of Reverse Mergers

Reverse mergers offer a faster and less expensive pathway for private companies to become publicly traded without the complexities of an initial public offering, enabling quicker access to capital markets. However, they carry risks such as potential undisclosed liabilities from the shell company and lower liquidity compared to traditional IPOs, which may impact investor confidence. The process also often results in less market visibility and regulatory scrutiny, potentially leading to challenges in maintaining long-term stock performance.

Pros and Cons of Horizontal Mergers

Horizontal mergers combine companies within the same industry, enhancing market share and operational efficiencies through economies of scale. Pros include increased market power, cost reductions, and expanded customer bases, which can lead to higher profitability and competitive advantage. Cons involve potential antitrust issues, cultural clashes, and integration challenges that may disrupt operations and reduce value if not managed effectively.

Case Studies: Reverse Merger vs Horizontal Merger

Case studies on reverse mergers, such as the 2013 Nikola Corporation transaction, highlight rapid public listing advantages without traditional IPO costs, contrasting with horizontal mergers like the 2018 Disney-Fox deal that emphasize market share expansion and operational synergies. Reverse mergers frequently serve smaller or emerging firms seeking quick access to capital markets, whereas horizontal mergers often involve industry giants aiming to consolidate market dominance and reduce competition. These examples demonstrate reverse mergers' speed and cost efficiency versus horizontal mergers' strategic growth and competitive positioning benefits.

Choosing the Right Merger Strategy

Selecting the right merger strategy depends on a company's goals and market conditions. A reverse merger allows a private company to become public quickly without the extensive paperwork required by an initial public offering, ideal for fast access to capital markets. In contrast, a horizontal merger involves combining two companies in the same industry to achieve economies of scale, reduce competition, and increase market share, making it suitable for growth and competitive advantage.

Reverse Merger Infographic

libterm.com

libterm.com