A friendly buyer streamlines the transaction process by fostering clear communication and mutual respect between parties. This approach reduces misunderstandings and accelerates deal closure, benefiting both buyers and sellers. Explore the rest of the article to discover how adopting a friendly buying strategy can enhance Your purchasing success.

Table of Comparison

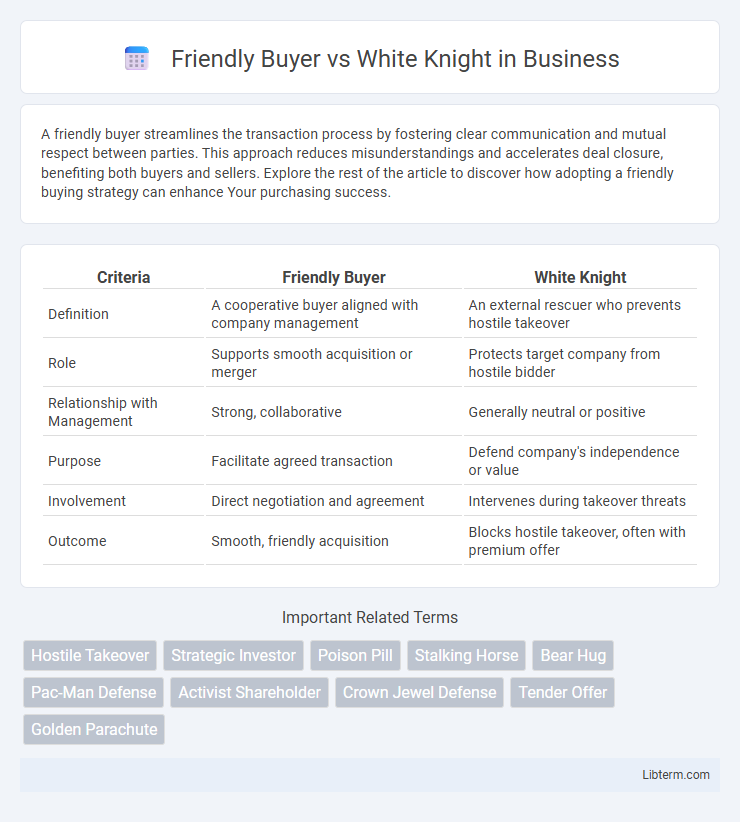

| Criteria | Friendly Buyer | White Knight |

|---|---|---|

| Definition | A cooperative buyer aligned with company management | An external rescuer who prevents hostile takeover |

| Role | Supports smooth acquisition or merger | Protects target company from hostile bidder |

| Relationship with Management | Strong, collaborative | Generally neutral or positive |

| Purpose | Facilitate agreed transaction | Defend company's independence or value |

| Involvement | Direct negotiation and agreement | Intervenes during takeover threats |

| Outcome | Smooth, friendly acquisition | Blocks hostile takeover, often with premium offer |

Understanding the Concepts: Friendly Buyer and White Knight

A Friendly Buyer is a company or individual that a target firm willingly accepts during an acquisition due to aligned interests and cooperative negotiation. A White Knight is a specific type of Friendly Buyer who rescues the target company from a hostile takeover by offering a more favorable acquisition proposal. Both concepts involve strategic partnerships aimed at preserving the target company's value and management control.

Key Differences Between Friendly Buyers and White Knights

Friendly buyers are willing purchasers who negotiate mutually beneficial terms, often aiming to preserve the target company's culture and existing management. White knights step in as rescuers during hostile takeover attempts, offering a preferable acquisition option to prevent the target from falling into hostile hands. While friendly buyers prioritize collaboration and strategic alignment, white knights focus on defense and protection against adversarial takeover threats.

The Role of a Friendly Buyer in Mergers and Acquisitions

A friendly buyer plays a pivotal role in mergers and acquisitions by providing a cooperative and mutually beneficial transaction environment, which helps ensure a smoother integration process and reduces the risk of hostile takeovers. These buyers often have aligned strategic goals and a willingness to maintain current management and operational structures, fostering stability for the target company. Their presence can enhance deal value and expedite regulatory approvals, contributing to better overall outcomes for stakeholders.

White Knight: Definition and Strategic Importance

A White Knight is a friendly investor or company that acquires a target firm facing a hostile takeover, providing a more acceptable alternative to the hostile bidder. This strategic intervention helps preserve the target company's existing management, corporate culture, and long-term business plans, often safeguarding shareholder value and employee interests. White Knights play a crucial role in merger and acquisition (M&A) scenarios by preventing hostile takeovers and maintaining favorable terms for the target firm.

Motivations Behind Friendly Buyers and White Knights

Friendly buyers seek to acquire companies with aligned strategic goals, aiming to preserve the target's culture and ensure a smooth integration process. White knights are motivated by the desire to prevent hostile takeovers, offering a lifeline to target companies facing aggressive bids from unfriendly acquirers. Both prioritize long-term value creation but differ in their primary incentives: friendly buyers emphasize cooperation and synergy, while white knights focus on defense and protection.

Impact on Shareholders: Friendly Buyer vs White Knight

A Friendly Buyer typically negotiates directly with the target company's management, resulting in smoother transactions and often premium offers that benefit shareholders through immediate value realization. White Knights intervene during hostile takeovers, offering an alternative bidder aligned with management, which can preserve shareholder value by preventing undervalued buyouts or hostile control. Shareholders generally experience more stable outcomes with Friendly Buyers, while White Knights can safeguard against hostile acquisitions but may involve prolonged uncertainty and complex negotiations.

Case Studies: Examples of Friendly Buyers and White Knights

Friendly buyers like Google's acquisition of YouTube demonstrate strategic, amicable takeovers that benefit both parties through collaboration and shared growth objectives. White knights, exemplified by PepsiCo's intervention to save Quaker Oats from a hostile takeover by Philip Morris, act as protective investors who defend target companies from aggressive bidders. Case studies reveal friendly buyers prioritize synergy and long-term value, while white knights focus on preserving company independence and preventing hostile control.

Risks and Benefits of Engaging a Friendly Buyer

Engaging a friendly buyer offers the benefit of a smoother transaction due to shared interests and cooperative negotiation, often resulting in favorable deal terms and enhanced confidentiality. However, risks include potential conflicts of interest, limited competitive bidding that can undervalue the asset, and dependency on the buyer's financial stability and strategic alignment. Proper due diligence and clear contractual safeguards are essential to mitigate risks and maximize the advantages of a friendly buyer engagement.

When to Choose a White Knight Over a Friendly Buyer

A White Knight is preferable when a company faces a hostile takeover and requires a strategic ally to preserve its independence and provide favorable terms compared to an unfriendly acquirer. In scenarios where a Friendly Buyer may not offer sufficient financial stability or industry expertise, a White Knight can ensure better long-term growth and protect stakeholder value. Choosing a White Knight often involves prioritizing company culture alignment, management continuity, and safeguarding existing jobs over simply maximizing short-term financial gains.

Industry Trends: The Future of Friendly Buyers and White Knights

Industry trends indicate a growing preference for friendly buyers who prioritize collaborative mergers and acquisitions, offering a smoother integration process and preserving company culture. White knights remain crucial in hostile takeover defenses, especially in sectors like technology and pharmaceuticals where intellectual property is vital. Future market dynamics suggest increased reliance on strategic alliances and friendly acquisitions, with white knights playing a strategic role in safeguarding shareholder interests during hostile bids.

Friendly Buyer Infographic

libterm.com

libterm.com