A swap contract is a financial derivative where two parties exchange cash flows or liabilities based on underlying assets, interest rates, or currencies. It allows you to manage risk, hedge exposure, or speculate on market movements without owning the underlying asset. Explore the full article to understand how swap contracts can benefit your investment strategy.

Table of Comparison

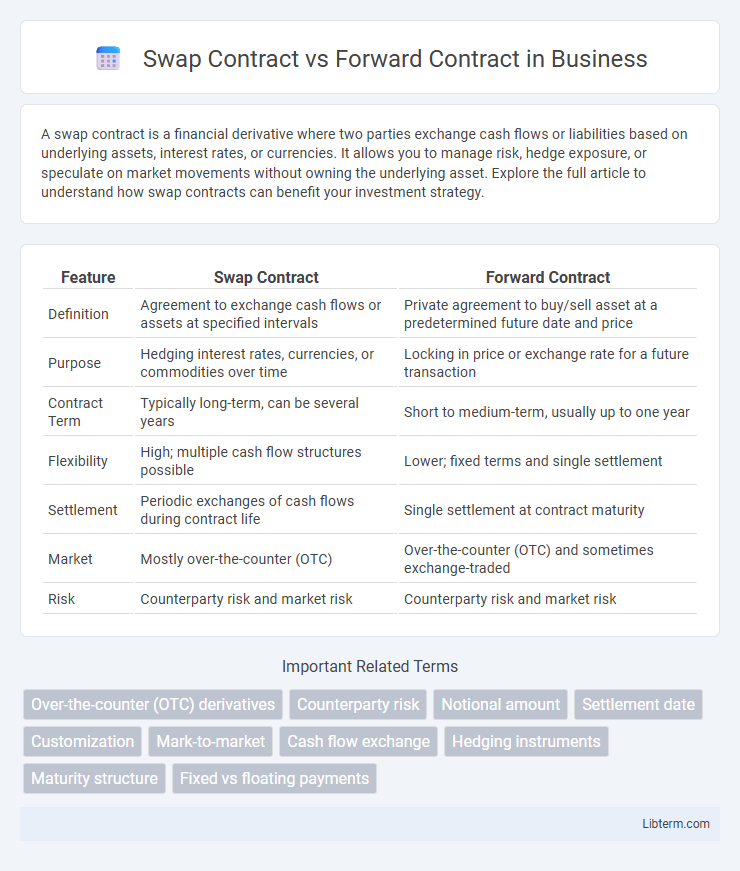

| Feature | Swap Contract | Forward Contract |

|---|---|---|

| Definition | Agreement to exchange cash flows or assets at specified intervals | Private agreement to buy/sell asset at a predetermined future date and price |

| Purpose | Hedging interest rates, currencies, or commodities over time | Locking in price or exchange rate for a future transaction |

| Contract Term | Typically long-term, can be several years | Short to medium-term, usually up to one year |

| Flexibility | High; multiple cash flow structures possible | Lower; fixed terms and single settlement |

| Settlement | Periodic exchanges of cash flows during contract life | Single settlement at contract maturity |

| Market | Mostly over-the-counter (OTC) | Over-the-counter (OTC) and sometimes exchange-traded |

| Risk | Counterparty risk and market risk | Counterparty risk and market risk |

Introduction to Swap and Forward Contracts

Swap contracts involve exchanging cash flows or assets between parties based on predefined terms, allowing customization to manage interest rate, currency, or commodity risk. Forward contracts represent agreements to buy or sell an asset at a specified price on a future date, commonly used for hedging against price fluctuations in currencies, commodities, or financial instruments. Both instruments are crucial in risk management strategies, with swaps offering ongoing settlement advantages and forwards providing fixed-price certainty.

Key Definitions: Swap Contract vs Forward Contract

A Swap Contract is a derivative agreement between two parties to exchange cash flows or financial instruments at specified intervals, often used to manage interest rate or currency risk. A Forward Contract is a customized agreement between two parties to buy or sell an asset at a predetermined price on a future date, primarily used for hedging price risk on commodities or currencies. Both contracts serve as tools for risk management but differ in structure, flexibility, and typical usage scenarios in financial markets.

Structural Differences Between Swaps and Forwards

Swaps involve exchange of cash flows based on notional principal amounts over a set period, typically featuring multiple payment dates, whereas forward contracts are agreements to buy or sell an asset at a predetermined price on a single future date. Structurally, swaps are composed of a series of linked forward contracts or payment exchanges, creating a continuous or segmented obligation, while forwards represent a one-time, binding contract with settlement at maturity. This structural distinction results in swaps offering greater flexibility for hedging ongoing exposures compared to the fixed, singular nature of forward agreements.

Transaction Mechanism: How Each Contract Works

A swap contract involves exchanging cash flows or financial instruments between parties over a set period, typically based on interest rates or currencies, with periodic settlements according to agreed terms. In contrast, a forward contract establishes an agreement to buy or sell an asset at a predetermined price on a specified future date, with a single settlement occurring at maturity. Swaps function as ongoing exchanges reflecting market conditions, while forwards fix terms upfront to manage future price risks.

Counterparty Risk Comparison

Swap contracts typically involve ongoing exchanges of cash flows between counterparties over an extended period, increasing exposure to counterparty risk due to the possibility of default at multiple settlement dates. Forward contracts, as agreements to buy or sell assets at a predetermined price on a future date, concentrate counterparty risk at a single point in time when settlement occurs. The cumulative risk in swaps generally exceeds that of forwards, necessitating robust collateral management and credit support annexes to mitigate potential losses from counterparty default.

Use Cases in Financial Markets

Swap contracts are extensively used in interest rate risk management and currency hedging by financial institutions to exchange cash flows and stabilize future expenses. Forward contracts primarily serve exporters and importers to lock in prices of commodities or currencies, mitigating the risk of adverse price movements. Both instruments enhance portfolio risk management but differ in duration and customization, with swaps suited for long-term strategies and forwards for short-term, specific commitments.

Pricing and Valuation Techniques

Swap contract pricing involves calculating the net present value (NPV) of future cash flows exchanged over the contract's life, often using discount rates derived from interest rate curves or relevant market benchmarks. Forward contracts are valued by determining the difference between the forward price, set at contract initiation based on spot price adjusted for cost of carry, and the current spot price, discounted back to present value using the risk-free interest rate. Both instruments rely heavily on discounting future cash flows but swaps typically require iterative curve bootstrapping and sensitivity analysis to capture complex periodic settlements and varying market risks.

Regulatory and Legal Considerations

Swap contracts are subject to stringent regulatory oversight under frameworks such as the Dodd-Frank Act in the United States and EMIR in the European Union, requiring centralized clearing, reporting, and adherence to margin requirements to mitigate systemic risk. Forward contracts, typically customized and traded over-the-counter (OTC), face less regulatory burden but must comply with bilateral credit risk management and disclosure obligations under local jurisdictional laws. Legal considerations for swaps often involve standardized documentation through ISDA agreements, whereas forward contracts depend on individually negotiated terms, impacting enforceability and dispute resolution.

Advantages and Disadvantages of Swap and Forward Contracts

Swap contracts offer flexibility by allowing parties to exchange cash flows based on different financial instruments, reducing exposure to interest rate or currency risk, but they can be complex to value and involve counterparty risk. Forward contracts provide a straightforward agreement to buy or sell assets at a predetermined price on a future date, ensuring price certainty and hedging against market volatility, though they carry the risk of settlement default and lack liquidity. While swaps enable customized risk management strategies, forwards are simpler but less adaptable and often subject to higher credit risk without centralized clearing.

Choosing the Right Contract for Risk Management

Swap contracts offer flexibility in managing interest rate, currency, and commodity price risks through periodic exchanges of cash flows, making them ideal for long-term hedging strategies. Forward contracts provide customized agreements to buy or sell an asset at a predetermined price on a specific future date, benefiting firms seeking to hedge short-term exposure with precise settlement terms. Selecting the right contract depends on the duration of the exposure, the nature of the underlying asset, and the firm's risk tolerance and liquidity needs.

Swap Contract Infographic

libterm.com

libterm.com