A Shareholders Agreement outlines the rights and responsibilities of company shareholders, ensuring smooth governance and conflict resolution. It details dividend policies, voting rights, and procedures for transferring shares, protecting your investment and control in the company. Explore this article to understand how a well-crafted Shareholders Agreement can safeguard your interests and promote business stability.

Table of Comparison

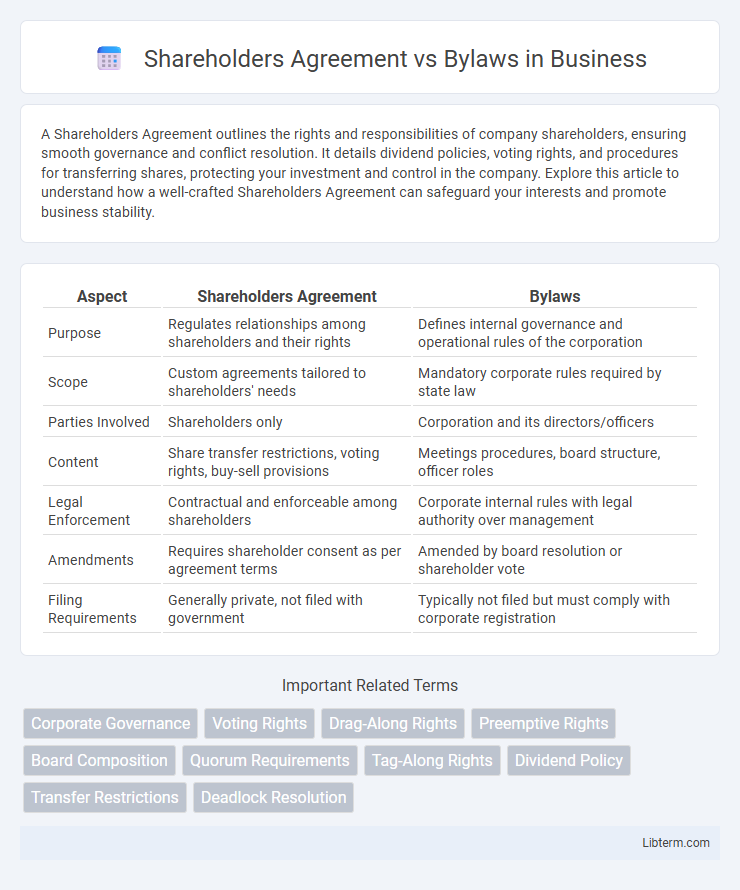

| Aspect | Shareholders Agreement | Bylaws |

|---|---|---|

| Purpose | Regulates relationships among shareholders and their rights | Defines internal governance and operational rules of the corporation |

| Scope | Custom agreements tailored to shareholders' needs | Mandatory corporate rules required by state law |

| Parties Involved | Shareholders only | Corporation and its directors/officers |

| Content | Share transfer restrictions, voting rights, buy-sell provisions | Meetings procedures, board structure, officer roles |

| Legal Enforcement | Contractual and enforceable among shareholders | Corporate internal rules with legal authority over management |

| Amendments | Requires shareholder consent as per agreement terms | Amended by board resolution or shareholder vote |

| Filing Requirements | Generally private, not filed with government | Typically not filed but must comply with corporate registration |

Introduction to Shareholders Agreements and Bylaws

Shareholders Agreements define specific rights and obligations among company shareholders, governing aspects like share transfers, voting rights, and dispute resolution. Bylaws establish the internal management rules of a corporation, including procedures for board meetings, officer responsibilities, and shareholder meetings. Together, these documents ensure clarity in corporate governance and protect shareholder interests.

Defining Shareholders Agreement

A Shareholders Agreement is a legally binding contract among a company's shareholders that outlines their rights, responsibilities, and obligations, governing the management and operation of the company. It addresses key issues such as share transfer restrictions, dispute resolution, voting rights, and dividend policies, providing protections beyond the scope of corporate bylaws. Unlike bylaws, which are internal rules adopted by the board of directors, a Shareholders Agreement modifies the relationship between shareholders and ensures equitable treatment and clarity in decision-making processes.

What Are Corporate Bylaws?

Corporate bylaws are internal rules adopted by a corporation's board of directors that govern the management and operational procedures of the company, including the roles, duties, and responsibilities of officers and directors. Unlike a shareholders agreement, which outlines the rights and obligations of shareholders, bylaws establish the foundational governance framework, such as meeting protocols, voting procedures, and officer appointments. These bylaws ensure consistent corporate governance compliance with state laws and provide mechanisms for resolving internal disputes within the corporation.

Key Differences Between Shareholders Agreements and Bylaws

Shareholders agreements primarily govern the relationship between shareholders, detailing rights, obligations, and transfer restrictions, while bylaws establish the internal rules and management structure of the corporation. Shareholders agreements often include provisions on voting rights, dividend policies, and dispute resolution, whereas bylaws typically outline board composition, meeting protocols, and officer duties. The former is a private contract enforceable among shareholders, and the latter is a public corporate document filed with the state and enforceable against the corporation and its directors.

Purpose and Function: Shareholders Agreement vs Bylaws

Shareholders agreements primarily govern the relationship among shareholders, detailing voting rights, share transfers, and dispute resolution to protect minority interests. Bylaws establish the internal rules for the corporation's management, including the roles of directors, meeting protocols, and operational procedures. While shareholders agreements provide flexibility tailored to shareholder needs, bylaws serve as foundational corporate governance documents filed with the state.

Legal Enforceability and Hierarchy

Shareholders Agreements provide legally enforceable contracts specifically outlining shareholder rights and obligations, often offering protections beyond those in Bylaws. Bylaws function as the corporation's internal rules, primarily governing management structure and procedures, and hold authority under corporate law unless contradicted by statutory requirements. In legal hierarchy, Shareholders Agreements typically prevail over Bylaws in disputes between shareholders, but cannot override mandatory statutory provisions or public policy.

Typical Provisions in Shareholders Agreements

Typical provisions in Shareholders Agreements include rights and obligations of shareholders, mechanisms for transfer of shares, dispute resolution processes, and protection of minority interests. These agreements often specify dividend policies, voting rights, and exit strategies to ensure alignment among shareholders. Unlike Bylaws, which govern internal corporate management, Shareholders Agreements provide detailed rules on shareholder relationships and control aspects.

Common Clauses Found in Bylaws

Common clauses found in corporate bylaws include provisions on the duties and powers of directors and officers, procedures for shareholder and board meetings, and rules governing the issuance and transfer of shares. Bylaws typically outline quorum requirements, voting rights, and mechanisms for amending the document. These clauses establish the internal management framework distinguishing bylaws from shareholders agreements that focus more on shareholder rights and relationship terms.

Choosing the Right Document for Your Corporation

Selecting between a Shareholders Agreement and Bylaws depends on the corporation's needs for governance and shareholder protections. Shareholders Agreements provide detailed provisions on shareholder rights, transfer restrictions, and dispute resolution, offering customized control beyond standard corporate rules. Bylaws establish internal procedures such as board structure and meeting protocols, serving as the foundational governance document required by corporate law.

Conclusion: Aligning Governance Documents for Effective Corporate Management

Aligning Shareholders Agreements and Bylaws ensures cohesive governance that balances shareholder rights with corporate operational rules. Effective corporate management relies on integrating these documents to clarify decision-making processes and prevent conflicts. Harmonized governance frameworks enhance transparency, accountability, and strategic alignment within a company.

Shareholders Agreement Infographic

libterm.com

libterm.com