Warrants are financial instruments that give you the right to purchase securities, typically stocks, at a predetermined price before a specified expiration date. They offer potential leverage and can be a strategic tool for investors looking to capitalize on future market movements without immediately buying the underlying shares. Explore the rest of the article to understand how warrants can fit into your investment strategy and the risks involved.

Table of Comparison

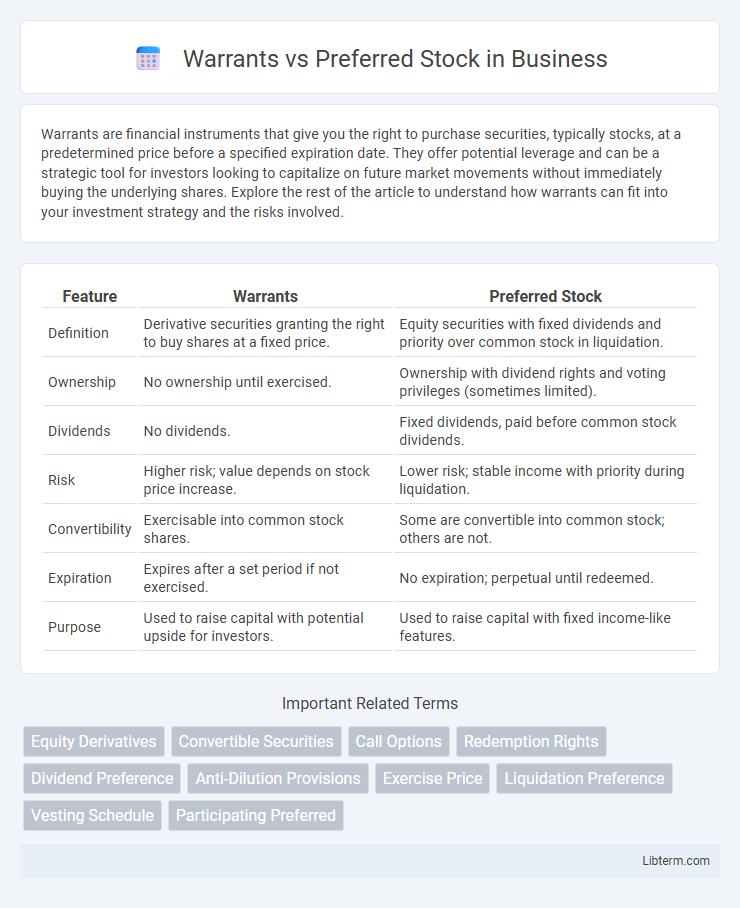

| Feature | Warrants | Preferred Stock |

|---|---|---|

| Definition | Derivative securities granting the right to buy shares at a fixed price. | Equity securities with fixed dividends and priority over common stock in liquidation. |

| Ownership | No ownership until exercised. | Ownership with dividend rights and voting privileges (sometimes limited). |

| Dividends | No dividends. | Fixed dividends, paid before common stock dividends. |

| Risk | Higher risk; value depends on stock price increase. | Lower risk; stable income with priority during liquidation. |

| Convertibility | Exercisable into common stock shares. | Some are convertible into common stock; others are not. |

| Expiration | Expires after a set period if not exercised. | No expiration; perpetual until redeemed. |

| Purpose | Used to raise capital with potential upside for investors. | Used to raise capital with fixed income-like features. |

Understanding Warrants and Preferred Stock

Warrants are financial instruments that grant the holder the right to purchase company stock at a specific price before expiration, offering potential for capital gains without immediate ownership. Preferred stock represents equity ownership with fixed dividends and priority over common stock in asset liquidation, blending features of debt and equity. Understanding these securities requires recognizing warrants as future rights to equity and preferred stock as a current, hybrid investment with preferential claims.

Key Features of Warrants

Warrants are financial instruments that provide investors the right to purchase company stock at a predetermined price within a specific timeframe, often extending beyond typical option durations. Unlike preferred stock, warrants do not pay dividends and do not confer ownership or voting rights until exercised. They offer leverage potential, allowing investors to benefit from stock price appreciation without immediate equity dilution.

Key Features of Preferred Stock

Preferred stock represents equity ownership with fixed dividend payments and priority over common stock in asset distribution during liquidation. It typically lacks voting rights but may include convertibility into common shares and cumulative dividend provisions. These characteristics make preferred stock a hybrid security balancing income stability and potential equity appreciation.

How Warrants Work in Practice

Warrants provide investors the right to purchase a company's stock at a predetermined price before expiration, often acting as a sweetener in financing deals. They function by allowing holders to benefit from potential stock price appreciation without immediately investing capital. Unlike preferred stock, warrants do not confer ownership or dividends but offer leverage exposure to equity gains when exercised.

Types of Preferred Stock Explained

Preferred stock includes multiple types such as cumulative, non-cumulative, participating, and convertible preferred shares, each with distinct dividend rights and claim priorities. Cumulative preferred stock mandates that missed dividends accumulate and must be paid before any dividends to common shareholders, while non-cumulative preferred stock does not offer this feature. Participating preferred stock allows investors to receive additional dividends beyond the fixed rate, and convertible preferred stock can be exchanged for a predetermined number of common shares, providing potential upside in stock price appreciation.

Benefits and Risks of Warrants

Warrants offer investors the opportunity to purchase company stock at a predetermined price, potentially leading to significant gains if the stock appreciates above that price. These financial instruments provide leveraged exposure with lower upfront costs compared to buying preferred stock outright, allowing for greater upside potential while limiting initial investment. However, warrants carry risks such as expiration without value if the stock price does not exceed the strike price, and dilution of existing shareholders when exercised, which can negatively impact overall share value.

Advantages and Disadvantages of Preferred Stock

Preferred stock offers fixed dividends, providing a predictable income stream and priority over common stock in dividend payments and asset liquidation. However, its limited voting rights restrict shareholder influence in company decisions, and dividend payments are not guaranteed, which can pose risks in financially unstable companies. Issuing preferred stock may dilute ownership less than common stock but often comes with higher costs and complexity in valuation.

Warrants vs Preferred Stock: Major Differences

Warrants provide the holder the right to purchase company shares at a specific price before expiration, acting as a long-term option, while preferred stock represents ownership with fixed dividends and priority over common stock in asset distribution. Warrants typically do not offer voting rights or dividends, unlike preferred stockholders who benefit from steady income and potential appreciation. The major difference lies in warrants being derivative securities that can convert into common stock, whereas preferred stock is a hybrid equity with characteristics of both debt and equity.

Investment Considerations for Investors

Warrants offer investors the potential for leveraged gains by allowing the purchase of shares at a fixed price before expiration, making them attractive for speculation in volatile markets. Preferred stock provides steady income through fixed dividends and priority over common stock in asset liquidation, appealing to investors seeking income stability and reduced risk. Evaluating the time horizon, risk tolerance, and income needs is crucial for investors when choosing between warrants and preferred stock in a diversified portfolio.

Which is Better: Warrants or Preferred Stock?

Warrants offer the potential for significant upside gains by allowing investors to purchase shares at a fixed price in the future, making them ideal for those seeking leveraged exposure with limited initial investment. Preferred stock provides steady income through fixed dividends and priority in asset claims, appealing to investors prioritizing income and lower risk. The choice between warrants and preferred stock depends on an investor's risk tolerance, investment horizon, and desire for income versus capital appreciation.

Warrants Infographic

libterm.com

libterm.com