Variable cost refers to expenses that change directly with production volume, such as raw materials and labor. Understanding these costs is crucial for managing your business's profitability and pricing strategies. Explore the rest of the article to learn how to effectively control and optimize variable costs.

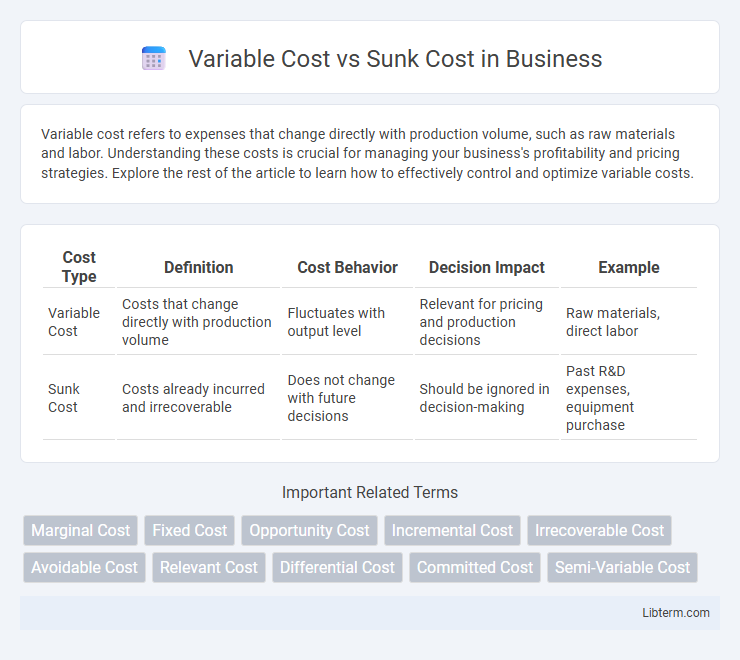

Table of Comparison

| Cost Type | Definition | Cost Behavior | Decision Impact | Example |

|---|---|---|---|---|

| Variable Cost | Costs that change directly with production volume | Fluctuates with output level | Relevant for pricing and production decisions | Raw materials, direct labor |

| Sunk Cost | Costs already incurred and irrecoverable | Does not change with future decisions | Should be ignored in decision-making | Past R&D expenses, equipment purchase |

Understanding Variable Costs: Definition and Examples

Variable costs fluctuate directly with production volume, encompassing expenses such as raw materials, direct labor, and utility costs linked to manufacturing. For example, in a car factory, the cost of steel and hourly wages of assembly workers rise as more vehicles are produced. Understanding variable costs is crucial for businesses to manage pricing strategies, control expenses, and optimize profitability.

What Are Sunk Costs? Key Characteristics

Sunk costs refer to expenses that have already been incurred and cannot be recovered, such as past investments in equipment or marketing campaigns. These costs are irrelevant to future decision-making because they remain constant regardless of the outcome of a current choice. Key characteristics of sunk costs include their irreversibility, historical nature, and the principle that rational decisions should ignore them to focus on variable costs and prospective benefits.

Core Differences Between Variable and Sunk Costs

Variable costs fluctuate directly with production volume, such as raw materials and hourly wages, making them controllable and relevant for short-term decision-making. Sunk costs represent past expenditures, like research and development or marketing expenses, that cannot be recovered and should not influence current business choices. The core difference lies in variable costs being avoidable and future-oriented, whereas sunk costs are fixed, irretrievable, and irrelevant to incremental decisions.

Role of Variable Costs in Business Decision-Making

Variable costs directly influence business decision-making by fluctuating with production volume, enabling managers to assess the incremental expenses associated with scaling operations. Understanding variable costs allows companies to optimize pricing strategies, control operational efficiency, and enhance profit margins. In contrast to sunk costs, which are irrecoverable, variable costs provide actionable data crucial for evaluating short-term financial decisions and resource allocation.

The Irrelevance of Sunk Costs in Future Planning

Sunk costs, expenses that have already been incurred and cannot be recovered, hold no relevance in future decision-making processes because they do not affect prospective cash flows or opportunity costs. Variable costs, on the other hand, fluctuate with production volume and are critical for analyzing incremental costs and optimizing operational efficiency. Ignoring sunk costs while focusing on variable costs ensures more rational and financially sound planning by emphasizing avoidable and controllable expenses.

Common Misconceptions: Variable vs Sunk Costs

Variable costs fluctuate directly with production volume, such as raw materials and labor, while sunk costs are past expenses that cannot be recovered, like initial investments or research expenses. A common misconception is treating sunk costs as relevant for future decision-making, despite their irrelevance to marginal cost analysis and operational choices. Understanding that variable costs affect immediate financial decisions and sunk costs should be ignored prevents inefficient resource allocation and flawed economic judgments.

Real-World Examples of Variable and Sunk Costs

Variable costs fluctuate with production levels, such as raw materials expenses in a manufacturing plant where increased output directly raises costs. Sunk costs, like a non-refundable marketing campaign or specialized equipment purchase, remain fixed and unrecoverable regardless of future business decisions. For instance, a software company investing in custom development software faces a sunk cost, while the expenses for cloud server usage rise with user demand, exemplifying variable costs.

How to Identify Variable and Sunk Costs in Accounting

Variable costs fluctuate directly with production volume, such as raw materials and direct labor, making them identifiable through their proportional relationship to output levels in accounting records. Sunk costs represent past expenditures like research and development or equipment purchases that cannot be recovered and should be recognized as fixed, non-recoverable costs in financial statements. Differentiating between these costs requires analyzing whether the expense varies with business activity or remains constant regardless of future decisions.

Impact on Profitability: Variable Cost vs Sunk Cost

Variable costs directly affect profitability as they fluctuate with production volume, influencing profit margins on each unit sold. Sunk costs, already incurred and irreversible, do not impact future profitability decisions but can lead to misallocation of resources if misinterpreted. Effective management separates variable costs for operational adjustments and disregards sunk costs to optimize profit outcomes.

Best Practices for Managing Costs in Business Operations

Effectively managing variable costs, which fluctuate with production levels, involves closely monitoring resource usage and optimizing operational efficiency to maintain profitability. Identifying and excluding sunk costs--expenses already incurred and irreversible--prevents distorted decision-making and ensures focus on relevant financial data. Regular cost analysis and dynamic budgeting empower businesses to control variable expenses while avoiding the trap of obsolete sunk cost considerations.

Variable Cost Infographic

libterm.com

libterm.com