Stock options grant you the right to buy company shares at a predetermined price, offering potential financial growth if the stock value increases. They serve as powerful incentives for employees, aligning your interests with the company's success while providing opportunities to build wealth. Explore the rest of this article to understand how stock options can enhance your financial strategy.

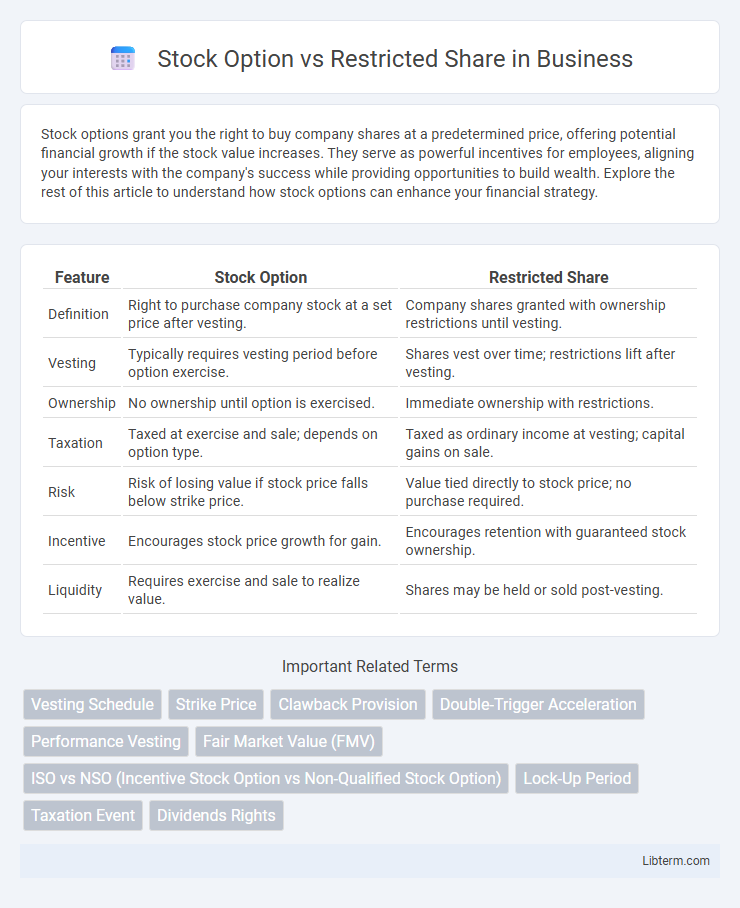

Table of Comparison

| Feature | Stock Option | Restricted Share |

|---|---|---|

| Definition | Right to purchase company stock at a set price after vesting. | Company shares granted with ownership restrictions until vesting. |

| Vesting | Typically requires vesting period before option exercise. | Shares vest over time; restrictions lift after vesting. |

| Ownership | No ownership until option is exercised. | Immediate ownership with restrictions. |

| Taxation | Taxed at exercise and sale; depends on option type. | Taxed as ordinary income at vesting; capital gains on sale. |

| Risk | Risk of losing value if stock price falls below strike price. | Value tied directly to stock price; no purchase required. |

| Incentive | Encourages stock price growth for gain. | Encourages retention with guaranteed stock ownership. |

| Liquidity | Requires exercise and sale to realize value. | Shares may be held or sold post-vesting. |

Introduction to Stock Options and Restricted Shares

Stock options grant employees the right to purchase company shares at a predetermined price, often incentivizing long-term performance by aligning employee interests with shareholders. Restricted shares are company stock given to employees with specific conditions or vesting periods, providing immediate ownership but limited transferability until restrictions lapse. Both serve as equity compensation tools, promoting employee retention and motivation through different mechanisms of potential financial gain.

Key Differences Between Stock Options and Restricted Shares

Stock options grant employees the right to purchase company shares at a predetermined price, providing potential profit if the stock value rises, while restricted shares are actual shares awarded but subject to vesting conditions and forfeiture risks. Stock options typically require employees to exercise their options to own shares, often involving potential tax implications at exercise and sale, whereas restricted shares usually generate taxable income upon vesting based on the current market value. The main difference lies in ownership timing and risk: stock options offer future potential ownership contingent on stock price appreciation, while restricted shares represent immediate ownership with restrictions until vesting criteria are met.

How Stock Options Work: A Brief Overview

Stock options grant employees the right to purchase company shares at a predetermined price, known as the strike price, after a specified vesting period. These options become valuable when the market price exceeds the strike price, allowing employees to buy shares at a discount and potentially sell them for a profit. Unlike restricted shares, which are outright grants of company stock subject to vesting, stock options require exercising to convert options into actual shares.

Understanding Restricted Shares: Features and Benefits

Restricted shares are company-issued stock granted to employees with conditions such as vesting periods that must be met before ownership transfers. These shares provide tangible equity ownership, often including voting rights and dividends, aligning employee interests with company performance. Unlike stock options, restricted shares retain value even if the stock price declines, offering greater downside protection for recipients.

Vesting Schedules: Stock Options vs Restricted Shares

Stock options typically have a vesting schedule that requires employees to meet specific time or performance milestones before they can exercise the options, often spanning three to five years. Restricted shares usually vest over a predetermined period or upon achieving certain goals, becoming fully owned by the employee once vested without the need for purchase. The key difference is that vested stock options require purchase at an exercise price, whereas restricted shares become the employee's property outright upon vesting.

Tax Implications: Comparing Stock Options and Restricted Shares

Stock options typically trigger taxable income at exercise based on the difference between the market price and the exercise price, while restricted shares are taxed as ordinary income when the shares vest at their fair market value. Stock options may qualify for more favorable capital gains tax rates if held long-term after exercise, whereas restricted shares usually become capital assets upon vesting, with gain or loss measured from that point. Employers often provide specific tax reporting forms such as Form W-2 for restricted shares and Form 3921 or 3922 for incentive stock options, reflecting these distinct tax treatments.

Advantages of Stock Options for Employees

Stock options offer employees the advantage of potential high financial gains by purchasing company shares at a predetermined price, often below market value, incentivizing performance and long-term commitment. They provide flexibility in timing the exercise, allowing employees to optimize tax outcomes and cash flow management. Unlike restricted shares, stock options do not require immediate ownership, reducing initial tax burdens and aligning employee interests with company growth.

Benefits of Restricted Shares: Why Companies Offer Them

Restricted shares provide employees with immediate ownership stakes that align their interests directly with company performance, enhancing motivation and retention. These shares typically come with fewer tax complexities compared to stock options, enabling employees to benefit from dividend payments and voting rights. Companies offer restricted shares to incentivize long-term commitment and reduce turnover, fostering a stable and engaged workforce.

Risks and Considerations: Stock Options vs Restricted Shares

Stock options carry the risk of becoming worthless if the company's stock price falls below the exercise price, potentially resulting in no financial gain despite an initial grant. Restricted shares, while retaining intrinsic value as actual shares, face the risk of forfeiture if vesting conditions or employment requirements are not met. Tax implications also differ; stock options may trigger ordinary income tax upon exercise and capital gains on sale, whereas restricted shares often incur tax liability at vesting based on market value.

Choosing the Right Equity Compensation: Factors to Consider

Choosing the right equity compensation between stock options and restricted shares depends on factors such as vesting schedules, tax implications, and potential for value appreciation. Stock options offer the incentive to purchase shares at a fixed price, benefiting employees in a rising market, while restricted shares grant actual ownership with immediate voting rights but may have stricter tax consequences. Understanding company growth projections, personal financial goals, and risk tolerance is crucial to optimizing equity compensation benefits.

Stock Option Infographic

libterm.com

libterm.com