Acquisition strategies play a critical role in business growth, enabling companies to expand market share and access new technologies. Understanding key factors like due diligence, valuation, and integration challenges ensures successful acquisitions that align with your long-term goals. Explore the full article to discover how to navigate the acquisition process effectively and maximize your investment.

Table of Comparison

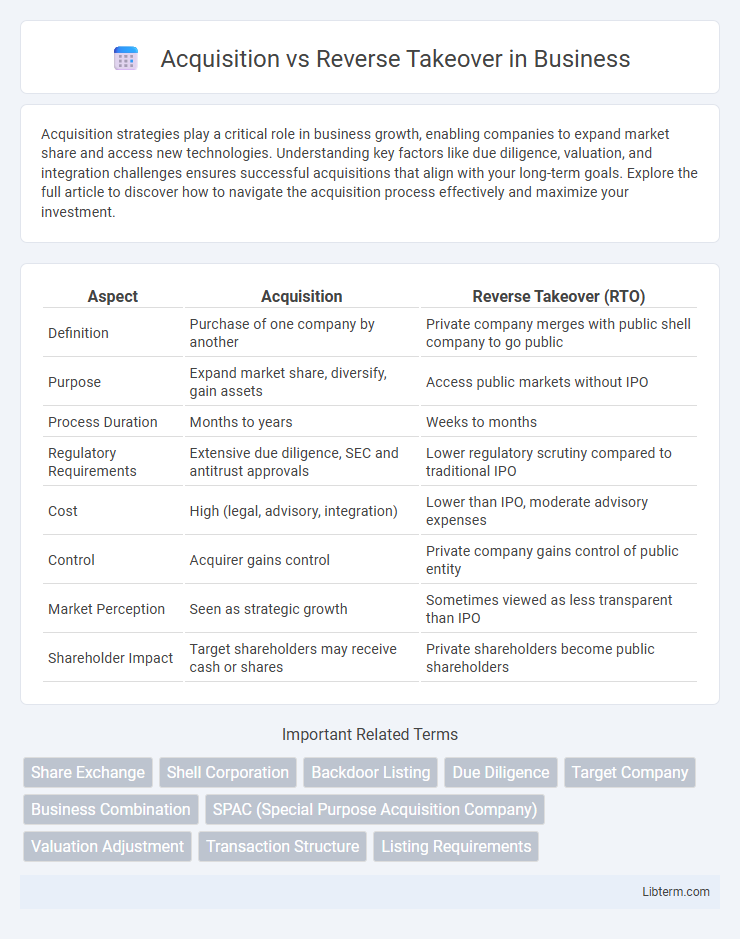

| Aspect | Acquisition | Reverse Takeover (RTO) |

|---|---|---|

| Definition | Purchase of one company by another | Private company merges with public shell company to go public |

| Purpose | Expand market share, diversify, gain assets | Access public markets without IPO |

| Process Duration | Months to years | Weeks to months |

| Regulatory Requirements | Extensive due diligence, SEC and antitrust approvals | Lower regulatory scrutiny compared to traditional IPO |

| Cost | High (legal, advisory, integration) | Lower than IPO, moderate advisory expenses |

| Control | Acquirer gains control | Private company gains control of public entity |

| Market Perception | Seen as strategic growth | Sometimes viewed as less transparent than IPO |

| Shareholder Impact | Target shareholders may receive cash or shares | Private shareholders become public shareholders |

Overview: Acquisition vs Reverse Takeover

An acquisition involves one company purchasing another to gain control, often aiming for synergistic growth and expanded market share. A reverse takeover (RTO) allows a private company to become publicly traded by merging with an existing public company, bypassing the traditional initial public offering process. Both strategies facilitate corporate expansion but differ fundamentally in execution and regulatory pathways.

Key Definitions and Concepts

Acquisition refers to the process where one company purchases another to gain control, often involving cash or stock transactions to absorb assets and liabilities. Reverse Takeover (RTO) is a method where a private company acquires a publicly listed company to bypass the lengthy initial public offering (IPO) process, allowing quicker access to capital markets. Both strategies facilitate corporate restructuring, but acquisitions emphasize ownership transfer while RTOs prioritize market entry through a shell company.

How Acquisitions Work

Acquisitions involve one company purchasing another by buying a majority stake or all of its shares, enabling full control over the target's operations and assets. This process often includes due diligence, negotiation of purchase price, and regulatory approval to ensure compliance and protect shareholder interests. Effective acquisitions result in seamless integration of resources, market expansion, and enhanced competitive advantage for the acquiring firm.

Process of Reverse Takeovers

Reverse takeovers involve a private company acquiring a publicly listed shell company to bypass the lengthy and complex initial public offering process. This process includes merging with the public entity, restructuring the combined business, and updating regulatory filings to reflect the new ownership and management. Reverse takeovers offer faster access to public capital markets while minimizing costs and regulatory scrutiny compared to traditional acquisitions.

Regulatory and Legal Framework

Acquisitions are governed by stringent regulatory frameworks including antitrust laws, securities regulations, and disclosure requirements enforced by bodies such as the SEC in the United States or the FCA in the UK. Reverse takeovers (RTOs), often categorized as backdoor listings, face specific legal scrutiny to ensure compliance with public listing rules and to prevent market manipulation, typically involving less intensive initial regulatory review but ongoing disclosure obligations. Both processes demand comprehensive due diligence to navigate complex legal challenges including shareholder approvals, compliance with financial reporting standards, and adherence to jurisdiction-specific takeover codes.

Financial Implications and Valuation

Acquisitions typically involve a direct purchase of a target company's equity or assets, resulting in immediate control and often significant upfront cash outflows or stock issuance, impacting the acquirer's balance sheet and earnings per share. Reverse takeovers (RTOs) offer a faster path to public markets by allowing a private company to merge with a publicly listed shell, often at a lower cost and with potentially less scrutiny, but can introduce valuation complexity due to differing financial reporting standards and less transparent market pricing. Both transactions require careful financial valuation methodologies, including discounted cash flow (DCF) analysis and comparable company multiples, to accurately assess synergies, control premiums, and post-transaction equity value while managing shareholder dilution risks.

Advantages of Acquisitions

Acquisitions provide companies with immediate access to established customer bases, operational infrastructure, and market share, facilitating faster growth compared to organic expansion. They allow for the integration of valuable assets, technologies, and talent, driving synergies and enhancing competitive advantage. Financially, acquisitions can improve cash flow stability and provide tax benefits through asset depreciation and loss carry-forwards.

Benefits and Risks of Reverse Takeovers

Reverse takeovers provide faster access to public markets compared to traditional acquisitions, reducing costs and regulatory hurdles. They enable private companies to bypass the lengthy initial public offering (IPO) process, offering liquidity and access to capital. Risks include potential undisclosed liabilities, market perception challenges, and integration difficulties that can impact shareholder value.

Case Studies: Notable Examples

Notable acquisition case studies include Facebook's acquisition of Instagram for $1 billion in 2012, significantly boosting its market share and user base. In contrast, the reverse takeover of Burger King by Justice Holdings in 2012 enabled Burger King to go public without a traditional IPO, streamlining the process and saving costs. These examples demonstrate how acquisitions rapidly expand company portfolios, while reverse takeovers provide alternative public listing strategies for faster market entry.

Choosing the Right Path: Strategic Considerations

Selecting between acquisition and reverse takeover hinges on company objectives, market conditions, and resource availability. Acquisitions offer established market presence and control infusion, while reverse takeovers provide faster public listing with potentially lower costs and regulatory hurdles. Evaluating factors such as valuation, speed, due diligence complexity, and integration challenges ensures alignment with strategic growth and capital-raising goals.

Acquisition Infographic

libterm.com

libterm.com