Fixed cost refers to business expenses that remain constant regardless of production levels, such as rent, salaries, and insurance. These costs are crucial for budgeting and financial planning since they do not fluctuate with sales volume. Discover how understanding fixed costs can improve your financial strategy in the rest of this article.

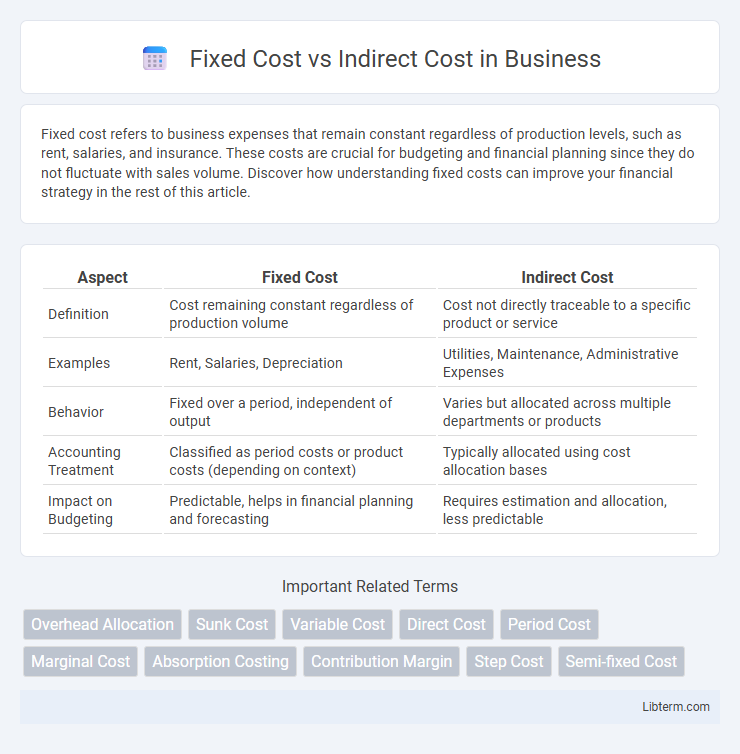

Table of Comparison

| Aspect | Fixed Cost | Indirect Cost |

|---|---|---|

| Definition | Cost remaining constant regardless of production volume | Cost not directly traceable to a specific product or service |

| Examples | Rent, Salaries, Depreciation | Utilities, Maintenance, Administrative Expenses |

| Behavior | Fixed over a period, independent of output | Varies but allocated across multiple departments or products |

| Accounting Treatment | Classified as period costs or product costs (depending on context) | Typically allocated using cost allocation bases |

| Impact on Budgeting | Predictable, helps in financial planning and forecasting | Requires estimation and allocation, less predictable |

Understanding Fixed Cost: Definition and Examples

Fixed cost refers to business expenses that remain constant regardless of production levels or sales volume, such as rent, salaries, and insurance premiums. These costs are essential for maintaining operations and do not fluctuate with the company's output, providing stability in budgeting and financial planning. Examples include monthly lease payments for office space, salaried employee wages, and depreciation of machinery, all classified as fixed costs critical for long-term operational viability.

What Are Indirect Costs? Key Characteristics

Indirect costs are expenses not directly traceable to a specific product or service but necessary for overall business operations, such as rent, utilities, and administrative salaries. They remain consistent regardless of production volume, distinguishing them from variable direct costs. These costs support multiple departments or projects, making their allocation essential for accurate financial reporting and budgeting.

Fixed Cost vs Indirect Cost: Core Differences

Fixed costs are expenses that remain constant regardless of production volume, such as rent and salaries, while indirect costs are expenses not directly tied to a specific product, like utilities and administrative salaries. Fixed costs can be either direct or indirect depending on their nature, but indirect costs are always expenses that support overall operations without direct product attribution. Understanding these distinctions aids in accurate costing, budgeting, and financial analysis within business management.

Impact on Budgeting and Financial Planning

Fixed costs, such as rent and salaries, remain constant regardless of production levels, providing predictable expense estimates crucial for accurate budgeting and long-term financial planning. Indirect costs, including utilities and administrative expenses, fluctuate and require flexible budgeting strategies to accommodate variable overheads and maintain financial control. Understanding the distinction between these costs enhances the precision of cost allocation and supports sustainable business growth through informed financial decision-making.

Classification and Examples of Fixed Costs

Fixed costs are expenses that remain constant regardless of production volume, classified as a subset of indirect costs because they cannot be directly traced to a specific product or service. Examples of fixed costs include rent, salaries of permanent staff, and depreciation on equipment or buildings, all of which do not fluctuate with operational activity. These costs play a crucial role in budgeting and financial forecasting by providing a predictable baseline expense that supports overall business operations.

Types and Categories of Indirect Costs

Fixed costs remain constant regardless of production levels, including rent, salaries, and insurance, while indirect costs encompass all expenses not directly traceable to a specific product, such as utilities, administrative salaries, and maintenance. Indirect costs are categorized into overhead costs like facility expenses, administrative costs involving management and support staff, and operational costs including supplies and depreciation. Understanding these types is essential for accurate cost allocation and budgeting in financial management.

Role in Cost Accounting and Reporting

Fixed costs represent expenses that remain constant regardless of production levels, such as rent and salaries, playing a crucial role in cost accounting by providing a stable baseline for budgeting and financial forecasting. Indirect costs, also known as overhead costs, include expenses like utilities and administrative salaries that are not directly traceable to specific products but are essential for overall operations. Accurate identification and allocation of fixed and indirect costs enhance cost reporting, enabling businesses to determine product profitability and make informed pricing decisions.

How to Identify and Allocate Fixed and Indirect Costs

Fixed costs are expenses that remain constant regardless of production levels, such as rent, salaries, and insurance, making them identifiable through consistent monthly accounting records. Indirect costs, also known as overhead costs, include utilities, maintenance, and administrative expenses that support overall operations but cannot be directly traced to a specific product or service. Allocation of fixed and indirect costs typically involves using cost drivers or allocation bases, such as machine hours or labor hours, to distribute these costs accurately across departments or products.

Business Decision-Making: Implications of Each Cost Type

Fixed costs, such as rent and salaries, remain constant regardless of production volume, enabling businesses to predict expenses and set pricing strategies effectively. Indirect costs, like utilities and administrative expenses, are not directly tied to a specific product, making accurate cost allocation essential for determining product profitability. Understanding the implications of fixed versus indirect costs aids managers in budgeting, forecasting, and optimizing resource allocation to enhance overall financial performance.

Best Practices for Managing Fixed and Indirect Costs

Effective management of fixed costs involves regularly reviewing long-term contracts and lease agreements to identify opportunities for renegotiation and cost reduction. For indirect costs, implementing a detailed cost allocation system enhances transparency and accountability, ensuring expenses like utilities and administrative salaries are accurately attributed to specific departments. Leveraging technology such as expense management software streamlines monitoring, helping organizations optimize both fixed and indirect costs while maintaining operational efficiency.

Fixed Cost Infographic

libterm.com

libterm.com