SAFE (Simple Agreement for Future Equity) is a popular equity financing instrument that allows startups to raise capital without immediately issuing shares. It provides investors with the right to obtain equity at a future date, typically during a subsequent financing round, offering simplicity and flexibility compared to traditional convertible notes. Explore the rest of this article to understand how SAFE can be a strategic tool for Your startup's financing needs.

Table of Comparison

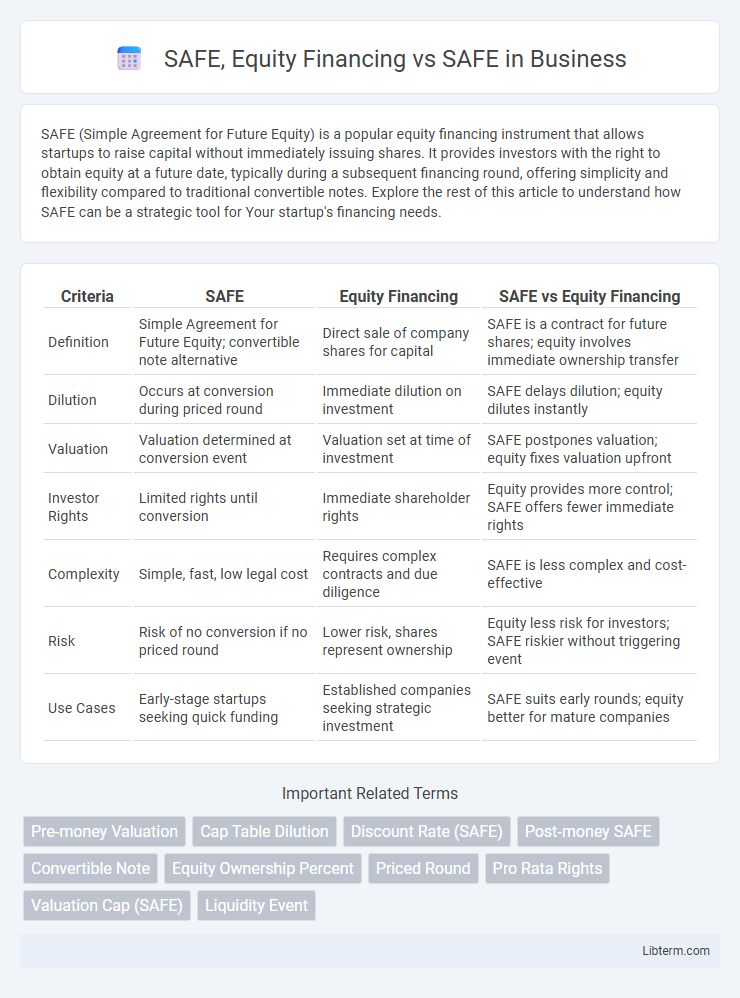

| Criteria | SAFE | Equity Financing | SAFE vs Equity Financing |

|---|---|---|---|

| Definition | Simple Agreement for Future Equity; convertible note alternative | Direct sale of company shares for capital | SAFE is a contract for future shares; equity involves immediate ownership transfer |

| Dilution | Occurs at conversion during priced round | Immediate dilution on investment | SAFE delays dilution; equity dilutes instantly |

| Valuation | Valuation determined at conversion event | Valuation set at time of investment | SAFE postpones valuation; equity fixes valuation upfront |

| Investor Rights | Limited rights until conversion | Immediate shareholder rights | Equity provides more control; SAFE offers fewer immediate rights |

| Complexity | Simple, fast, low legal cost | Requires complex contracts and due diligence | SAFE is less complex and cost-effective |

| Risk | Risk of no conversion if no priced round | Lower risk, shares represent ownership | Equity less risk for investors; SAFE riskier without triggering event |

| Use Cases | Early-stage startups seeking quick funding | Established companies seeking strategic investment | SAFE suits early rounds; equity better for mature companies |

Understanding SAFE: A Brief Overview

SAFE (Simple Agreement for Future Equity) provides startups with a flexible method to raise capital without immediate valuation, contrasting traditional equity financing that involves issuing shares upfront. In SAFE agreements, investors receive a future equity stake based on a triggering event like a priced equity round, while equity financing requires an immediate exchange of capital for stock. Understanding SAFE highlights its advantage in reducing legal complexity and deferring valuation discussions, making it suitable for early-stage fundraising.

What is Equity Financing?

Equity financing involves raising capital by selling shares of ownership in a company, allowing investors to gain equity stakes and potential dividends. This method provides long-term growth potential and aligns investor interests with company success without immediate repayment obligations. Compared to SAFE (Simple Agreement for Future Equity), equity financing grants actual ownership at the time of investment rather than a future conversion event.

Key Differences Between SAFE and Equity Financing

SAFE (Simple Agreement for Future Equity) offers a streamlined approach to startup funding by providing investors with future equity without setting a valuation at the time of investment, contrasting with traditional equity financing where ownership percentage and valuation are determined upfront. Unlike equity financing, SAFE agreements typically avoid immediate dilution and legal complexities, making them faster and cheaper to execute for early-stage companies. Key differences include SAFE's conversion into equity upon a triggering event like a priced fundraising round, while equity financing involves issuing shares directly in exchange for capital.

How SAFE Instruments Work

SAFE (Simple Agreement for Future Equity) instruments allow investors to convert their investment into equity at a future financing round, typically at a discounted price or with a valuation cap, without setting a specific price per share at the time of investment. Unlike traditional equity financing where shares and valuations are fixed upfront, SAFEs provide startups with flexible capital infusion without immediate dilution or debt obligations. This mechanism accelerates fundraising by delaying valuation discussions and streamlining legal complexities, enabling startups to focus on growth until a priced equity round occurs.

Advantages of SAFE for Startups

SAFE (Simple Agreement for Future Equity) offers startups a faster and more cost-effective alternative to traditional equity financing by eliminating the need for immediate valuation and complex negotiations. This agreement allows startups to raise capital without giving up equity or control upfront, which preserves founder ownership and simplifies the fundraising process. SAFE's flexibility and simplicity reduce legal expenses and administrative burdens, enabling startups to focus more resources on growth and product development.

Drawbacks of SAFE Agreements

SAFE agreements provide startups with quick access to capital without immediate dilution, but they carry risks such as uncertainty in valuation and potential investor dilution during future equity rounds. Unlike traditional equity financing, SAFEs lack set maturity dates and interest rates, which may complicate investor exit strategies and create ambiguity around ownership percentages. This lack of clarity can lead to disputes or unfavorable terms for early investors as the company scales.

Benefits and Risks of Equity Financing

Equity financing involves raising capital by selling shares of ownership in a company, providing investors with voting rights and potential dividends. Benefits include access to substantial funds without debt repayment obligations, alignment of investor and company success, and enhanced credibility with stakeholders. Risks involve dilution of existing ownership, potential loss of control, and pressure to meet shareholder expectations impacting strategic decisions.

When to Choose SAFE Over Equity Financing

SAFE (Simple Agreement for Future Equity) offers a faster, less complex alternative to traditional equity financing, making it ideal for early-stage startups seeking quick capital without immediate valuation negotiations. Startups anticipating multiple funding rounds or uncertain valuations benefit from SAFE agreements, as they delay equity issuance until a priced round occurs, minimizing legal costs and administrative burdens. SAFE is particularly suitable when founders prioritize speed and flexibility over immediate shareholder dilution and prefer streamlined terms that convert into equity during future financing events.

Impact on Ownership and Control

SAFE (Simple Agreement for Future Equity) agreements allow startups to raise funds without immediate dilution of ownership, as investors convert their investment into equity during a future financing round. In contrast, traditional equity financing results in immediate ownership dilution and impacts control, as new shareholders receive voting rights and board influence upon investment. SAFE preserves founder control longer by deferring equity issuance, but eventual conversion can significantly dilute ownership depending on valuation and cap terms.

Which is Right for Your Startup: SAFE or Equity Financing?

SAFE (Simple Agreement for Future Equity) offers startups a streamlined way to raise capital without immediate valuation, providing flexibility and speed compared to traditional equity financing. Equity financing involves selling actual shares of the company, giving investors ownership and voting rights but requiring valuation and more complex legal processes. Choosing between SAFE and equity financing depends on your startup's stage, need for quick funds, investor preferences, and long-term control considerations.

SAFE, Equity Financing Infographic

libterm.com

libterm.com