Pre-money valuation determines the value of a company before new investment or funding is added, influencing ownership percentages and investment terms. It plays a crucial role in fundraising negotiations, affecting both investors and founders. Discover how mastering pre-money valuation can impact your investment strategy and company growth by reading the rest of the article.

Table of Comparison

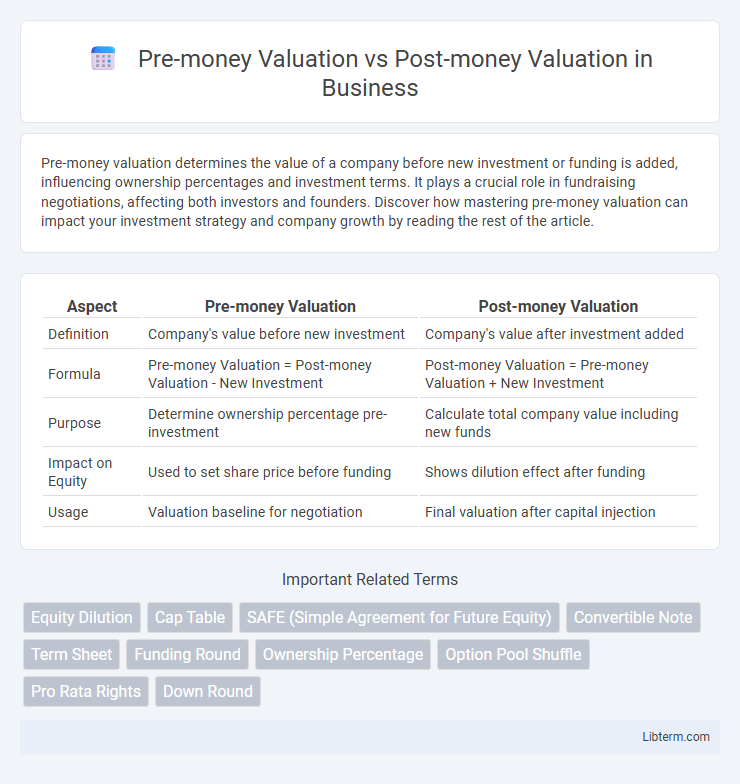

| Aspect | Pre-money Valuation | Post-money Valuation |

|---|---|---|

| Definition | Company's value before new investment | Company's value after investment added |

| Formula | Pre-money Valuation = Post-money Valuation - New Investment | Post-money Valuation = Pre-money Valuation + New Investment |

| Purpose | Determine ownership percentage pre-investment | Calculate total company value including new funds |

| Impact on Equity | Used to set share price before funding | Shows dilution effect after funding |

| Usage | Valuation baseline for negotiation | Final valuation after capital injection |

Introduction to Valuation in Startup Funding

Pre-money valuation represents a startup's estimated worth before new capital investment, serving as a critical baseline for negotiations between founders and investors. Post-money valuation is calculated by adding the investment amount to the pre-money valuation, reflecting the startup's estimated value immediately after the funding round. Understanding these concepts is essential for accurately determining ownership percentages and assessing dilution in startup funding.

Defining Pre-money Valuation

Pre-money valuation refers to the estimated value of a company immediately before receiving external funding or investment. It establishes the baseline worth of the company used by investors to determine the ownership percentage they receive in exchange for their capital. This valuation excludes the new capital injection, distinguishing it from post-money valuation, which adds investment funds to the pre-money figure.

Understanding Post-money Valuation

Post-money valuation represents a company's estimated worth immediately after receiving external funding, including the new investment amount. It is calculated by adding the investment to the pre-money valuation, reflecting the total equity value post-investment. Understanding post-money valuation is crucial for investors and founders to determine ownership percentages and dilution effects during funding rounds.

Key Differences Between Pre-money and Post-money Valuation

Pre-money valuation refers to a company's estimated worth before receiving external funding or investment, while post-money valuation represents the company's value immediately after the new capital is added. The key difference lies in the inclusion of new investment: post-money valuation equals pre-money valuation plus the amount of new equity funding. Understanding this distinction is crucial for investors and entrepreneurs to accurately assess ownership percentages and company value during funding rounds.

Importance of Accurate Valuation in Fundraising

Accurate pre-money and post-money valuations are crucial in fundraising as they determine the ownership percentage that investors and founders receive, directly impacting control and future dilution. Precise valuation ensures fair negotiation, builds investor confidence, and aligns expectations for funding rounds, which helps secure necessary capital efficiently. Overvaluing or undervaluing can lead to missed investment opportunities or excessive dilution, affecting the company's growth trajectory and investor relations.

Factors Influencing Pre-money Valuation

Pre-money valuation is primarily influenced by the company's current financial performance, market conditions, and growth potential, as well as comparable company valuations and investor demand. Key factors also include the strength of the management team, intellectual property, and competitive advantages within the industry. Accurate assessment of these elements ensures realistic valuation before new capital is added, affecting equity distribution in funding rounds.

Calculating Post-money Valuation

Calculating post-money valuation involves adding the investment amount to the pre-money valuation, reflecting the company's total value after new funding. For example, a startup with a pre-money valuation of $5 million receiving a $2 million investment results in a post-money valuation of $7 million. This figure determines equity ownership percentages for investors and founders following the financing round.

Impact on Equity and Ownership Stakes

Pre-money valuation determines a company's value before new investment, directly influencing the percentage of equity investors receive and founders retain. Post-money valuation reflects the company's value after funding, calculated by adding the investment amount to the pre-money valuation, which dilutes existing ownership stakes proportionally. Understanding the difference is crucial for stakeholders to accurately assess ownership dilution and the true equity distribution following capital infusion.

Common Mistakes in Startup Valuation

Confusing pre-money valuation with post-money valuation is a common startup valuation mistake that leads to inaccurate equity distribution and investor misunderstandings. Startups often overlook the impact of new funding rounds on post-money valuation, resulting in dilution errors and misaligned stakeholder expectations. Accurate differentiation ensures proper capitalization table management and fair investment negotiations.

Pre-money vs Post-money: Which Should You Focus On?

Pre-money valuation represents a company's worth before new investment, while post-money valuation includes the investment amount, reflecting the company's value immediately after funding. Focusing on pre-money valuation helps founders understand the baseline value without dilution, whereas post-money valuation provides investors insight into their ownership percentage and investment impact. For strategic decision-making, prioritize post-money valuation to gauge actual equity stakes and funding effects on company control.

Pre-money Valuation Infographic

libterm.com

libterm.com