Debt financing offers businesses a way to raise capital by borrowing funds that must be repaid with interest over time. It allows companies to maintain ownership control while leveraging borrowed money for growth or operational needs. Explore this article to understand how debt financing can impact your financial strategy and business success.

Table of Comparison

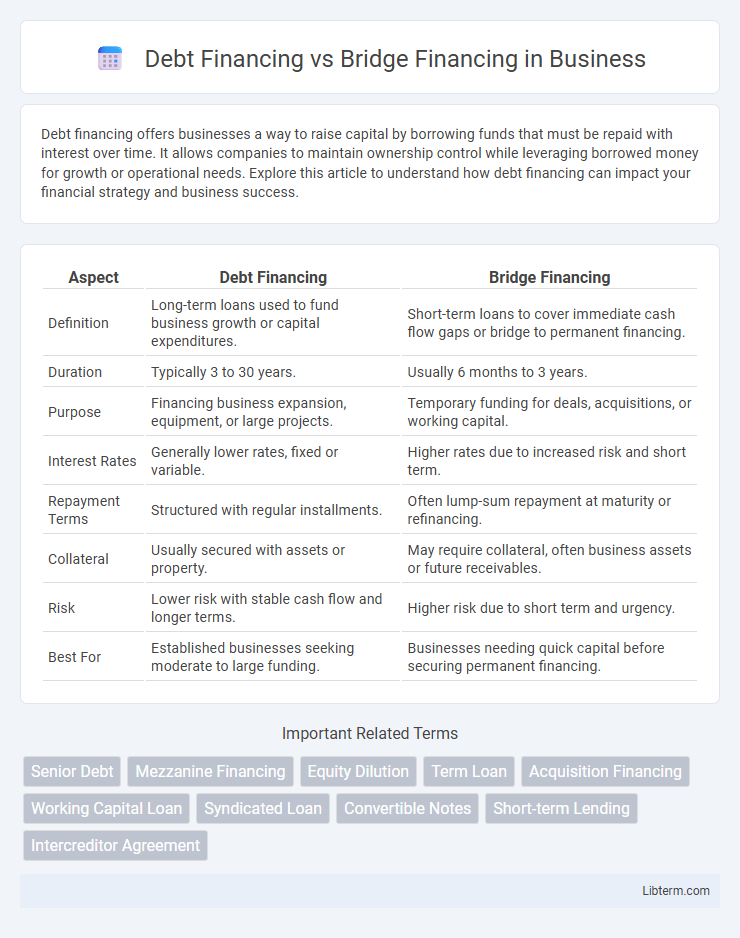

| Aspect | Debt Financing | Bridge Financing |

|---|---|---|

| Definition | Long-term loans used to fund business growth or capital expenditures. | Short-term loans to cover immediate cash flow gaps or bridge to permanent financing. |

| Duration | Typically 3 to 30 years. | Usually 6 months to 3 years. |

| Purpose | Financing business expansion, equipment, or large projects. | Temporary funding for deals, acquisitions, or working capital. |

| Interest Rates | Generally lower rates, fixed or variable. | Higher rates due to increased risk and short term. |

| Repayment Terms | Structured with regular installments. | Often lump-sum repayment at maturity or refinancing. |

| Collateral | Usually secured with assets or property. | May require collateral, often business assets or future receivables. |

| Risk | Lower risk with stable cash flow and longer terms. | Higher risk due to short term and urgency. |

| Best For | Established businesses seeking moderate to large funding. | Businesses needing quick capital before securing permanent financing. |

Introduction to Debt Financing and Bridge Financing

Debt financing involves borrowing funds from external lenders with a structured repayment plan and fixed interest rates, commonly used for long-term business investments or capital expenditures. Bridge financing provides short-term capital to bridge cash flow gaps, enabling companies to meet immediate financial obligations before securing permanent financing. Both methods serve distinct purposes in corporate financing strategies, with debt financing emphasizing stability and bridge financing prioritizing speed and flexibility.

Key Definitions and Concepts

Debt financing involves borrowing capital through loans or bonds to fund long-term business operations or expansions, typically with scheduled repayments and fixed or variable interest rates. Bridge financing is a short-term loan designed to provide immediate liquidity until permanent financing is secured or an existing obligation is settled, often used in real estate or corporate acquisitions. Key concepts include maturity duration, interest rates, collateral requirements, and intended use of funds, with debt financing focusing on strategic growth and bridge financing addressing temporary cash flow gaps.

How Debt Financing Works

Debt financing involves borrowing a fixed amount of capital from lenders or financial institutions that must be repaid over time with interest. Borrowers enter into formal agreements specifying repayment schedules, interest rates, and collateral requirements, which provide the lender with security. This method allows businesses to raise funds without diluting ownership while leveraging future cash flows to meet immediate capital needs.

How Bridge Financing Works

Bridge financing functions as a short-term loan designed to provide immediate liquidity by bridging the gap between the purchase of a new asset and the sale of an existing one, often used in real estate or business acquisitions. Typically secured by collateral, bridge loans carry higher interest rates than traditional debt financing due to their risk and short duration, usually ranging from six months to three years. This financing method allows borrowers to quickly access funds without waiting for long-term financing approval, enabling seamless transitions and preventing cash flow interruptions.

Major Differences Between Debt and Bridge Financing

Debt financing involves securing long-term funds through loans or bonds that must be repaid with interest over a set period, providing capital for sustained business growth or large projects. Bridge financing is a short-term loan designed to cover immediate cash flow gaps or to quickly finance a transaction until permanent financing is obtained. The major differences lie in duration, purpose, and repayment structure: debt financing is long-term with structured payments, while bridge financing is temporary with higher interest rates and faster repayment requirements.

Pros and Cons of Debt Financing

Debt financing provides companies with substantial capital without diluting ownership, allowing for fixed interest payments and potential tax benefits from interest deductions. However, the obligation to make regular repayments can strain cash flow and increase financial risk, particularly if revenues fluctuate or decline. Unlike bridge financing, debt financing typically involves longer terms and stricter covenants, which may limit operational flexibility.

Pros and Cons of Bridge Financing

Bridge financing offers rapid access to capital, making it ideal for short-term liquidity needs or transitional phases like property transactions, but it typically comes with higher interest rates and fees compared to traditional debt financing. This form of financing provides flexibility with fewer qualification hurdles, yet the repayment terms are often shorter and more stringent, increasing pressure on borrowers to secure long-term funding quickly. While bridge loans can expedite deals and bridge cash flow gaps, their cost and risk profile require careful consideration against potential benefits.

Ideal Scenarios for Debt Financing

Debt financing is ideal for established businesses with predictable cash flows seeking long-term capital to fund growth, equipment purchases, or expansion projects. Companies with strong credit histories can obtain lower interest rates and favorable terms, making debt financing cost-effective compared to equity dilution. It is best suited when cash flow stability supports timely interest and principal repayments without compromising operational liquidity.

Best Use Cases for Bridge Financing

Bridge financing is best suited for short-term capital needs such as covering immediate liquidity gaps, facilitating property transactions, or providing quick funds before securing long-term financing. It is ideal for real estate developers awaiting permanent mortgage approval or businesses in acquisition deals requiring fast capital infusion. This financing type offers flexibility and speed, making it valuable when timing and rapid access to funds are crucial.

Choosing the Right Financing Option

Selecting the right financing option depends on the company's short-term liquidity needs and long-term financial strategy, with debt financing providing structured repayments over time and bridge financing offering quick capital to cover immediate gaps. Debt financing is ideal for businesses seeking stable, long-term growth and predictable payments, while bridge financing suits scenarios requiring rapid funds to seize timely opportunities or transition between financing rounds. Evaluating interest rates, repayment terms, and the impact on cash flow ensures that the chosen financing aligns with the company's operational goals and risk tolerance.

Debt Financing Infographic

libterm.com

libterm.com